As the April 15th tax deadline approaches, small business owners are on a tight schedule to get their financial books in order and finalize their tax filings. Timely tax preparation ensures compliance with the Internal Revenue Service (IRS) and can maximize potential tax savings. This becomes a critical period in business, and specific strategic actions must be taken so that small businesses remain compliant, maximize returns, and minimize liabilities when filing taxes. This article provides seven actionable tax tips to help small business owners navigate the crunch time effectively.

Organizing Financial Records

Gathering Necessary Documents and Receipts

As one of the basics for filing taxes, small businesses must gather all pertinent financial documents, such as invoices, bank statements, expense receipts, and payroll details. Gathering these documents helps small businesses aggregate and systemize these records to afford a vast, complete record base for use in tax preparation and filing.

Utilizing Accounting Software for Efficient Record-Keeping

Accounting software simplifies record-keeping, facilitating easier tax preparation and real-time financial tracking. Nowadays, small business owners are privileged to have several programs dedicated to clientele and account record-keeping management. Up-to-date accounting software helps your business to integrate seamlessly with other leading accounting software platforms. It offers you direct access to ensure your business’s financial data is accurate and up to date for filing taxes. Thanks to such tools, financial data can be structured and sorted according to the classification rules in preparation for tax filing.

Creating a Checklist to Ensure Nothing Is Overlooked

For small business owners, a broad checklist will guard against the usual omissions and assure the inclusion of all required documents and information, which are requisites during the preparation to file taxes. A checklist should comprise the fields of income, deductible expenses, tax documents, and any specific information related to their unique business type. At the end of this financial review, the business owner should have a checklist covering all financial records.

Maximizing Deductions and Credits

Identifying Eligible Business Expenses

Understanding what makes up a deductible business expense helps ensure small businesses make the most of tax-saving opportunities. From home computers and vehicles to social networking-related expenditures to staff and benefits, all business owners should be careful to keep relevant documentation as this will enable them to use the deduction system to the utmost extent. Identifying eligible business expenses helps small business owners take advantage of all possible deductions.

Exploring Available Tax Deductions and Credits for Small Businesses

The tax code gives an array of deductions and credits meant to support small businesses. Alongside typical business expenses, SME proprietors must check for available pertinent deductions to their sector. For instance, the Small Business Health Care Tax Credit, the Research and Development Tax Credit, and several state and local incentives are all geared towards the same purpose: promoting small businesses. We guide you to strategically employ the most recent tax benefits to lower your taxable income and increase your tax savings. At Xendoo, we also keep up with the latest tax benefits to ensure that businesses signed with us get the most out of the benefits.

Strategizing to Maximize Tax Savings

Strategic tax planning is essential to optimizing small business outcomes. With a thorough knowledge of eligibility for deductions and credits, entrepreneurs can now employ tactics that help them minimize tax liability. This could involve reformatting certain parts of the business systems or making good use of the timing of investments and purchases by aligning them with tax compliance. Our bookkeeping services include expert professional advice on the structure of transactions and operations to maximize available benefits and opportunities by saving more on your tax bill.

Navigating Tax Law Changes

Highlighting Recent Changes in Tax Laws Affecting Small Businesses

Tax laws are constantly changing, and they significantly affect small businesses. Significant updates and modifications are made to initial tax laws as often as monthly. Business owners should consider keeping themselves updated with recent amendments that may frame their filing of return of income, which otherwise can be detrimental to the company due to delayed payments and, in some extreme cases, penalties. Let us help you stay updated with all the changes to ensure your business stays compliant and takes advantage of new opportunities the tax law updates might create.

Understanding Implications and Opportunities Presented by Tax Law Updates

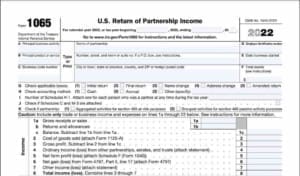

Effective tax planning considers the implications and impacts of the changes in tax laws and their applicability. Each tax legislation change has pros and cons because of its diverse impacts. Both partnerships and LLCs need to be fully informed about these impacts regardless. These changes bring about essential tax savings if carefully considered. Our book-handling services provide you as a business owner with expert analysis on how changes in tax laws impact your business and alert you to opportunities that will see new provisions for tax savings.

