Minimizing your company’s tax burden can help maximize profits. One way of doing this is through business tax credits. Leveraging the right tax credits can save your business thousands of dollars in taxes each year.

However, there are many types of business tax credits and the IRS has strict eligibility requirements. How do you know which tax credits will save you the most money? An experienced tax professional can identify which credits you’re eligible for and even file them for you.

This guide goes over business tax credits that could save you money on taxes. You’ll also learn how to maximize their impact with the help of an experienced CPA or tax accountant.

Small Business Tax Credits vs. Deductions

Small business tax credits and deductions are valuable tools for reducing your tax bill. They are incentives the government offers to reduce the amount of taxes you owe. However, they work in different ways.

Tax Credits

Unlike deductions, tax credits directly reduce the amount of taxes you owe instead of lowering your taxable income. If you’re eligible, you can lower the amount of taxes you owe dollar-for-dollar.

For example, let’s say you owe $1,500, but you have a credit worth $500. You could deduct the credit amount ($500) from what you owe ($1,500). Then, your total amount would be $1,000.

Tax credits can range from investing in research and development to hiring new employees.

For example, the Work Opportunity Tax Credit rewards small businesses for hiring individuals that meet certain criteria. Knowing which tax credits are available to you and how to use them can significantly impact your business finances.

Tax Deductions

Deductions can move you to a lower tax bracket, so the IRS taxes you at a lower rate. Examples of tax deductions include business expenses like office supplies, equipment, and travel costs.

Deductions can also be tricky as there are different rules for claiming them, and not all expenses are tax deductible. If you’re unsure which small business tax deductions you may qualify for, consult a tax professional.

11 Small Business Tax Credits

The IRS has specific eligibility requirements for each tax credit. To maximize your tax savings, here are 11 of the top tax credits for businesses and how to use them.

