5 Reasons Catch-Up Bookkeeping Can Propel Your Start-up or Small Business

Managing finances can make a big difference in the success of start-ups and small businesses. Maintaining updated and accurate financial records is crucial for many financial management functions. Catch-up bookkeeping is a method for bringing your financial records up to date when they have become outdated. This catch-up bookkeeping is crucial for small business owners, especially those in the early stages, as it helps them achieve financial clarity, maximize tax deductions, and enhance financial management. This is where Xendoo.com is helpful, as it provides a wide range of services curated according to the needs of small- to medium-sized enterprises. This article will highlight the five essential reasons why catch-up bookkeeping can drive a start-up or small business forward, allowing the owners to make informed decisions for long-term success.

1. Gain Financial Clarity

Importance of Clear Financial Records

Clear financial records form the foundation of effective management, especially for start-ups and small businesses. By bringing your books up to date, you gain a clear picture of your business’s financial health, allowing you to make informed decisions about the future.

- Learn more about financial statements from Investopedia and how to understand them better.

Visibility into Income, Expenses, and Cash Flow

Catch-up bookkeeping provides comprehensive visibility into your financial situation, including revenue sources, operational costs, and cash flow. This helps you maintain sufficient working capital and plan for future expenses.

- For tips on managing business cash flow, check out the SBA’s guide to cash flow management.

Benefits of Informed Decision-Making

Accurate financial records are critical for making strategic decisions. With detailed insights into your income, expenses, and cash flow, you can identify areas to reduce costs, allocate resources more efficiently, and spot new opportunities. Xendoo.com supports you by ensuring your finances are current and organized.

Maximize Tax Deductions

Challenges of Tax Season for Entrepreneurs

Tax season is often a stressful time for business owners. Small businesses, especially those without a dedicated accounting team, struggle to track eligible deductions and rapid changes in tax laws add another layer of complexity.

How Catch-Up Bookkeeping Helps Capture All Eligible Expenses and Deductions

Catch-up bookkeeping meticulously tracks eligible expenses, maximizing deductions and reducing tax liabilities. Xendoo.com’s expert accountants ensure your records are accurate, compliant, and up-to-date, helping you capture all potential deductions.

Potential Cost Savings and Advantages of Organized Records During Tax Preparation

The tax benefits of using catch-up bookkeeping are an important factor to help save money when preparing returns. Simultaneously, by maintaining an orderly record of all the financial activity the business is involved in, business owners will benefit financially by saving time and money when submitting their annual taxes. These can enable them to provide accurate and detailed records to their tax preparer that can prevent errors if they are not claiming deserving deductions and credits. Accurate and organized record-keeping allows tax preparers to spot tax-saving opportunities, deferring some income and accelerating spending, potentially leading to great tax savings.

Spot Financial Trends

Value of Analyzing Historical Financial Data

Analyzing historical data reveals valuable trends that can guide your business decisions. Reviewing revenue, costs, and net profit patterns over time can uncover strengths, weaknesses, and growth opportunities, helping refine your business strategy.

How Catch-Up Bookkeeping Enables Businesses to Identify Trends and Patterns

Catch-up bookkeeping is the basis for examining the data to determine current and future trends and patterns. This can be done by upgrading financial documents, spotting the development of the business’s financial performance, and detecting periodic patterns and trends. For example, a drop in sales during winter or marketing activities triggers an increase in sales. This level of data allows organizations much-needed insight into making strategic decisions, such as targeting marketing or tapping into a new market to ride on trends and boost revenue.

Examples of Strategic Decision-Making Based on Financial Insights

Another way that financial intelligence impacts these tactical decisions is by tailoring price strategies according to consumer buying behaviors. Collecting past sales data can help one learn that some products are often consumed more at a particular time of the year or that customers are ready to pay a higher price only for a specific selection. Using the information obtained, small business owners will be able to invent a pricing strategy, which will allow them to increase their earnings.

Another example is identifying cost-saving opportunities based on the data collected from historical expenses. By analyzing past expenses, a business can locate where cost reductions are possible, such as canceling some contracts with suppliers or simplifying internal processes. These instances illustrate that analyzing historical financial data helps businesses make well-informed strategic decisions, boosting their efficiency and growth.

Enhance Investor Confidence

Importance of Transparent Financial Records for Attracting Investors

Transparency accounting is very important in attracting investors as it gives a clear picture of the business’s financial health and performance, which comes in handy in informing decisions about injections. The investors use financial reports to consult about the possibility of investing in the business. Also, these reports serve as a means of assessing the risks and return on investment that would come their way. The accounting records convince investors that the business is good in finance, stable, and sustainable enough to make a profit for them, which is good evidence of effective management.

How Catch-Up Bookkeeping Demonstrates Commitment to Financial Integrity

Catch-up bookkeeping is proof of financial integrity because it ends the gaps between the books, provides the most accurate and up-to-date records, and complies with accounting standards and regulations. As a result, it indicates that you perform these duties responsibly and strive to provide them with faultless and notable financial information. This attitude of having confidence in your financial values will build trust among investors, and they will be certain that you meet their investment goals.

Benefits of Organized Financial Statements in Investor Relations

Properly prepared financial statements are a major stakeholder relationship enhancer, showing investors the cleaned and arranged version of your company’s financial performance. Structured financial statements make understanding your business’s investment prospects fairly simple. Investors can easily find out how your business is performing, identify trends and patterns, and make informed investment decisions as you always remain transparent. Another benefit is that you can create the statements of financial statements to communicate the results of financial performance to potential investors in the most efficient way, which leads to improved relationships and trust in your business.

