Client Accounting Services vs Traditional Accounting

Accounting is a core part of running a business. It affects how performance is measured, how decisions are made, and

FREE Review of Your Books! Schedule Now >

Xendoo’s online accounting services combine powerful technology with expert support, giving you accurate books, timely reports, and data-driven insights that power growth.

Our team of accountants reconciles your books weekly and delivers timely monthly reports, keeping your financials tax-ready year-round. With 24/7 access to your dashboard and ongoing support from your dedicated accountant, you gain clarity in your financials and confidence in your growth.

Your numbers are always up-to-date. With weekly bookkeeping, your accountant ensures accurate financials and timely monthly reports.

Behind on your books? We’ve got you covered. Your books will be updated accurately, bringing financial clarity and the confidence to move forward.

Year-round tax support from expert advisors, dedicated to maximizing your tax savings and keeping your business compliant.

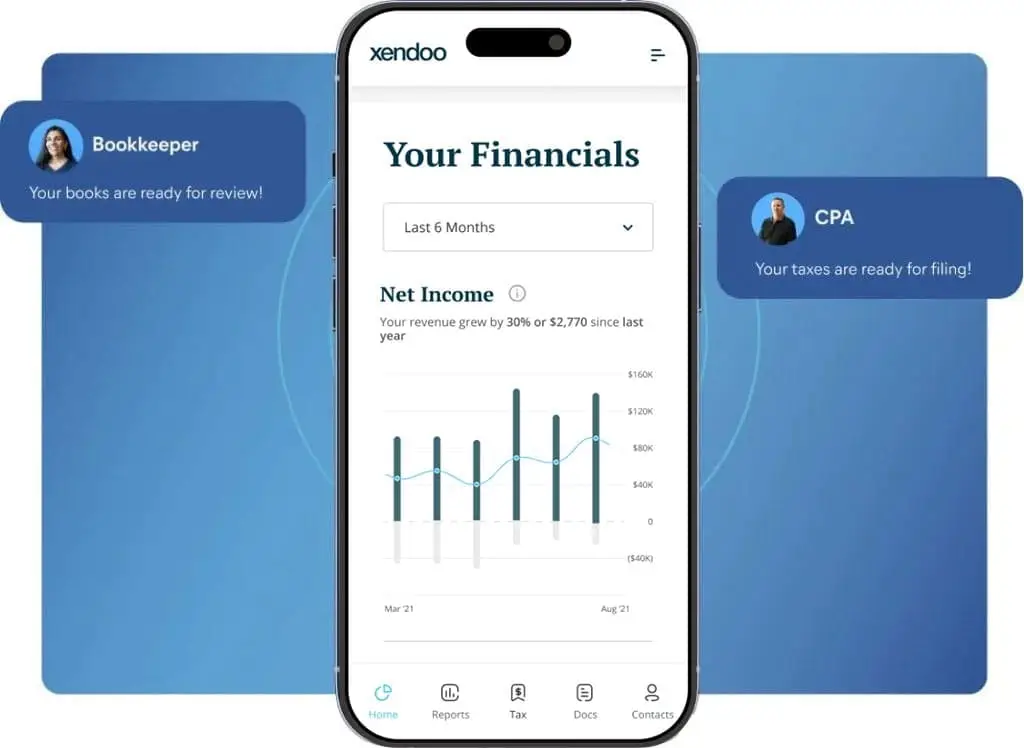

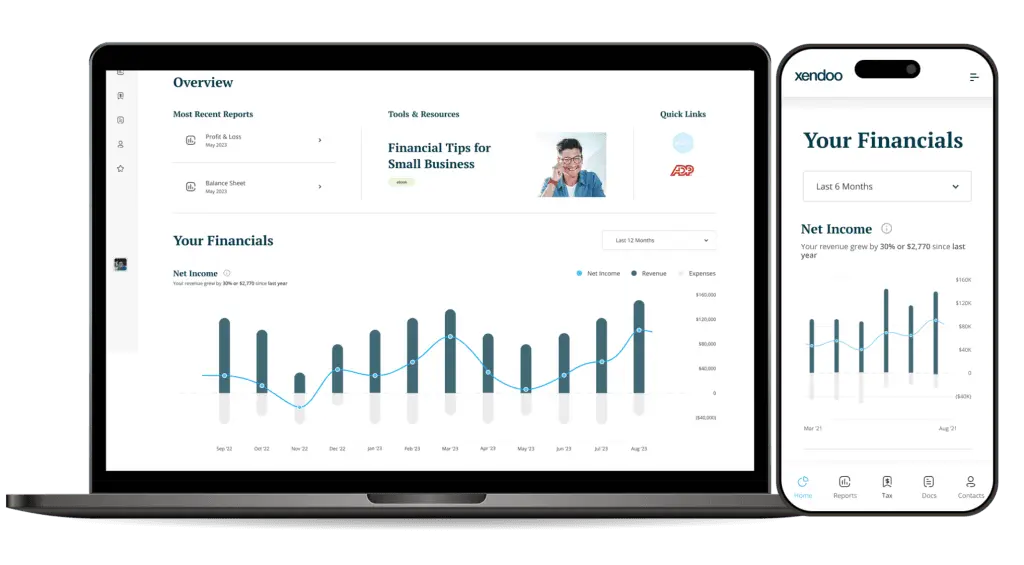

Technology + Human Support: Proprietary dashboard with 24/7/365 access on mobile and desktop, paired with a dedicated accountant.

Tax-Ready Books: Weekly reconciliations and timely monthly reports keep you compliant and prepared year-round.

Data-Driven Insights: Reports and metrics designed to inform decisions and support growth.

Industry Expertise: Tailored support for eCommerce, franchises, professional services, and more.

Seamless Integrations: Integrates with industry-leading platforms like Xero and QuickBooks Online to streamline workflows.

View your financial data 24/7 through Xendoo’s mobile app or desktop dashboard, wherever you are.

Communicate easily, ask questions, and get answers fast inside the platform.

See your expenses broken down by category, with clear totals so you can compare costs.

Track changes in revenue and net income so you can make confident, informed decisions.

Timely Financials: Timely financial statements, giving you a clear view of performance.

