Boost Profits With The Guide to e-Commerce Accounting

Managing an eCommerce business extends beyond the simple transaction of goods online. Unlike traditional businesses, eCommerce accounting involves unique challenges, like managing inventory costs, tracking marketing spending across multiple channels, and dealing with complex tax regulations. These complexities can leave you needing help to make sense of your finances and unsure of your business’s true performance.

An important part of managing an eComm business is understanding and visibility of the eComm financial ecosystem, emphasizing the chosen accounting approach.

This in-depth guide will explore the complexities of eCommerce accounting.. From outlining the pivotal role of proper financial oversight to pinpointing the tangible advantages gained from streamlined accounting solutions, this guide is a valuable resource for eCommerce entrepreneurs looking to fortify their financial foundations and propel their businesses toward enduring success and growth.

The Significance of eCommerce Accounting

Running a successful eCommerce business requires clear control and visibility of your finances. It’s easier to make smart decisions for your business with clear and organized accounting.

Think of accounting as your financial roadmap. It helps you track everything from who owes you money (receivables) to whom you owe (payables), expenses, and supplier invoices. This way, you have a clear picture of your cash flow and can make informed decisions about your business, like how much to invest in inventory or marketing.

Investing in a proper accounting system that can handle the increasing complexity as your business grows is crucial. This will save you time and headaches, allowing you to focus on what matters most: growing your business.

Your eCommerce business needs insightful accounting to understand its health. It goes beyond simply keeping track of numbers. Understanding your numbers empowers you to make smart decisions. You can see where your money goes so that you can invest wisely. Accounting also helps you forecast your short-term and long-term income to plan effectively.

Good accounting helps you stay on top of taxes and avoid penalties. This frees up your time and energy to focus on what matters most – growing your business!

Accurate bookkeeping and accounting are your secret weapon against wasted spending and missed opportunities. By combining powerful analytics with your everyday bookkeeping, you will gain valuable knowledge about your business and unlock insights about your customers.

These insights are like gold. They’ll help you become laser-focused on strategies that resonate deeply with your target audience, leading to more meaningful connections and scaling your business.

That’s not all. By knowing your financial data, you can identify areas where your business can become efficient: streamlined operations, reduced costs, and more efficiency.

Plus, having all your financial data in one place gives you a clear bird’s-eye view of your business. This means you can make data-driven decisions perfectly aligned with your customers’ wants and market demands.

Understanding E-commerce Accounting: Your Guide to Profitable Decisions

E-commerce accounting might sound intimidating, but it’s ultimately about understanding your financial data to make smart business decisions that boost your profits. It helps you answer questions like:

- How much money is coming in and going out?

- Where can I make cuts without impacting my sales?

- Am I investing in the right marketing channels?

Here’s a breakdown to make things easier:

Think of bookkeeping as the “how” and accounting as the “what” of your finances. Bookkeeping involves recording and managing daily transactions, like sales, expenses, and payments. Accounting analyzes that data to tell you the “what,” like your overall profitability and growth potential.

The foundation of good accounting is accurate bookkeeping. If you categorize and track your transactions correctly, the insights you get from the data will be reliable. This can lead to missed opportunities or even costly mistakes.

There are two main accounting methods: cash-basis and accrual.

- Cash-basis accounting: Records income when you receive payment and expenses when you pay them. This is simpler and often used by startups.

- Accrual accounting: Records income when it’s earned (even if not received yet) and expenses when incurred (even if not paid yet). This provides a more accurate picture of your business’s financial health but is also more complex.

The next section will delve deeper into bookkeeping practices for e-commerce businesses. We’ll explore how to keep your financial data organized and ready for valuable analysis.

Improving Your eCommerce Accounting

Insights into cash flow and comprehensive reporting capabilities are vital for eCommerce businesses to understand their financial health, monitor performance, and identify opportunities for improvement. This level of insight is especially important in the dynamic and fast-paced eCommerce environment, where quick and informed decisions can greatly impact growth and success.

Scalability for Sustainable Growth:

Some robust accounting solutions cater to both new and established businesses. Look for features that can adapt and grow alongside your company. This eliminates the need for major overhauls later on, allowing you to focus on scaling your business seamlessly.