Ensure Compliance and Avoid Penalties

Risks of Non-Compliance with Regulations and Tax Laws

Violation of regulations and tax laws can lead to punitive measures in the form of fines, lawsuits, and permanent harm to reputation. Regulatory agencies and tax authorities expect businesses to follow their laws, including those related, for instance, to financial reporting, taxation, and employment. Compliance with these laws may lead to penalties, sanctions, and business closure. Through catch-up bookkeeping service, Xendoo.com maintains your business on the right side of the law, making sure your business is compliant and safe from avoidable risk.

How Catch-Up Bookkeeping Helps Businesses Stay on the Right Side of the Law

Financial management must be done proactively to reduce the risks of non-compliance. By adopting a proactive approach to financial management, businesses may recognize compliance problems and remediate them promptly, such as adopting internal controls, performing regular audits, and being updated about the modifications in regulations and tax laws. Proactive financial management also includes the creation of a culture of compliance within the organization where employees know their responsibilities and are dedicated to following the laws.

Catch-up bookkeeping has a couple of extremely vital provisions for start-ups and small businesses: financial clarity and understanding through knowledge, maximizing deductibility of tax, detecting patterns, and developing the investors’ confidence. Implementing organized financial records will be as significant as making it possible for people to be well-informed about their business at any level. Asking for professional help is not a sign of weakness; instead, it will assist in understanding financial complexities and preparing your enterprise for business. Create the habit, starting today, and you will be able to manage the flow of cash transactions in your business while striving to accomplish your goals.

About Xendoo

We share your passion for small businesses and are inspired by your dedication to making your dreams a reality. Your dedication to making your dreams a reality inspires us. That’s why we’re committed to providing you with the financial visibility and support you need to thrive.

More Than Just Numbers

It’s more than simply crunching numbers. It’s about building meaningful relationships with our clients and understanding their needs. Our people-first mentality ensures you receive personalized attention and expert guidance throughout your financial journey.

A One-Stop Solution

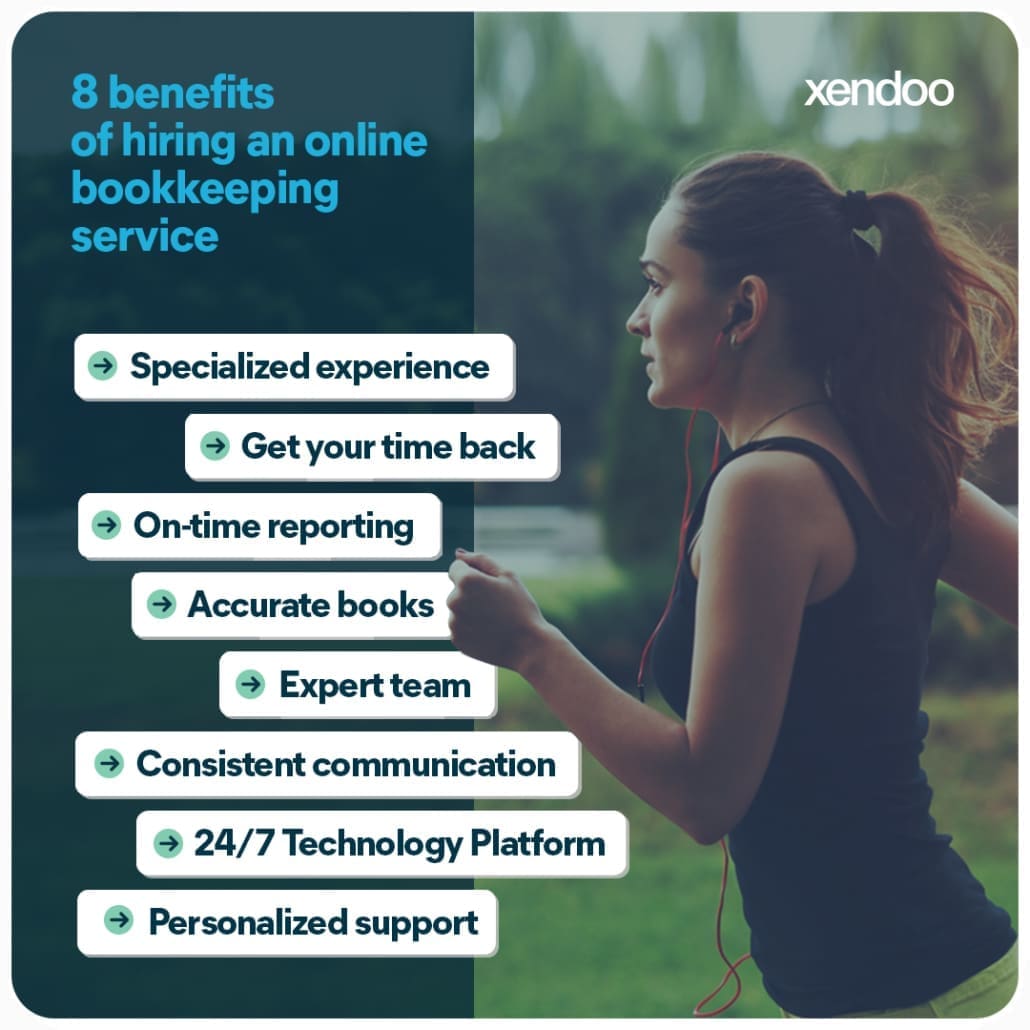

Xendoo offers a comprehensive suite of services, including:

- Full-service bookkeeping and accounting team to free up your time and resources.

- Hassle-free tax preparation and filing

- Fractional CFO Services to work with you on a roadmap of future growth

- A dashboard that provides real-time financial insights

Passionate about your success? Xendoo is, too. We provide the financial visibility and support small businesses need to thrive and scale. Let us handle the financial burden so you can focus on what matters most – running your business and achieving your goals.

Contact Xendoo today and discover how we can give you time back to grow your business.