Consulting with a Tax Professional for Personalized Guidance

Most tax law changes require interpretation. Accounting for complicated tax laws and the high rate of environmental changes leaves small companies with only one option: to reach out to experienced tax lawyers or accountants. These professional consultants can offer personalized advice and tailor it to the specific needs and circumstances of the business so that any unclaimed deductions and credits are discouraged and errors are avoided. Our people-first mentality ensures you receive personalized attention and expert guidance throughout your financial journey. We share your passion and your dedication to making your dreams a reality inspires us. That’s why we’re committed to providing you with the financial visibility and support you need to thrive. We build meaningful relationships with our clients and understand their needs.

Utilizing Technology for Efficiency

Overview of Tax Preparation Software Options

The right tax preparation software can greatly increase efficiency and accuracy during tax filing. In the digital era, small business owners have many tax preparation software applications that can facilitate filing by shortening the time to prepare the returns. Be it user-friendly tools designed specifically for small businesses or more comprehensive solutions covering complex tax scenarios, these tools make tax preparation a more straightforward job driving the sector’s development. Based on your business’s needs, we have bookkeeping and accounting solutions that best match your business model and streamline tax filing.

Streamlining Tax Filing Processes with Digital Tools

Digital tools help automate many stages of tax preparations, from calculations to final submission. This effort reduces time and creates a lower risk of human mistakes since accuracy is considered higher when filing taxes. With the help of the best technology, Xendoo.com is there to make your tax filing process a breeze, assure you that you save time, and reduce the possibility of making a mistake.

Ensuring Data Security and Accuracy When Using Technology

In digital tax preparation, prime concentration is paid toward data security and accuracy. Although technology, in some cases, may provide support in tax preparation, and there are some instances when using data digital tools is indispensable, it’s equally important to keep in mind the necessity for the security of the data and accuracy in using the digital tools. Small business owners need to use due diligence in choosing a software provider based on how the company ensures the data stored on their platforms are secure. at Xendoo.com uses advanced security measures to protect your financial data and ensure that your tax filing data is safe and accurate. Our entry systems enable small business owners to double-check their calculations and entries when inputting information to ensure the accuracy of their financial records.

Handling Contractor Forms and Other Documents

Collecting and Verifying 1099 Forms from Contractors

Proper management of the 1099 forms is crucial to accurate tax reports. Small businesses dealing with independent contractors must be cautious; they must collect and review the 1099 forms from each contractor before the year-end tax deadline. These forms provide crucial details about grants whose payments were given to private contractors, and if a mistake is made, it may result in penalties or audits. Small firms could be income earners from various origins, i.e., sales, services, investments, and properties that can be rented. Our bookkeeping services help collect, verify, and organize 1099 forms from your contractors to help achieve compliant and accurate payment reporting to the contractor.

Reporting Income Accurately from Various Sources

Accurate tax filing means accurately reporting income from different sources. It is crucial to meet all income-earning sources to avoid incurring fines and comply with tax laws. Keeping journal entries up to date and comparing individual credit memos to the financials is critical to correct income reporting. Accuracy must be maintained in reporting, thereby minimizing the chances of errors and penalties.

Tips for Addressing Discrepancies or Missing Information

Small business owners must attend immediately to the discrepancies or missing information resulting from contractor forms or other documents. This may involve contacting subcontractors for explanations, private consultation with tax specialists, or appeals to the authority of relevant government agencies to receive the correct and timely reporting. Xendoo’s bookkeeping services include the expertise you need to correct discrepancies or fill in missing information to ensure your tax filings are complete and accurate. We provide the financial visibility and support small businesses need to thrive and scale. Let us handle the financial burden so you can focus on what matters most – running your business and achieving your goals.

Avoiding Common Tax Mistakes

Identifying and Avoiding Common Errors in Tax Filing

Due to the intricacy and probability of compounding errors with this process, filing taxes has often been a difficult task for small businesses to deal with. Succinctly stated, the common pitfalls involve underestimated cost of living, forgetting to inform about income sources, neglecting required forms, and misunderstanding of tax laws. These are common mistakes that may lead you to an audit or penalty. Xendoo.com will help you avoid such pitfalls and, more so, help you be sure that your tax filing is error-proof.