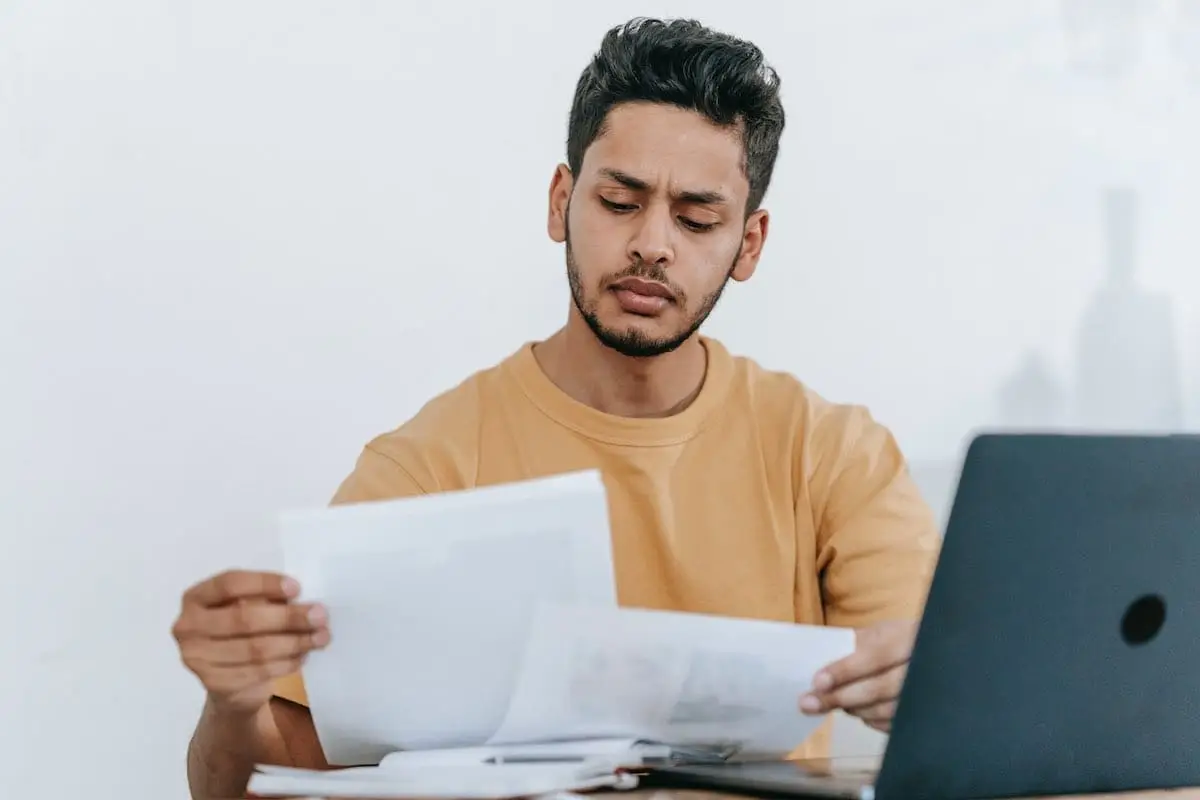

1. Work Opportunity Credit (Form 5884)

The Work Opportunity Tax Credit (WOTC) is a federal tax credit available to employers who hire and employ individuals from certain targeted groups. The IRS bases this credit on the employee category, how much you’ve paid them during the first year of employment, and how many hours they’ve worked.

To qualify, you must hire an eligible worker in one of these categories:

- Unemployed veterans

- Ex-felons

- Temporary Assistance for Needy Families (TANF) recipients

- Supplemental Nutrition Assistance Program (SNAP) recipients

- Designated community residents

- Vocational rehabilitation referrals

- Long-term family assistance recipients

- Qualified summer youth employees

- Qualified long-term unemployed individuals

You can claim the Work Opportunity Tax Credit by completing Form 5884 and submitting it along with your tax return.

You must also provide information about newly-hired employees on Form 8850 within 28 days of the hire. You’ll submit this form to your state workforce agency for certification.

In case of an IRS audit, you should maintain records for your WOTC claims for at least the last four years. Those who meet all eligibility requirements could receive up to 40% of the first $6,000 in wages ($2,400) as a tax credit.

2. R&D Credit (Form 6765)

Businesses that invest in research and development (R&D) activities might be eligible for the R&D Tax Credit. To be eligible, your business must incur expenses for developing or improving a product, process, technique, invention, or software. Qualifying expenses may include wages, supplies, and contract research fees.

Startups that have less than $5 million in annual gross receipts could apply up to $250,000 of the credit to offset payroll taxes. Since the IRS calculates the tax credit amount based on the amount a company spends on R&D, most early-stage startups don’t qualify for the full amount.

The Inflation Reduction Act increased the maximum threshold from $250,000 to $500,000, starting with the tax year 2023.

To obtain this credit, businesses must submit Form 6765 to their federal income tax return by April 18, 2023. You must also include information about your R&D activities and expenses.

3. Alternative Fuel and Electric Vehicle Credits

Taxpayers who purchase, lease, or install alternative fuel vehicles and infrastructure are eligible for a series of federal tax credits. The credit amounts vary depending on the type of vehicle or infrastructure you install.

- Biodiesel and Renewable Diesel Fuels Credit (Form 8864) – Claim a credit of up to $1.00 per gallon of biodiesel, renewable diesel, and alternative fuels you purchase.

- Alternative Fuel Vehicle Refueling Property Credit (Form 8911) – If you install an alternative fuel vehicle refueling station, you can receive up to $30,000 in tax credits.

- Biofuel Producer Credit (Form 6478) – This credit is available to taxpayers who produce biodiesel and renewable diesel fuels. The amount varies depending on the type of fuel you produce.

- Qualified Electric Vehicle Credit (Form 8834) – If you purchase or lease a new electric vehicle, you may be eligible for up to $7,500 in credits.

You’ll need to file the appropriate form with your federal income tax return to claim these credits. Your filing date should match the deadline for your tax return. Alternative fuel and electric vehicle credits may be subject to phase-out dates and other restrictions. It’s best to consult a professional for tax compliance and filing information.

