You’ve put your heart and soul into your business. So why does it feel like you’re spinning your wheels, trying to keep up with your core business and your administrative overhead at the same time?

When you first started your company, it might have made sense to try to handle your own bookkeeping and accounting needs. After all, it kept costs down. But it may not have taken long to realize that you could use some help.

Why not rely on an online accounting service to take these tasks off your plate so you can focus on your business?

Today, we’ll take a closer look at the business benefits of online bookkeeping and see how these services can help you to get your head out of the books and back in the game.

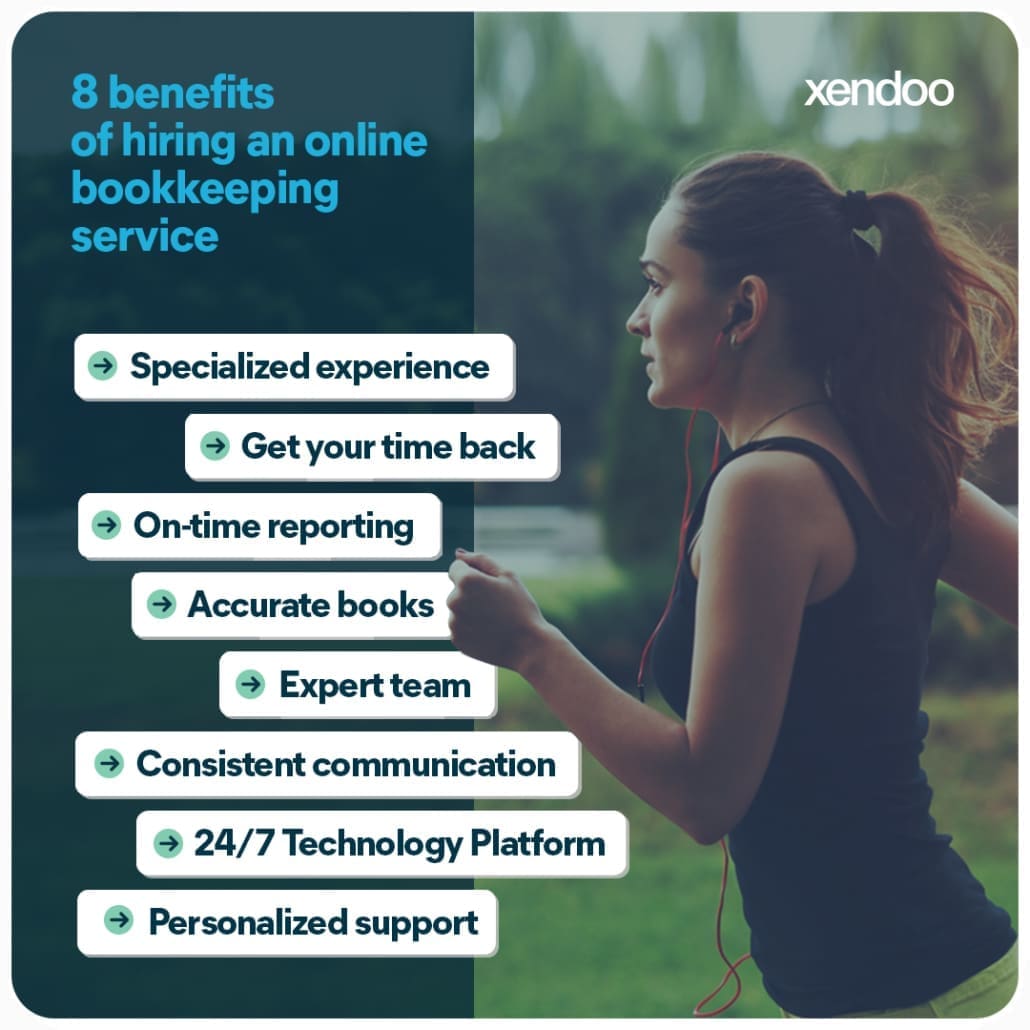

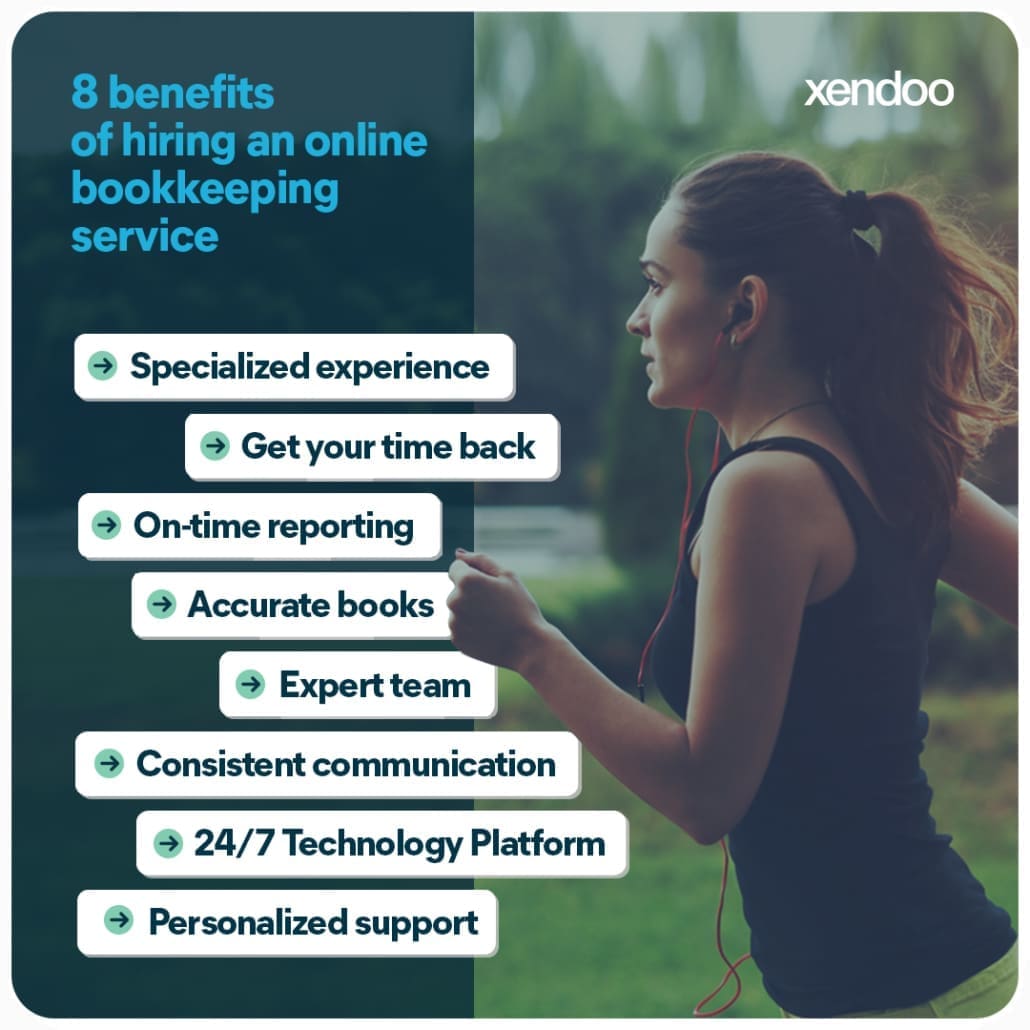

Business Benefits of Online Bookkeeping

Traditionally, businesses would hire a staff member to handle their books. They might even consider hiring a full-scale accounting department, depending on the size of their company.

But these days, more and more companies are going digital, opting to use online accounting and bookkeeping services to handle their needs. This is happening for good reasons, as online bookkeeping offers a host of benefits. We’ll explore some of these benefits in depth below.

1. Specialized Experience

Today’s businesses require specialists, not generalists. Increased regulation and the unique needs of individual businesses often demand a specialized set of skills. It’s rare that a staff accountant has experience in the kinds of niche areas that your business needs.

