With the qualified business income deduction (QBI), small business owners and self-employed workers could deduct up to 20% of their taxable income.

The QBI deduction is only available to pass-through entities between the tax years 2018-2025. A pass-through entity is a business that doesn’t need to file a separate business tax return. Instead, the owners report business income on their personal income tax returns.

Pass-through entities include:

- Sole proprietorships

- Partnerships

- LLCs

- S-Corps

In some cases, certain trusts and estates may also qualify. As a pass-through entity, business owners pay taxes for their business on their personal tax returns.

If your business is a pass-through entity, you may be able to lower your taxable income with the 20% QBI deduction.

This post will cover everything businesses need to know about the qualified business income deduction—including how to claim it.

What is the qualified business income deduction?

The qualified business income deduction (QBI) is part of the Tax Cuts and Jobs Act (TCJA) of 2017. With the deduction, non-corporate taxpayers (pass-through businesses) can deduct 20% of their qualified business income.

Since it’s a deduction, it will lower your taxable income, which might mean that you get taxed at a lower rate. In other words, you could pay less in taxes if you qualify.

Who qualifies for the QBI deduction?

To qualify for the QBI deduction, you must have income from a pass-through entity.

There are some exceptions and income limits, especially if your business is an SSTB—a specific service trade or business.

SSTBs

If your company’s main asset is your skill or reputation, or that of your employees, then your business is an SSTB. Some common SSTB industries include:

- Health

- Law

- Accounting

- Art and design

- Consulting

- Financial services

- Investment management

SSTBs can’t claim any QBI deduction once they reach the highest income limit. If your business isn’t an SSTB, you can claim a full or partial deduction. REIT/PTP dividends also qualify for the QBI deduction.

REIT and PTPs

If you have dividends from a Real Estate Investment Trust (REIT) or a Publicly Traded Partnership (PTP), you could deduct 20% of that income too. You must hold the dividends for more than 45 days to qualify.

If you have qualified business income and dividends, you can deduct 20% of your taxable income from each. As long as your total QBI deduction falls under 20% of your taxable income, you can take advantage of the stackable deductions.

Taxable income limits

The rules get complex once your taxable income hits the QBI limit. You may qualify for a partial deduction, depending on your total taxable income and your business.

Your filing status is the main factor that determines your income limits. Joint filers have one set of numbers, while all other filers have their own range.

QBI (full deduction)

To qualify for the full 20% deduction, your taxable income must be under $340,100 if you’re filing jointly.

If you’re filing single, head of household, or something else, your taxable income must be under $170,050.

| Filing Status | 2022 Taxable Income | QBI | SSTB |

| Joint | Up to $340,100 | 20% | 20% |

| All others | Up to $170,050 | 20% | 20% |

QBI (partial deduction)

If your joint taxable income is between $340,100 and $440,100, you’re eligible for a partial QBI deduction.

For those that aren’t filing jointly, your income needs to fall between $170,050 and $220,050 to qualify for a partial deduction.

| Filing Status | 2022 Taxable Income | QBI | SSTB |

| Joint | Up to $440,100 | Partial | 0% |

| All others | Up to $220,050 | Partial | 0% |

Once you pass the taxable income limits above, you’ll need to do a little bit of math to find your deduction amount.

You’ll choose the higher deduction out of the two options below:

- 50% of the W-2 wages paid by your business

- 25% of the W-2 wages and 2.5% of property

For a property to qualify, you must still be able to claim it as a depreciation expense, so its value is spread out over many years.

Property that qualifies is usually under 10 years old. For real estate, the depreciation life is between 27 and 39 years, depending on if it’s residential or commercial.

2023 QBI taxable income limits

Hopefully, you’ve filed your tax return and claimed the QBI deduction for the 2022 tax year. If not, it’s good to plan ahead for next year. For 2023, you can find the taxable income limits using the charts below.

| Filing Status | 2023 Taxable Income | QBI | SSTB |

| Joint | Up to $364,200 | 20% | 20% |

| Joint | Up to $464,200 | Partial | 0% |

| All others | Up to $182,100 | 20% | 20% |

| All others | Up to $232,100 | Partial | 0% |

| Filing Status | 2023 Taxable Income | Option 1 | Option 2 |

| Joint | Over $464,200 | 50% W2 wages | 25% W2 wages + 2.5% qualified property |

| All others | Over $232,100 | 50% W2 wages | 25% W2 wages + 2.5% qualified property |

QBI deduction example

To simplify the QBI deduction process, let’s look at some examples.

Say you’re a sole proprietor with a single filing status. In 2022 you earned:

- $100,000 from your independent contract work

- $50,000 in REIT dividends

If this is your total taxable income, you qualify for the full 20% deduction.