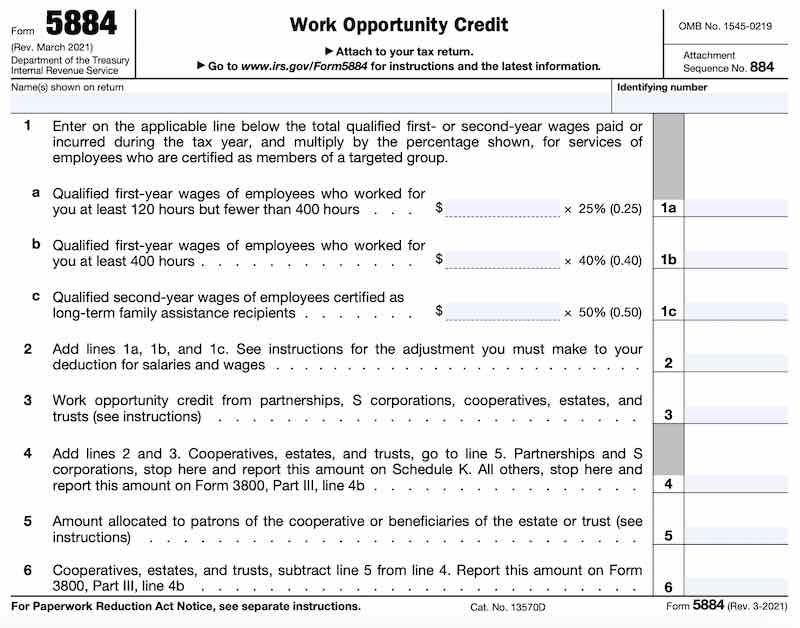

4. Employer-Provided Childcare (Form 8882)

If your business provides childcare assistance to its employees, then you may be eligible for the Employer-Provided Childcare Credit (Form 8882). The government encourages businesses to offer childcare benefits to assist working parents. The credit can offset some of those costs.

To determine eligibility, you’ll need to calculate the cost of qualified expenses for each employee. The credit equals 25% of qualifying expenses up to $150,000. You can also claim 10% of childcare resources and referral expenses.

To claim the Employer-Provided Childcare Credit, submit Form 8882 by the tax return due date. You have up to three years to file claims for this credit. Also, you should keep childcare expense records for at least four years from the filing date.

5. Small Employer Health Insurance Premiums (Form 8941)

To offset health insurance coverage expenses, you can use the Small Employer Health Insurance Premiums Credit (Form 8941). You must have fewer than 25 full-time employees and pay at least half the single coverage cost for each employee.

You can calculate the amount of the credit as a percentage (up to 50%) of your health insurance premiums. For non-profits, it is up to 35%. To claim the credit, you must submit Form 8941 with your federal income tax return by April 18, 2023. You will need to provide information about your health coverage and expenses.

