1099 Filing Requirements for the 2026 Tax Season: What Small Businesses & Contractors Need to Know

The 2026 tax season is here, and that means it’s time for businesses and self-employed individuals to make sure they

Get a FREE Review of Your Books Learn More >

Bookkeeping | Catch-Up | Taxes

Online bookkeeping and accounting services for small business that go beyond the numbers. Get a dedicated team of experts who understand the complexities of your business, your industry, and your goals, providing custom accounting and tax solutions to support your success.

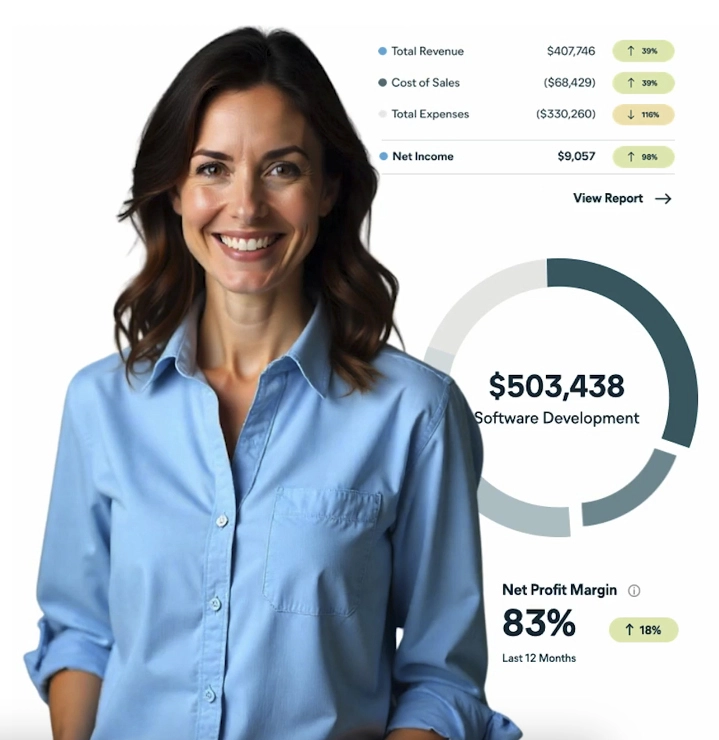

Your numbers are always up-to-date. With weekly bookkeeping, your accountant ensures accurate financials and timely monthly reports.

Behind on your books? We’ve got you covered. Your books will be updated accurately, bringing financial clarity and the confidence to move forward.

Year-round tax support from expert advisors, dedicated to maximizing your tax savings and keeping your business compliant.

Up-to-date books with data-driven financial insights so you can scale with confidence.