But what if your sole proprietorship is a small piece of your portfolio? Take the following scenario instead and say you have:

- Total taxable income is $400,000

- Paid $40,000 in W2 wages

- Qualified property worth $300,000

In this case, you won’t qualify for the full 20% deduction.

Even though your pass-through income is under $170,050, your total taxable income is well over the highest limit. You’ll need to do some simple math to find your deduction amount and decide which partial deduction will save you the most.

50% partial QBI deduction

First, multiply the wages you paid by 50%. This will give you your first deduction amount.

- $40,000 x 0.5 = $20,000

25% partial QBI deduction

Next, follow the three steps below to calculate your second amount.

- Take the wages you paid and multiply it by 25% – $40,000 x 0.25 = $10,000

- Multiply your qualified property value by 2.5% – $300,000 x .025 = $7,500

- Combine the two numbers – $10,000 + $7,500 = $17,500

In this case, the 50% partial deduction is higher, so it’s the better option.

How to claim the QBI deduction

You may not have the time or desire to figure out eligibility requirements, gather and fill the required documents, and submit your forms to the IRS by the deadlines.

If you think you qualify for the QBI deduction, these steps will simplify and maximize your small business tax deductions.

1. Leverage CPA services

The easiest way for small business owners to maximize their QBI deduction and other tax credits is to work with a tax CPA. Professional financial services like xendoo help small business owners get the best deductions. We also have in-house bookkeepers and CPAs to file your taxes without sharing your information with third-party services.

If you’d like to know the overall process to claim a QBI deduction, you can read through the simplified steps below.

2. Calculate taxable income

Your CPA will calculate your taxable income for the year. Your taxable income is all your combined income, minus deductions based on your business activity and expenses.

3. Determine if you’re eligible

Once you’ve calculated your taxable income for the year, you’ll know whether you’re eligible for the QBI or not.

If you’re filing jointly in 2022 and your income is under $340,100, you’re eligible for the full 20% deduction. All other filers are eligible for the full deduction when taxable income is under $170,050.

Even if your income is above the limit, you might qualify for a partial tax deduction.

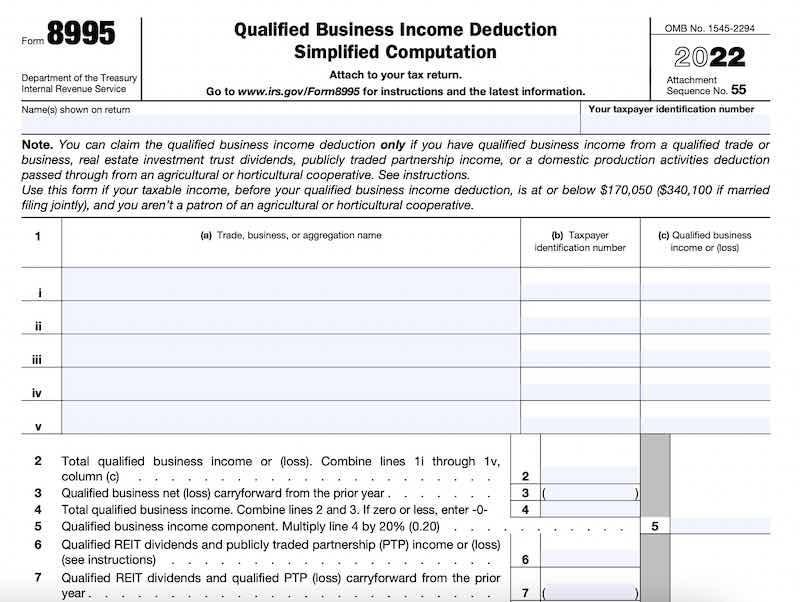

4. File Form 8895 or 8895-A

If you’re eligible for a full or partial deduction, you’ll need to file the correct form. There are two forms, and the one you’ll file depends on if you get a full or partial deduction.

If you’re eligible for:

- The full deduction – fill out Form 8895

- A partial deduction – fill out Form 8995-A

Both forms come with worksheets to help you find your exact QBI deduction amount. However, it will take some time and math on your part.

If you missed the tax deadline but filed an extension, you can still claim the QBI deduction. To get caught up and take advantage of all the tax breaks, many businesses consult catch up bookkeeping experts and CPAs.

xendoo does business taxes, bookkeeping, and accounting under one roof. To learn more about xendoo’s services and how they can help you manage all your business finances (and save money in the long run), schedule a call today.

[av_sidebar widget_area=’Blog Post Disclaimer’ av_uid=’av-om2w’]