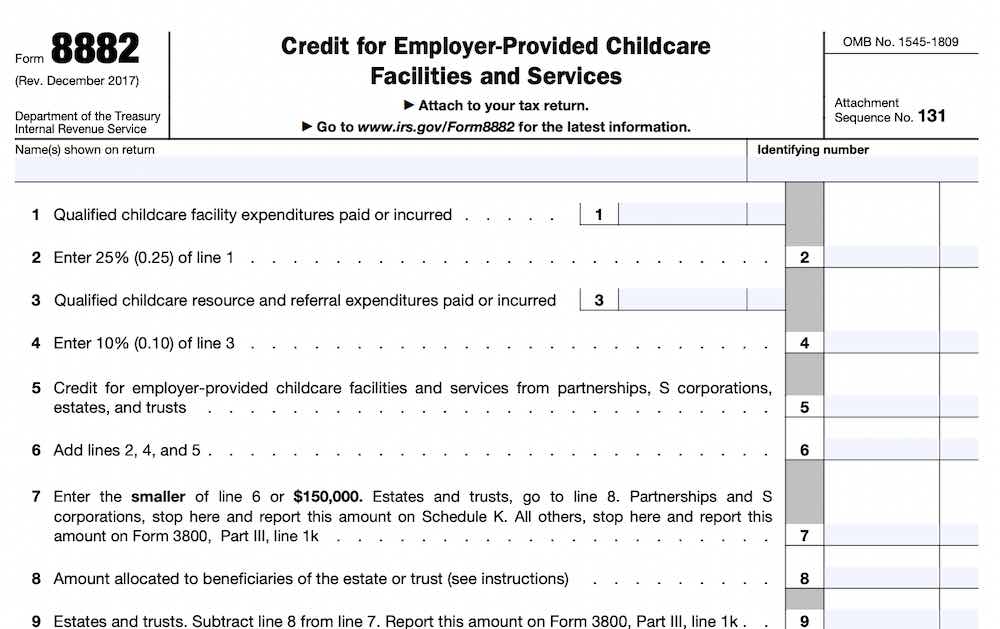

6. Paid Family and Medical Leave Credit (Form 8994)

Your business may be eligible for the Paid Family and Medical Leave Credit (Form 8994) if it provides paid leave to employees. The credit encourages businesses to offer paid leave by offsetting the costs.

To qualify, a business must have a written policy that provides at least four weeks of annual paid family and medical leave to full-time employees. Part-time employees should receive up to two weeks of paid leave.

You can calculate the credit as a percentage (ranging from 12.5% to 25%) of the wages you pay employees while on leave. You must provide records of wages along with Form 8994 by April 18. 2023.

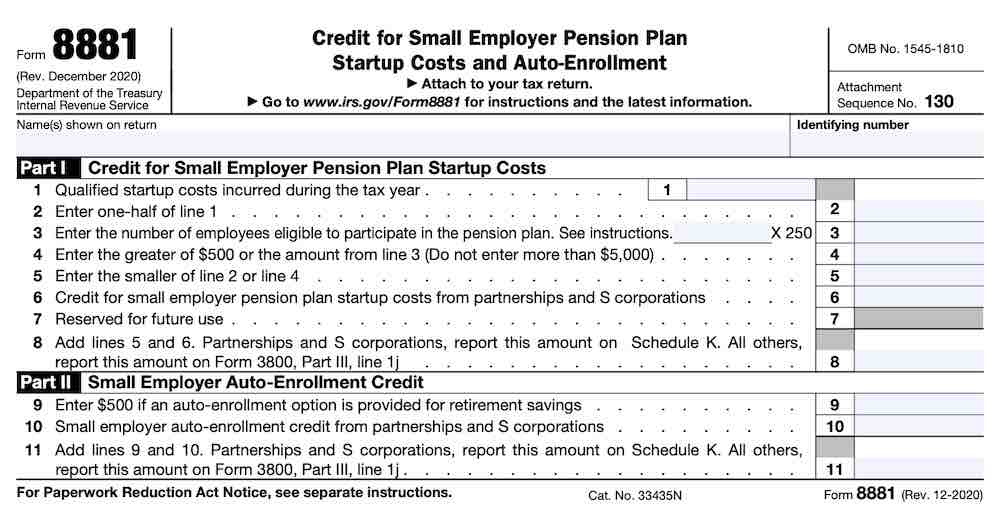

7. Retirement Plan Startup Costs (Form 8881)

Businesses that have a qualified retirement plan are eligible for the federal Retirement Plan Startup Costs tax credit (Form 8881). It incentivizes businesses to offer retirement plans—401(k), SEP, SIMPLE IRA, and others—to employees.

The maximum credit is 50% of qualifying startup costs with a $500 limit. If your business qualifies you could reduce your tax bill by up to $500. To qualify, a business must have 100 or fewer employees that have received at least $5,000 in compensation from you in the previous year.

To claim the credit, submit Form 8881. The deadline to submit will vary depending on your tax filing status.

