There’s a lot to keep track of when you run a business. Many business owners look at their calendars halfway through April and realize that they missed their tax deadline. If this happened to you, it’s not too late to take action. You might be wondering: What happens if you miss the tax deadline?

In this article, we’ll go over everything you need to know about late tax filings and payments and provide an action plan to get you back on track.

Table of contents

- Tax filing deadlines

- What happens if you’re getting a refund (you don’t owe taxes)?

- If you miss the tax deadline and owe taxes

- What if you can’t pay your taxes?

- How to file taxes after you’ve missed the deadline

Tax filing deadlines

Before diving into what happens if you miss a tax deadline, let’s cover the most important tax filing deadlines for businesses. If you’ve applied for a tax filing extension before your deadline, then refer to the extension deadline section in the table below.

| Deadline | What’s due | Business entity it applies to |

| March 15, 2023 | Tax returns (Form 1065, Schedule K-1, or 1120S) | Partnerships, multi-member LLCs, and S-Corps |

| April 18, 2023 | Tax returns (Form 1040, Schedule C, or 1120) | Sole proprietorships, single-member LLCs, and C-Corps |

| September 15, 2023 | Business tax return extensions | Partnerships, multi-member LLCs, and S-Corps |

| October 15, 2023 | Tax return extensions for individuals and C-Corps | Sole proprietorships, single-member LLCs, and C-Corps |

The tax day for 2023 tax returns will fall on March 15, 2024, for partnerships and S-Corps and April 15, 2024, for other businesses.

Difference between filing and paying taxes

There is a difference between filing and paying your taxes. “Filing” refers to submitting the required paperwork, whereas “paying” means sending the money you owe to the IRS.

While you file tax returns once a year, businesses must also pay estimated taxes quarterly. The deadline for both is the same in Q1 of 2023, but quarterly taxes have different due dates throughout the year.

Also, the penalties for filing and paying late taxes differ. In fact, the penalty for filing late is more severe than the penalty for paying late. This means that even if you can’t pay your taxes on time, you should file or extend before the due date.

What happens if you’re getting a refund (you don’t owe taxes)

If you missed the tax filing deadline but are due a refund, you’re in luck—there is no penalty. The government is happy to hold on to your money, interest-free, for a bit longer.

However, you have up to three years from the filing deadline to complete a return and claim that refund. Don’t delay too long, especially if you receive a Premium Tax Credit for insurance. Failure to file a tax return could jeopardize business tax credits, so it’s better to act soon.

What happens if you miss the tax deadline and owe taxes

If you owe taxes and missed the filing deadline, there’s a mix of good and bad news. The bad news is that you can’t file an extension at this point, and the IRS may charge a failure-to-file or failure-to-pay penalty for missing the deadline.

The good news is that you can still file your tax return—the faster you file, the more you can avoid extra costs. What happens if you don’t file taxes also depends on how long it’s been since you last filed.

Penalties and interest

Penalties and interest vary based on your situation and how late you are in filing and paying taxes. The penalty for late filing is ten times larger than the penalty for late payments.

- Late payment penalty: 0.5% per month of the unpaid tax, up to a maximum of 25% of the amount due.

- Filing late penalty (if no extension): 5% of the unpaid tax per month, up to a maximum of 25% of the amount due.

What if you can’t pay your taxes?

If you’re unable to pay your taxes in full, there are several courses of action you can take. Most importantly, be proactive and communicate with the IRS. The options below will help you minimize the financial impact of late tax payments.

Pay with a credit card

If you’re unable to pay your taxes, you could explore borrowing options. For example, you could use a credit card to pay your taxes. This can cover your tax liability in full and avoid more penalties and interest.

However, carefully consider the interest rates and repayment terms for any loan or credit card before proceeding.

Request a payment installment plan

You may qualify for a payment installment plan with the IRS if you can’t pay in full. With an installment plan, you’ll pay your tax liability over a period of time through monthly payments. To apply for an installment agreement, submit Form 9465 with your tax return or online through the IRS website.

Apply for an offer in compromise

An offer in compromise (OIC) is a program that allows you to settle your tax debt for less than the full amount you owe. It’s typically available to taxpayers who demonstrate that paying their full tax liability would cause financial hardship. To apply for an OIC, submit Form 656 and a $205 non-refundable application fee.

Request a temporary delay

You can request that the IRS temporarily delay collection until your financial situation improves. To do this, you’ll provide the IRS with information about your income, expenses, and assets. If the IRS determines that you can’t pay, they may grant a temporary delay.