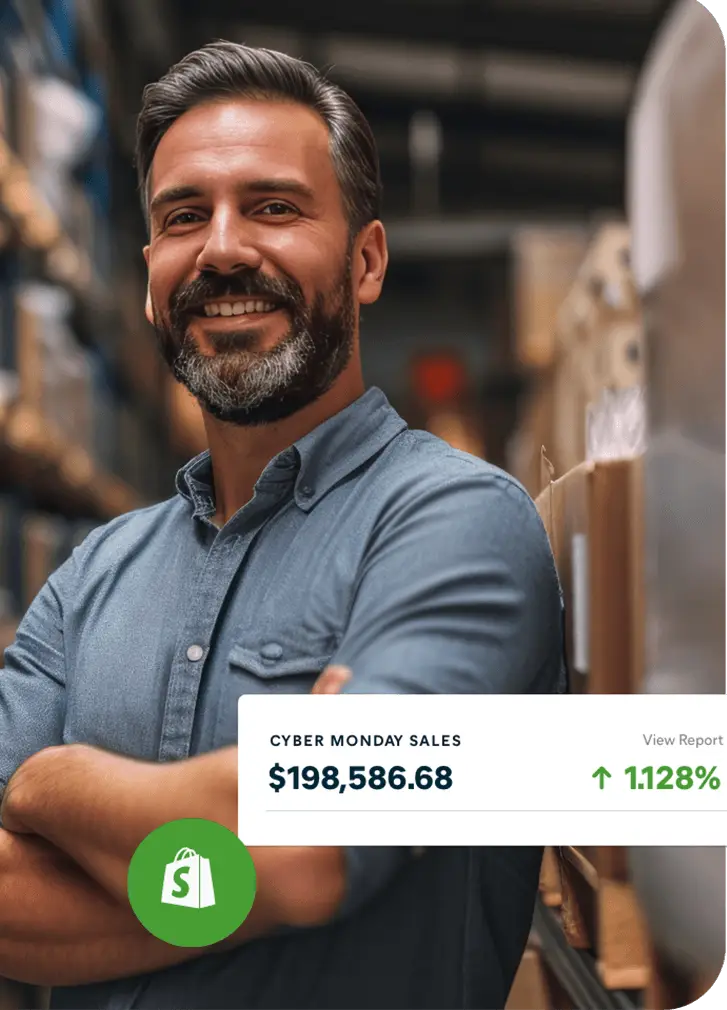

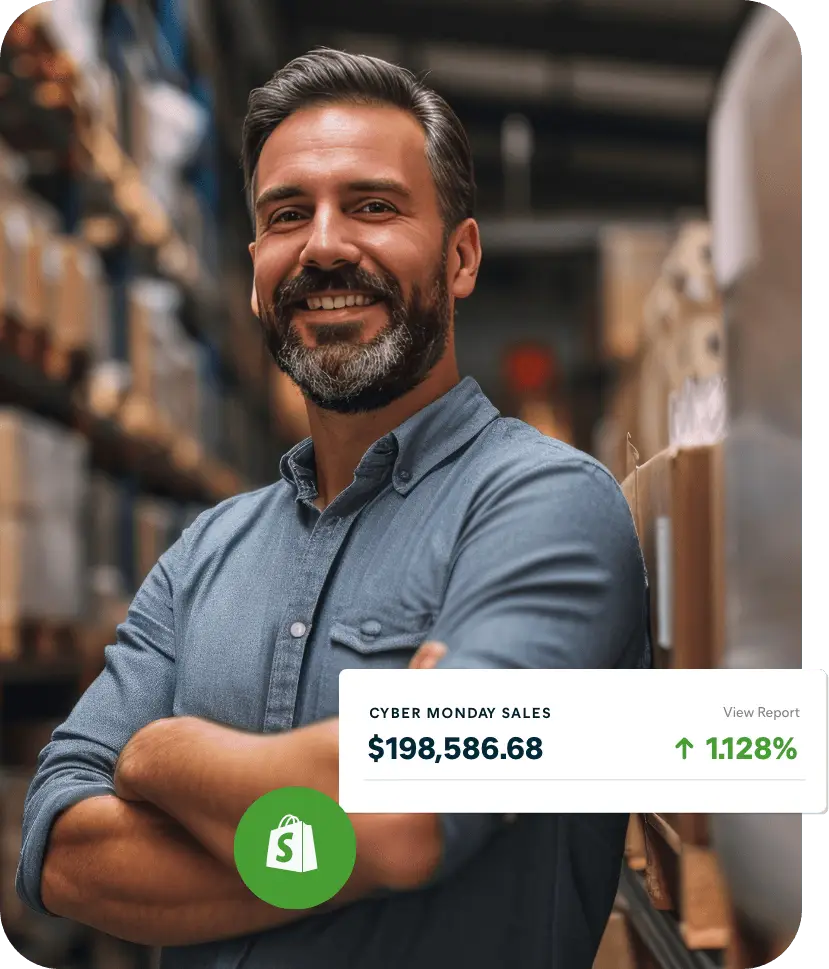

A team that understands the online marketplace with the complexity of integrations.

Maximize billable hours and optimize your time with clear

financial visibility.

Streamline financial management with our franchisor-specific dashboard, designed for benchmarking and tracking location performance.

Streamline sales, expenses, and reporting all in one place. Check out all our industries.

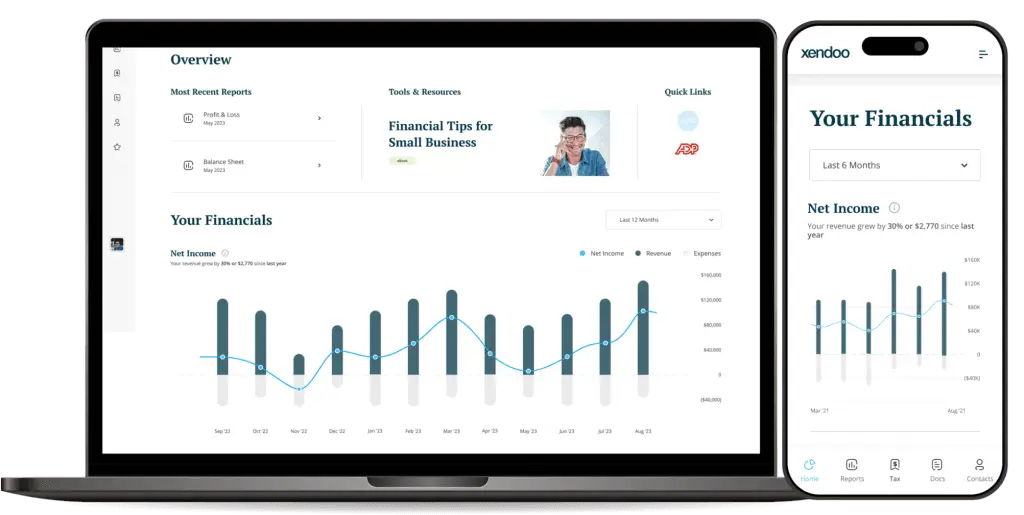

View your financial data 24/7 through Xendoo’s mobile app or desktop dashboard, wherever you are.

Communicate easily, ask questions, and get answers fast inside the platform.

See your expenses broken down by category, with clear totals so you can compare costs.

Track changes in revenue and net income so you can make confident, informed decisions.

The 2026 tax season is here, and that means it’s time for businesses and self-employed individuals to make sure they

As eCommerce businesses scale, growth often outpaces visibility. Sales increase, channels expand, and payouts accelerate, yet many business owners still

Bookkeeping usually falls behind in small, quiet ways. A month is skipped. Reconciliations stop. Transactions pile up in uncategorized accounts.

Across invoicing and payment platforms, business owners are increasingly seeing a simple prompt: “Get paid now.” It appears helpful. Immediate

Summary: As businesses become more profitable, choosing the right tax structure becomes an important planning decision. This blog explains when

As 2025 comes to a close, the window to reduce your tax bill is still open, but only if the

Summary To get your eCommerce books ready for tax season, make sure your numbers are accurate. Check your COGS, update

Today’s eCommerce businesses run on data, automation, and speed. Whether selling on Shopify, Amazon, or multiple online channels, success requires