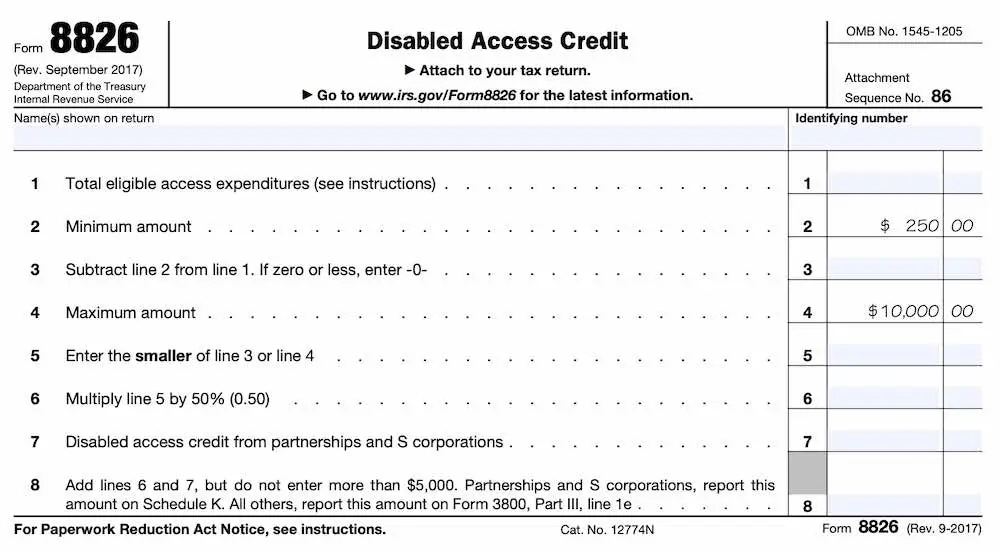

8. Disabled Access Credit (Form 8826)

If you’ve spent money to make your business locations accessible to individuals with disabilities, you may qualify for the federal Disabled Access Credit (Form 8826). Qualifying costs include modifying entrances, restrooms, and parking.

To apply for the credit, your business must have earned $1 million or less and have fewer than 30 employees. The maximum credit will be 50% of the expenses, with a maximum of $5,000 per year. To receive the credit, you’ll need to submit Form 8826.

Note, you may also be eligible for a business expense deduction of up to $15,000 too. It’s called the Architectural Barrier Removal Tax Deduction. To be eligible, you must have spent money on making your facility ADA-accessible to the elderly or disabled.

9. Energy Efficient Home Credit (Form 8908)

The Inflation Reduction Act (IRA) brought the Energy Efficient Home Credit (Form 8908) back. If you’re a contractor that has made energy-efficient improvements to homes you sold or rental properties, you may qualify.

The maximum credit limit for the 2022 tax year is a $500 lifetime credit. As a lifetime credit, any amount you took in previous years would count toward the total $500 limit.

However, the IRA increased this to an annual credit of up to $1,200 for years after 2022. To qualify for this business tax credit, you must meet energy-efficient improvements. Those may include installing energy-efficient:

- Insulation

- Windows

- Water heaters

- Central air conditioning

- Furnaces

- Doors

- Roofing

To claim this credit, you’ll need to keep records of qualified energy-efficient expenses and file Form 8908.

10. Low-Income Housing Credit (Form 8586)

To qualify for the Low-Income Housing Credit (Form 8586), your business must develop and operate low-income residential housing. Eligible businesses must meet specific criteria set by the IRS. These include:

- Income restrictions

- Rent limits

- A commitment to maintain the property over a particular period

You base the credit amount on the qualified basis of the property, which is either 4% or 9% of the project’s gross construction costs.

11. General Business Credit (Form 3380)

The General Business Credit (Form 3800) tallies up all applicable business tax credits. You calculate the credit as the sum of all applicable business tax credits claimed in the current year. You can carry back unused amounts for one year or carry forward 20 years.

You’ll submit Form 3800 with your federal income tax return. Your tax return deadline will depend on your filing status. When filing, provide information about all the business tax credits you’ll claim during the current year.

Lower Your Tax Bill With a CPA

With knowledge of the tax code, including business tax credits, deductions, and more, your CPA can do more than prepare your taxes. An experienced CPA can provide valuable advice on the best ways to lower your tax bill and maximize the profitability of your business.

Tax credits are powerful tools. xendoo has a team of in-house bookkeepers, CPAs, and tax experts. You don’t just get business tax services, you get personalized financial advice.

As tax professionals, we make it our mission to maximize your business tax savings. Schedule a free consultation and we’ll get to know your business and unique tax situation.

[av_sidebar widget_area=’Blog Post Disclaimer’ av_uid=’av-om2w’]