Free Small Business Expense Tracking Spreadsheet

Small business expense tracking can be tedious, but it’s one that all companies–from “mom and pop” shops to international enterprises–must do. Fortunately, business expense tracking apps make the job easier. An app is ideal if you have a business with many employees, sales, and tax considerations.

For some small businesses, however, paying a subscription fee for an expense tracker may not be feasible in the beginning. In this case, they can use a free business expense tracker or template. While expense tracking will remain manual, it will keep their finances organized in one place.

We’re sharing a free business expense tracking spreadsheet that you can use. You can jump to the spreadsheet here and scroll further to learn how small businesses can keep track of expenses for free or at little cost.

- Why do you need to track small business expenses?

- What are common business expenses?

- What is the best way to track expenses for small businesses?

- Small business expense tracking spreadsheet

Why do you need to track small business expenses?

As you may know, you’re required to file taxes each year. Come tax time, no one wants to sift through old receipts to account for each expense.

Once you start expense tracking regularly, you can eliminate such hassles. Moreover, up-to-date records ensure that you file tax returns accurately. Therefore, should the IRS audit your company, you won’t have anything to worry about. Besides saving you time, you’ll also want to track expenses to take advantage of tax deductions and better financial health.

Tax Deductions

Everyone has to deal with taxes every year–companies and individuals. You may be eligible for tax deductions for certain expenses or activities. If you qualify for a deduction, you can lower the tax amount you owe and use the savings to grow the business.

While it may surprise you, many small business expenses qualify for tax deductions. However, only a small proportion of small business owners benefit from them. This is primarily due to inadequate expense tracking practices and not knowing how much you can save.

With reliable accounting software, you’ll have expense reports. These will give you a complete picture of your spending and tax deductions. If you’re unsure what counts as a deduction, you can review our list of over 20 tax deductions for small businesses.

Financial health

Data from the Bureau of Labor Statistics (BLS) shows that 20% of small businesses fail within the first year. This figure rises to 50% by the fifth year. But there’s a silver lining.

Most of these businesses do not fail because there’s no market. Surprisingly, some companies make a lot of money and still fail. Some of the reasons for this include:

- Financial mismanagement

- Cash flow issues

- Unsustainable growth

- Poor planning

As you can see, all those factors are related to finances. By ironing up your expense tracking processes, you can significantly increase the chances of success for your business. You’ll be able to quickly spot unnecessary, unusual, and fraudulent activity that may bring your business down.

This way, you can limit business expenses to necessary expenses and prevent costs from going overboard. In addition, you can learn how to read and interpret financial statements.

What are common business expenses?

Businesses in varying industries have different expense profiles. Even still, there are expenses that almost all businesses have. In the expense tracking spreadsheet, you’ll find areas to record each of these expenses, including:

- Advertising and marketing – Costs associated with hiring a marketing agency or a consultant.

- Auto expenses – If you use your car for business, you can expense repairs and mileage.

- Bank charges – Fees and costs for a business bank account and credit cards.

- Commissions – They will be recorded here if you pay out sales commissions.

- Contract labor – This is for businesses that hire freelancers or contract employees.

- Interest – If you have a business loan, its interest is considered an expense.

- Legal & professional – Consult with lawyers, accountants, and other professionals.

- Merchant fees – These are costs that merchants like Shopify and Amazon charge.

- Payroll, payroll taxes, and processing – Expenses related to paying employees and processing those payments.

- Recruiting & HR – Costs associated with finding and hiring employees.

- Training & Education – Expenses related to furthering your or your employees’ business education.

- Software and tools – Many tools you use for your company are expenses (and tax-deductible).

- Rent or lease – If you have a physical store or office, you can add it as an expense.

- Utilities – Many utilities, including the Internet, are business expenses.

These are just a few examples. You’ll find more inside the small business expense tracking spreadsheet.

What is the best way to track expenses for small businesses?

At this stage, you know why it’s important to track business expenses, but how do you do it? You have two options: business expense tracking spreadsheets or apps.

1. Business expense tracking apps

The best options for business expense tracking are expense tracker apps. These solutions sync to your bank accounts and business credit cards and categorize your expenses. This eliminates most of the manual work and automates inputting the costs yourself in a spreadsheet. As a result, the only expenses you usually add manually are those you pay for in cash.

Such solutions generate expense reports in addition to maintaining expense records. These reports help you understand your spending habits and how they impact cash flow and financial health. You don’t have to set time aside for this. You can review your expenses using a mobile app while on the go. Overall, they reduce the amount of time you spend on expense records.

Some business expense tracking apps include:

- Mint

- Quickbooks (integrates with Xendoo)

- Xero (integrates with Xendoo)

- Zoho Expense

- Expensify

To learn more about each app and if it’s a good fit for your company, you can view our guide to expense tracking apps here.

2. Business expense tracking spreadsheets

While business expense tracker apps may be ideal, they’re sometimes inaccessible to small businesses. There may be a learning curve. Your company may not have many employees or complex expenses or the budget to afford a subscription. Whatever the reason, you’ll still have expenses to manage and report.

Using this free business expense tracking spreadsheet is the ideal option. Expense tracking spreadsheets use standardized templates to help you track various business expenses and key details. It’s the perfect middle ground between expense tracker apps and other inadequate methods.

Instead of worrying about how to record expenses, you’ll have a simple outline to follow. And you’ll have key insights such as:

- The amount of money spent

- The purpose of spending money

- What the money was spent on

- Who spent the money

The good thing about spreadsheets is that they give you flexibility. Along with the general expenses spreadsheets, you can have spreadsheets to report particular expenses. For example, this may include:

- Mileage reports, especially if you reimburse employees for mileage

- Travel expense reports for long business trips

Although, it is ideal to keep everything in one central place. Otherwise, it becomes harder to manage and you might not have the full picture of your finances.