Double-Checking Calculations and Entries for Accuracy

All business owners want to avoid mistakes by double-checking all calculations, entries, and documents; that is why they should check everything before filing their tax returns. One preparation step is to review the financial statements, check deductions and credits, and ensure that all incomes and expenditures are reported appropriately. Small business owners need to ensure that their business records are accurate down to the last decimal, especially when it comes to entered data and calculated entries.

Learning from Past Mistakes to Improve Future Tax Filings

Analyzing previous tax filing processes and pinpointing mistakes can be crucial steps for small business owners that will allow them to enhance their capabilities. By studying past misstatements and trying to improve the trajectory to rectify them, any future filings will be accessible, and the chance of mistakes being made will be significantly reduced. From analyzing records, we at Xendoo offer insights that would prevent past financial record-keeping mistakes from happening; this progressively improves your filing.

Exploring Extensions and Estimated Tax Payments

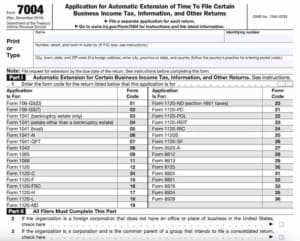

Understanding the Option to File for a Tax Extension

It does add some time to your tax preparation, but it can do wonders to ensure things are correct. Often, small business owners are granted an extension on their taxes when there is insufficient time to collect all the requisite information or finalize filing the tax return. This can erase the panicky situation for the last minute and not push filers to submit hurried or faulty filings, which can attract penalties and errors. However, small business owners need to ensure that the extension pushes the filing due date rather than the extent of the payment deadlines. Xendoo.com can walk with you on how to file an extension and ensure you know what it means and what it takes.

Making Estimated Tax Payments to Avoid Penalties

Small business owners who anticipate owing taxes are advised to consider making estimated tax payments to prevent cheques or interest charges. If the pre-bid meeting or communication is not done correctly, the procurement officer can be liable for heavy fines, even with the extension sought. Calculate and pay estimated tax so that penalties are withheld with the extension. We offer you advice on making those payments and remaining in a positive standing with your business.

Factors to Consider Before Opting for an Extension or Estimated Payments

It is vital to consider whether filing an extension or paying estimated payments would be better for your business. Before deciding to get an extension or making the estimated tax payments, small business people should apply critical thinking only to their particular situation. For instance, whether they have cash flow, the tax returns they file, and whether they need all the necessary documents. Seeking tax advice from professionals not only helps a taxpayer to make the right choice but also to understand various tax implications.

Navigating the tax season requires diligence, strategic planning, and support. By favorable implementation of the seven top last-minute tax strategies, small business owners will confidently navigate the intricacies of tax filing while ensuring compliance and maximizing potential savings. Taking advantage of guidance from an experienced tax advisor is a necessary process that will help reconstruct the tax code and its regulation changes. Remember, the goal is not just to meet the deadline but to do so in a way that benefits your business’s financial health and future growth prospects.

About Xendoo

We share your passion for small businesses and are inspired by your dedication to making your dreams a reality. That’s why we’re committed to providing you with the financial visibility and support you need to thrive.

More Than Just Numbers

It’s more than simply crunching numbers. It’s about building meaningful relationships with our clients and understanding their needs. Our people-first mentality ensures you receive personalized attention and expert guidance throughout your financial journey.

A One-Stop Solution

Xendoo offers a comprehensive suite of services, including:

- Full-service bookkeeping and accounting team to free up your time and resources.

- Hassle-free tax preparation and filing

- Fractional CFO Services to work with you on a roadmap of future growth

- A dashboard that provides real-time financial insights

Passionate about your success? Xendoo is, too. We provide the financial visibility and support small businesses need to thrive and scale. Let us handle the financial burden so you can focus on what matters most – running your business and achieving your goals.

Contact Xendoo today and discover how we can give you time back to grow your business.