Data-Driven Insights: Access trends and metrics to help you make informed decisions.

Stress-Free Tax Prep: With organized, tax-ready books, filing season becomes straightforward.

Scalability for Growth: Processes and systems that adapt as your business expands.

I can't say enough good things about and the Xendoo team! My books have never been this accurate, and having the ability to schedule calls directly on calendar at any time has made managing my finances so much easier. The team is incredibly professional, knowledgeable, and responsive."

"We have been using Xendoo for Accounting Since 2018 with our four different companies and we think we work well together and they deliver on our expectations. Tax planning and completing the tax returns via the Xendoo portal, makes life easier on all, so communication is streamlined and less back and forth. Reaching our assigned team members has been easy. Look forward for continued help from Mario and Louis! We thank them for what they do for us."

Regain your time – focus on growth while we take care of the numbers.

Accounting is a core part of running a business. It affects how performance is measured, how decisions are made, and

SaaS businesses operate in one of the most capital-driven growth environments in modern business. Whether pursuing venture capital, private equity

For many SaaS businesses, bookkeeping starts as an internal task. A founder handles it. An ops lead owns it part-time.

The 2026 tax season is here, and that means it’s time for businesses and self-employed individuals to make sure they

As eCommerce businesses scale, growth often outpaces visibility. Sales increase, channels expand, and payouts accelerate, yet many business owners still

Bookkeeping usually falls behind in small, quiet ways. A month is skipped. Reconciliations stop. Transactions pile up in uncategorized accounts.

Across invoicing and payment platforms, business owners are increasingly seeing a simple prompt: “Get paid now.” It appears helpful. Immediate

Summary: As businesses become more profitable, choosing the right tax structure becomes an important planning decision. This blog explains when