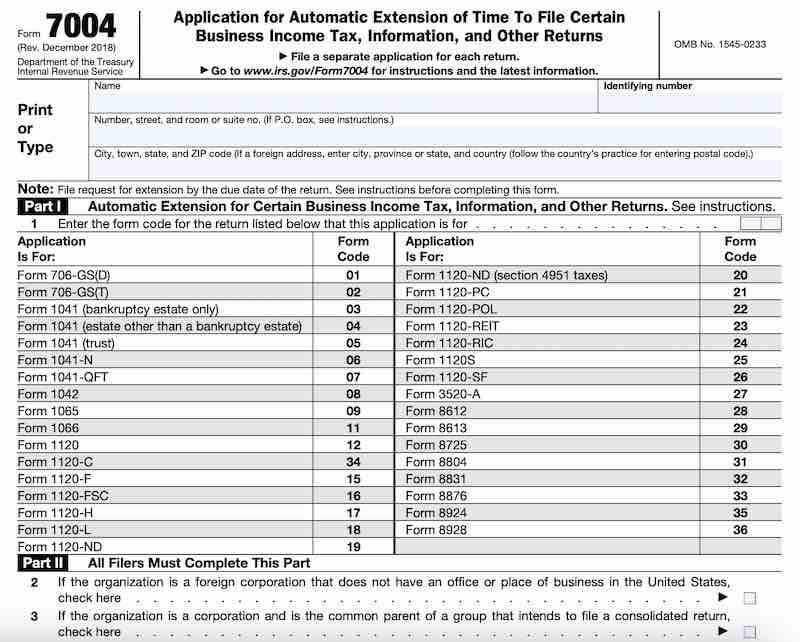

How to file for a tax extension

To file for a tax extension as a business, you can file Form 7004 online to the IRS. If tax returns were due on April 15, you’ll need to file your extension before then too.

An extension only grants you more time to file your tax return, not to pay any taxes due. You must still pay your estimated tax liability by the original tax deadline.

How to file taxes after you’ve missed the deadline

When you’ve missed the tax deadline, these steps will help you get caught up, file your taxes, and avoid extra costs.

1. Collect all your documents as soon as possible

The first step is to gather the documents you need to file your business taxes.

To file taxes for your business, you’ll need:

- Income statements and any other documents that report your earnings for the tax year.

- Expense records – receipts, invoices, and other documentation for deductible expenses, such as business expenses, or charitable donations.

- Bank and credit card statements to make sure you haven’t missed any income or deductible expenses

- Accounting software, tax forms, schedules, and instructions to help you file.

2. Get help from catch up bookkeeping and tax experts

If you’re behind on your books, you may struggle to collect all the financial documents you need. Luckily, there are catch up bookkeeping services that can help you get organized (and avoid falling behind again).

Look for catch up bookkeeping services with bookkeepers and certified public accountants (CPAs). Both can help you navigate the complexities of late tax filing.

Catch up bookkeeping experts and tax CPAs can:

- Organize your financial records: Get your financial records in order, so you get caught up on late and back taxes.

- Develop a plan: Address any penalties and interest for late tax filing or payments.

- Establish a system for the future: With bookkeeping year-round, you’ll have all the documents you need for taxes.

- Remind and prepare you for tax deadlines: They’ll handle current and future tax filings, so it’s always on time and accurate.

Your business may also pay less in taxes with a CPA, who identifies all your eligible tax credits and deductions.

3. File a past-due return

The process to file a past-due tax return is similar to how you’d file normally. Some tips that can make filing a little easier include:

- Use tax software: Many tax software programs include features that help you manage your books and tax documents.

- Review your return for accuracy: Double-checking your return can help you avoid more hold-ups from inaccuracies or mistakes.

- File electronically: Filing your tax return electronically can speed up the process.

Missing the tax deadline can be stressful, but it’s not the end of the world. By understanding the consequences and taking appropriate action, you can minimize the impact of late tax filing on your finances.

xendoo’s bookkeepers, accountants, and CPAs are experts at small business tax preparation. We can help you can regain control and stay on track for future tax seasons. If you’re behind on your books or taxes, schedule a chat and learn how xendoo can help.

FAQs

Can you file taxes after the deadline?

Yes, you can file taxes after the deadline. If you missed the tax deadline and didn’t request an extension, file as soon as possible to minimize penalties and interest.

[av_sidebar widget_area=’Blog Post Disclaimer’ av_uid=’av-om2w’]