Conversely, an online accounting firm can often provide experience in such areas as:

- Personal financial planning and assistance

- Forensic Accounting

- Managerial Accounting

- IT auditing

- Non-profits

- Tax Preparation

Some of these tasks tend to be cyclical, such as your annual tax preparation. It makes sense to consult with an online accounting firm that can provide the services you need when you need them without the overhead of hiring a full-time CPA.

2. Accurate Books and Low Cost

One of the greatest business benefits of online bookkeeping is a reduction in cost.

According to the Journal of Accountancy, the average salary for a full-time CPA is over $100,000 per year. The cost of a full-time bookkeeper is cheaper, but your business may still be looking at paying over $40,000 per year for their services, according to the U.S. Department of Labor Statistics.

Don’t forget that these salaries are only a starting point. Hiring a full-time employee also demands that you provide employment benefits. You may even have to make adjustments to your facilities in order to provide an office or similar workspace.

Time is another factor to consider. Who will be in charge of hiring and managing your employees? Unless you have a human resources department, these responsibilities might fall on your shoulders as the business owner. Sure, hiring a CPA means you won’t be handling the books, but instead, you’ll have the task of hiring an additional employee.

Why swap one responsibility for another, when you can simply outsource your needs to an accounting firm?

Online bookkeeping services can be surprisingly affordable, eliminating the overhead associated with hiring a regular employee.

By relying on an online solution for your financial needs, you won’t have to worry about diverting valuable space to set up an office or workstation,, allowing you to cut costs in every imaginable capacity.

3. On-time Reporting

Staying on top of the details is a full-time job in and of itself. But the more information you have about your business, the better. As a business owner, you want access to trends like:

- Losses

- Profits

- Tax information

- Personnel and payroll data

- Insurance payments

- Procurement

Online bookkeeping ensures that you have access to the latest information, with reports available with unparalleled speed. This data is useful for highlighting areas of your business that could stand to be improved, which is why you need access to these reports in a timely manner. Since these reports are generated online, you’ll also save on paperwork.

In addition to internal reporting, online bookkeeping services can speed up your invoicing process. By streamlining your entire financial department, you’ll be in a better position to send invoices to clients and maintain your overall cash flow.

Faster reporting can accelerate this process even further by monitoring your income and alerting you to clients that have outstanding payments that need to be collected.

In addition, virtual accounting services can help you to manage your inventory. Xendoo, for example, can help you integrate your platforms and inventory with software like Xero, which has a number of basic inventory management features, as well as other third-party platforms that can help you optimize your ability to keep track of your inventory. These tools can be a great help when it comes to keeping your shelves stocked and your orders flowing.

This increased efficiency doesn’t just save you a headache; it can help grow your business, too. Having access to the latest data increases the rate at which you can invoice clients and receive payments.

The data you receive from an online bookkeeper can even help you plan for the future, which can be helpful when it comes to tasks like managing your inventory and looking for ways to expand your business.

4. Accurate Books

While CPAs typically have an advanced degree in addition to their certification, there are no advanced professional standards when it comes to bookkeeping.

That’s not meant to be a slam against bookkeepers, as many of them do an excellent job. But if you try to cut corners by hiring a junior accountant or a financial novice, you could end up with errors creeping into your books. That’s also true if you try and handle the books yourself, especially since it’s unlikely you’ll be able to give your books your full, undivided attention.

Why is accuracy so important? For starters, accurate books can eliminate accounting errors. Maintaining accurate books can be essential for the efficient management of your business.

But when it comes to tax preparation or other financial audits, accuracy is indispensable. Make an error in your tax forms, for example, and your business could be looking at penalties and additional fees that could otherwise be avoided.

Accuracy is one of the top business benefits of online bookkeeping. Accounting firms rely on the best bookkeepers in the industry, which ensures that businesses receive the benefit of meticulous, detail-oriented professionals to handle their books. In turn, this can ensure a smooth process when it comes time to prepare and pay your taxes.

If you’re concerned about the accuracy of your current books, an online accounting firm can perform an audit and troubleshoot your financials, ensuring you’re back on track for an error-free future.

