10 Accounting Tips for Small Businesses to Keep the Books Balanced

In the ever-evolving business landscape, small to medium-sized businesses (SMBs) are increasingly adopting innovative tools to streamline operations and enhance financial management. One crucial determinant of success for any SMB is how it handles its monthly finances. Good accounting practices not only conform a business to regulations but also create valuable information that can help the business grow. In this article, we provide 10 actionable accounting tips to help small businesses keep their books balanced and achieve financial stability.

Tip 1: Keep Personal and Business Finances Separate

Maintaining separate accounts for personal and business finances is fundamental to clear and accurate bookkeeping. Mixing personal and business transactions can lead to confusion, errors, and potential legal issues. By opening a dedicated business bank account, you ensure that all business expenses and income are recorded separately. This not only simplifies tax preparation but also provides a clear picture of your business’s financial health.

Actionable Advice: Start by setting up a dedicated business bank account and, if needed, a separate credit card for business expenses. This will help you track business expenditures accurately and maintain clear records.

Tip 2: Use Cloud-Based Accounting Software

Embracing cloud-based accounting software can revolutionize your financial management. Unlike traditional software that requires installations on individual desktops and frequent updates, cloud-based solutions offer real-time access to your financial data from any internet-connected device. This flexibility is crucial for informed decision-making and strategic planning.

Recommendations: Popular cloud-based accounting software options include QuickBooks Online, Xero, and FreshBooks. These tools offer features such as automatic backups, real-time data syncing, and integration with other business applications.

Actionable Advice: Choose the right software based on your business needs and get started by migrating your existing financial data to the cloud. This will not only enhance your efficiency but also provide you with accurate, up-to-date financial information at your fingertips.

Tip 3: Track Every Expense

Accurate expense tracking is essential for maintaining balanced books and making informed financial decisions. Every business expense, no matter how small, should be logged and categorized appropriately. This helps in monitoring cash flow, managing budgets, and preparing for taxes.

Actionable Advice: Utilize digital tools and receipt management apps to log expenses in real time. Regularly update your records to ensure no expense goes untracked.

Tip 4: Regularly Reconcile Your Accounts

Regular account reconciliation is crucial to prevent errors and discrepancies in your financial records. By comparing your internal records with bank statements, you can identify and rectify any inconsistencies promptly. This practice helps in maintaining accurate financial records and avoiding potential issues during audits.

Actionable Advice: Schedule monthly or quarterly account reconciliations. Use accounting software that automates this process and alerts you to any mismatches.

Tip 5: Monitor Your Cash Flow

Cash flow management is vital for the stability and growth of your business. By keeping a close eye on your cash inflows and outflows, you can ensure that your business has enough liquidity to meet its obligations and seize growth opportunities.

Actionable Advice: Create cash flow statements and forecasts to predict future cash needs. Use these insights to plan for expenses, manage shortfalls, and make informed investment decisions.

Tip 6: Keep Detailed Records

Maintaining detailed records of all financial transactions is essential for transparency and accuracy. This includes invoices, receipts, bank statements, and tax documents. Thorough record-keeping not only aids in financial management but also ensures compliance with regulatory requirements.

Actionable Advice: Implement a systematic approach to record-keeping, using both digital and physical storage methods. Regularly update and back up your records to prevent data loss.

Tip 7: Set Aside Money for Taxes

Preparing for tax liabilities is crucial to avoid financial surprises and penalties. By setting aside money regularly for taxes, you can ensure that you meet your tax obligations on time and avoid the stress of last-minute scrambling.

Actionable Advice: Estimate your tax liabilities based on your income and expenses. Set aside a portion of your revenue each month in a separate tax savings account.

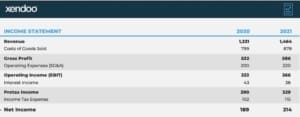

Tip 8: Review Financial Reports Regularly

Regularly reviewing financial statements is key to making informed business decisions. Financial reports such as income statements, balance sheets, and cash flow statements provide insights into your business’s financial performance and health.

Actionable Advice: Schedule regular reviews of your financial reports. Use these reviews to identify trends, spot potential issues, and make strategic decisions.

Tip 9: Hire a Professional Accountant and/or Bookkeeper

Seeking professional accounting or bookkeeping help can provide significant benefits, even for small businesses. Bookkeeping involves the day-to-day recording of transactions, maintaining accurate financial records, and managing receipts and invoices. An experienced bookkeeper ensures your financial data is up-to-date and organized. On the other hand, accounting encompasses a broader scope, including analyzing financial data, preparing financial statements, and providing strategic insights. An experienced accountant can offer valuable insights, ensure compliance with regulations, and help optimize your overall financial management practices.

Actionable Advice: Consider hiring an accountant or bookkeeper on a part-time or freelance basis if a full-time hire is not feasible. Look for professionals with experience in your industry and a solid track record. Alternatively, consider Xendoo. Xendoo specializes in providing tailored bookkeeping and accounting solutions for small businesses. By choosing Xendoo, you gain access to a team of experienced professionals who can help manage your financial records and offer strategic insights, ensuring your business thrives.

Tip 10: Plan for the Future

Financial planning and setting long-term goals are essential for business growth. By creating a financial plan, you can align your resources with your strategic objectives and ensure sustainable development.

Actionable Advice: Develop a financial plan that includes projections for revenue, expenses, and cash flow. Regularly update your plan to reflect changes in your business environment and goals.

Conclusion

Balanced books are the foundation of a successful small business. By implementing these 10 accounting tips, you can achieve greater financial stability, make informed decisions, and drive your business toward growth and profitability. At Xendoo, we specialize in providing cloud-based accounting services tailored to the unique needs of small businesses. Our goal is to transform your financial management practices, making them more efficient, transparent, and accessible. Interested in seeing how Xendoo can make a difference in your business? Read more about Xendoo or schedule a call to discuss your specific needs. Embrace the future of accounting with Xendoo and take the first step towards smarter financial management.