Streamlined Processes and Reduced Errors:

Many platforms offer automated transaction tracking features. This saves you valuable time and reduces the risk of human error in recording sales and expenses.

Navigating Tax Complexities:

E-commerce businesses, especially those operating across state lines or internationally, often face complex tax requirements. Look for solutions that offer tax assistance features to help you stay compliant and avoid unnecessary complications.

Gaining Clear Financial Insights:

Comprehensive reporting capabilities and clear cash flow insights are crucial for understanding your financial health, monitoring performance, and identifying areas for improvement. This is especially important in the fast-paced world of e-commerce, where quick and informed decisions can significantly impact your success.

Multi-Channel Integration for Effortless Data Management:

Managing finances across multiple sales channels can be time-consuming and error-prone. Look for solutions that integrate seamlessly with popular e-commerce platforms like Shopify, Amazon, and eBay. This allows you to systematically consolidate and analyze your financial data from various sources, ensuring accurate and comprehensive financial visibility across your entire business.

In conclusion, choosing the right accounting tools empowers your e-commerce business to manage finances efficiently, gain valuable insights, and fuel sustained growth in the competitive landscape. Explore your options and find the solutions that best suit your needs and goals.

Practical Tips for Immediate Implementation

- Employ Cash Basis Accounting: This beginner-friendly method simplifies record-keeping by tracking transactions when cash moves, making tax preparation easier.

- Monitor and Categorize Transactions: Automate this process using accounting software to improve accuracy and potentially save tax through precise expense categorization.

- Synchronize Sales Channels: Integrate transactions from various platforms into a single database for easier financial oversight and analysis.

- Automate Tax Calculations: Simplify complex tax requirements across jurisdictions by leveraging accounting software capabilities.

- Distinguish Chargebacks and Returns: Track and categorize these accurately for proper financial recording and analysis.

- Generate Detailed Reports: Utilize robust reporting features to gain insights into your business, analyze performance, identify trends, and make informed strategic decisions.

- Integrate Budgeting and Forecasting: Employ budgeting and forecasting tools within your accounting software to gain insight into future financial projections for informed business decisions. This helps plan for future investments, expansions, and potential challenges.

- Utilize Inventory Management: Leverage accounting software’s features to track stock levels, manage inventory across locations, and optimize stock control. This ensures effective inventory management, accurate financial reporting, and informed purchasing decisions.

- Automate Invoice Generation: Automate sending and generating invoices through your accounting software, saving time and ensuring accuracy, professionalism, and, ultimately, improved cash flow and client satisfaction.

- Track Expenses Meticulously: Use your accounting software to track and categorize business expenses meticulously. This helps identify cost-saving opportunities, ensure compliance with tax regulations, and facilitate accurate financial reporting.

Long-Term eCommerce Accounting Strategies

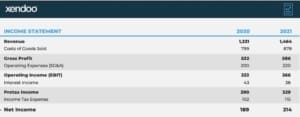

Detailed Accounting Reports: Regularly analyze reports to gain insights into sales trends, profitability, and inventory management.

Cash Flow Management: Monthly cash flow statements offer a clear view of financial health, highlighting areas for potential improvement.

Scalable Accounting Policies: Regularly review and adjust your accounting practices to accommodate business growth and expansion, ensuring your systems can scale with your business.

Integration with CRM Systems: Integrate Xero with Customer Relationship Management (CRM) software to gain a comprehensive understanding of customer behavior and preferences, enabling targeted marketing strategies and improved customer engagement.

Advanced Data Analytics: Leverage Xero’s advanced analytics capabilities to delve deeper into financial and operational data, gaining profound insights for strategic planning, forecasting, and enhanced decision-making.

Next Steps with Xendoo

The next steps involve implementing your newfound understanding of e-commerce accounting to streamline your processes and unlock even greater efficiency and visibility for your business. By harnessing the synergy between robust bookkeeping and your online sales platform, businesses can optimize efficiency and lay the groundwork for sustained success in the dynamic eCommerce landscape. Let Xendoo help you remove the guesswork and embrace the power of data-driven e-commerce accounting. It’s time to build a business that’s agile, responsive, and ready to crush its goals.