Xendoo offers “catch-up bookkeeping” services that you can rely on to update your books so that you can keep things accurate. This can be particularly helpful for business owners who have been multitasking or ones who need a helping hand to stay current on their financial records.

Ultimately, assigning your bookkeeping needs to an online firm can prevent errors from recurring in the future.

5. Expert Team

Virtual bookkeeping companies rely on the best and brightest bookkeepers that the industry has to offer. But the benefits of this go beyond accuracy and attention to detail. Having an expert team behind you can provide the confidence that your business can grow and that you’ll enjoy the dedicated support you need for any financial change.

An expert team can be counted on to understand the best practices for modern bookkeeping. They will also be familiar with the latest financial software. With these tools, they can provide you with consistent, efficient reporting and expert financial analysis.

These expert-level skills would typically be out of reach for small business owners, as many lack the funds to invest in bookkeepers of this caliber. However online firms can provide you with top-tier care and insight at a mere fraction of the cost of hiring an employee, helping you balance quality and affordability with your financial needs.

6. Consistent Communication

Information is only as helpful as it is available. When you rely on a staff accountant, you’ll typically have access to financial data during normal business hours, which limits you to Monday through Friday from 9 to 5. But what if you need a piece of information when your staff accountant is “off the clock”?

Today’s business world doesn’t operate within the traditional 40-hour workweek. A global economy and a shift toward 24-hour customer service have placed new demands on business owners. You need a solution that matches these needs.

Online accounting firms can fill this need by being available when you need their services the most, offering you consistent, regular communication through email, phone, and other channels.

This kind of streamlined communication may be particularly helpful for business owners who have to travel often. Digital communication solutions can ensure that your accounting staff is right in your pocket, even when you’re out of the office—or even out of the country.

In other words, a virtual financial team never clocks out and never takes a sick day. You can rely on online firms to provide you with the data you need when you need it most, so your business never has to slow down.

7. 24/7 Technology Platform

You’re probably already familiar with software like QuickBooks, but this is just the tip of a larger digital iceberg. Virtual accounting firms have access to the latest digital tools and software packages to help their clients optimize their business.

At Xendoo, we can sync your accounts and optimize your books using the following platforms:

- Amazon

- TaxJar

- Gusto

- Stripe

- Shopify

- Expensify

- Bill.com

Of course, this list is always subject to change, which is one of the best business benefits of online bookkeeping.

Virtual accounting firms can take advantage of the latest online bookkeeping features offered in these and other software platforms. Virtual firms also have the resources to keep up with changes in technology.

By adapting and innovating, online accountants can ensure your business can continue to thrive and compete in an increasingly digital climate.

8. Personalized Support

Finally, there is simply no substitute for the personalized, custom support that you receive when you partner with an online bookkeeping service. The days of hiring a one-size-fits-all accountant are over. Modern businesses require the agility and personalization that come from a virtual firm.

An online accounting firm can adjust its areas of specialty to the needs of your business, providing solutions for the usual bookkeeping services as well as solutions for eCommerce, business software integration, and more.

But perhaps most importantly, a virtual financial firm offers an array of services that can be tapped into as your business evolves and grows, so you can have the confidence that you’ll always have access to industry-leading services that are tailored to the needs of your business.

What Can Xendoo Do for You?

Are you ready to experience the business benefits of online bookkeeping for yourself? Why not consider what Xendoo can do for you and your business? Join high-profile businesses like Starbucks and Century 21 in trusting an industry leader to handle your books, prepare your taxes, generate reports, and perform a host of other financial services that are tailored to the unique demands of your business.

Xendoo offers flexible pricing based on the size of your business. We even provide scalable solutions to help your business to grow. Each plan includes standard bookkeeping services, as well as reporting on profits and loss and other data.

Select plans include provisions for tax returns and consulting, which can be invaluable for businesses of any size.

Sign up for our bookkeeping services, and you’ll see how our advanced services can help your business. It’s time to stop handling your own books. Let us handle the details so that you can keep your focus on what matters: Growing the business you love and connecting with the customers you’ve come to rely on.