While the purpose of each expense spreadsheet may vary, they’ll have similarities. These include:

- Columns for filling in data such as expense descriptions, date, unit cost, vendor, and method of payment

- Rows for each expense item

- Columns with formulas that automatically calculate total expenses

In fairness, updating expense tracking spreadsheets requires commitment and can be tedious. However, if you are just starting out with a low budget, they can help you stay organized. Most entrepreneurs move to accounting software as their business grows because it will integrate with other tools like those for eCommerce stores, payroll, and inventory.

How can integrating tax software benefit small businesses?

Integrating tax software can greatly benefit small businesses by streamlining the tax preparation process. By integrating their expense spreadsheets with tax software, small businesses can automate tasks such as categorizing expenses, calculating deductions, and preparing tax forms. This integration ensures that spreadsheet data is properly formatted and categorized, facilitating the efficient importation of data into tax software. Consequently, small businesses can save time and reduce the risk of human error when compiling year-end financial statements, estimating taxes owed, and filing tax returns. Integrating tax software simplifies tax preparation, enhances accuracy, and enables businesses to maximize their eligible deductions.

Small business expense tracking spreadsheet

You can get the Google sheet for small business expense tracking here. To use the sheet, you’ll first make a copy and edit the copy.

When you’re tracking expenses or any finances, you’ll come across accounting terms like gross revenue, net income, and gross income. To use this spreadsheet, you’ll want to be familiar with them.

What is gross revenue?

Along with the primary revenue stream, your business may have several sources of revenue. Gross revenue is the total of your business’s revenues over a given time period. It is not the same as gross profit.

Gross revenue solely focuses on earnings. As such, it does not account for the expenses incurred, such as the cost of production. Therefore, tracking gross revenue is important as it shows the potential of a business to grow and generate profits for shareholders.

Gross revenue is also known as the “top line” because it usually appears at the top of the income statement. Similarly, gross revenue is at the top of our free expense tracking spreadsheet. It’s important not to confuse gross revenue with net revenue. Along with the total earnings, the latter also accounts for expenses.

What is gross profit?

Unlike gross revenue, gross profit accounts for the costs of goods sold. To calculate your gross profit, you take the costs of goods or the cost it takes to produce and subtract it from the total gross revenue. The calculation will look like this:

- Gross Revenue – Cost of Goods Sold = Gross Profit

What is total net income?

For this, you’ll need to calculate net income (NI), also known as earnings. It refers to the business’s total money (gross revenue) minus total expenses. Your expense items are on the left column of the sheet–marketing, bank charges, interest payments, etc.

To calculate total net income, you must subtract all expenses from the total gross revenue or the amount earned.

- Gross Revenue – Total Expenses = Total Net Income

In simple terms, net income is the money the business has after paying for all expenses. Keep in mind that the cost of goods sold (COGs) is often considered a necessary expense. It should also be subtracted when calculating total net income.

Total net income vs. total expenses

The two most important numbers for expense tracking are total net income and total expenses. It’s important to know how they’re related and how they differ.

Total expenses refer to the sum of all the costs your business incurs. On the other hand, total net income refers to the money that’s left once you deduct total expenses from gross revenues. Therefore, you must first know the total expenses to calculate the total net income.

How to use the sheet

With our free expense tracking template, you won’t have to worry about building your own and figuring out the categories to include. It includes a list of the common small business expenses and sections for other expenses, gross revenues, refunds, and total net income.

Depending on the expense you want to record, you need only find the right category and add it. The sheet will automatically calculate each month’s total gross revenue, expenses, and net income.

Every business must track business expenses. However, paying for an expense-tracking app may not be an option. Also, while tracking expenses manually using a spreadsheet is possible, you may want to focus on other business activities.

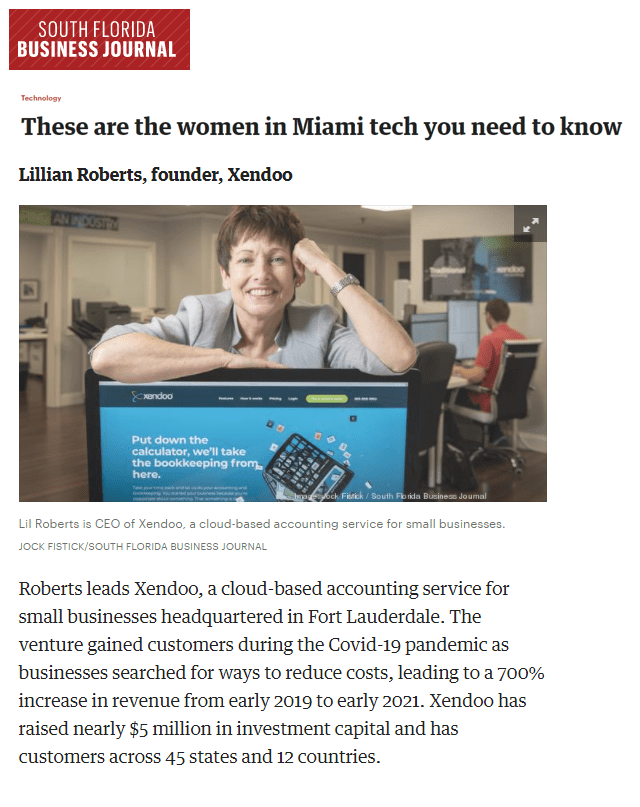

If that sounds like you, xendoo is exactly what you need. We have a team of virtual bookkeepers and accountants who can manage all your accounting needs. Moreover, you can also integrate Xendoo with software like Gusto, Stripe, Quickbooks, Xero, and more.