Form 1065 is the end-of-year tax form for small businesses that operate as partnerships. So if you registered your business entity as a partnership, you must file the form at the end of your company’s tax year.

With all the responsibilities that come with running a business, it can be difficult to stay on top of the latest tax requirements, regulations, and deadlines. Form 1065 is a complex tax form with many requirements.

While you may pass off your tax return filing to a professional, it’s helpful to understand what’s going on with your business taxes. If you’re a small business owner trying to understand Form 1065 and its requirements, this guide will clear things up for you.

What is Form 1065: U.S. Return of Partnership Income?

Form 1065 is an informational form for partnerships to declare their profits, losses, deductions, and business tax credits for the year. To the IRS, an informational form is one that does not calculate any tax due.

There is no tax due with this form because partnerships are taxed as pass-through entities in the U.S. This means that the company itself doesn’t pay taxes on the profits it makes. Instead, the tax liability is passed on to the owner or owners of the business.

Although there is no tax due on Form 1065, you still need to fill it out accurately to reflect your company’s business activity for the year.

Who must file Form 1065?

If your business fits any of the following, you’ll need to file a yearly Form 1065.

- All partnerships with business activity in the US

- LLCs (limited liability companies) that have elected a partnership tax status

- Foreign partnerships with at least $20,000 of income coming from business activity in the U.S

- 501 (d) nonprofit religious organizations must also show member dividends whether they’re distributed or not.

Who doesn’t have to file Form 1065?

As with any business tax form, there are exemptions. You may not need to file it if:

- You hold 100% ownership of a business with your spouse as your only business partner. You can choose to be treated as a Qualified Joint Venture instead and report your business activity on a joint Form 1040. This won’t reduce your tax liability, but it will give both you and your spouse credit for social security earnings.

- Your business is a foreign partnership that earned less than $20,000 from activity in the U.S.

- You run a partnership business with specific attributes—syndicates, joint ventures, and pools.

- You’re part of a publicly traded partnership, and your company’s passive income does not exceed 90% of the company’s total gross income. You’ll file Form 1120 instead.

- You are a real estate mortgage investment conduit (REMIC) operating as a partnership, you’ll file Form 1066 instead.

When to file Form 1065?

Form 1065 is due three months after the end of the tax year—on the 15th day to be exact. If your partnership follows the calendar year like most small businesses, your deadline falls on March 15th.

If the deadline falls on a weekend or legal holiday, you’ll file the form by the next non-holiday business day. March 15th is the deadline for calendar year partnerships in 2022 and 2023.

What to do if you miss the Form 1065 deadline?

If you don’t file Form 1065 by the deadline, your company will be responsible for a $220 fee for each month you’re late. The fee amount may change from year to year. So it’s best practice to file an extension if you’re not prepared to file by the deadline.

How to file Form 1065

Most companies hire a CPA or tax professional to file their 1065 because it’s a complicated form. It’s much more likely to be accurate when filed by a small business tax preparation service, but there are a few basic steps all partnerships need to follow.

1. Gather your year-end financial statements and records

The first thing you’ll need to do is prepare accurate records for your company’s tax year. You’ll need to have clear totals of your company’s gains or losses, as well as the deductions and credits you’re eligible for.

There are many documents that you may need to attach to your return, depending on your business. Some of these include:

- Your company’s year-end profit and loss statement – shows all business activity for the year.

- The year-end balance sheet – shows what your company owns and what it owes to others.

- Schedule K-1 forms for each business partner – show each partner’s share of the company’s profit, losses, and credits.

- Schedule L – reconciles your company’s balance sheet with its tax return.

- Schedule M-1 – reconciles your company’s profit and loss statement with your year-end tax return.

You might need to attach a few other schedules, depending on your partnership’s operations and activity. It’s best to consult with a tax professional before you file Form 1065.

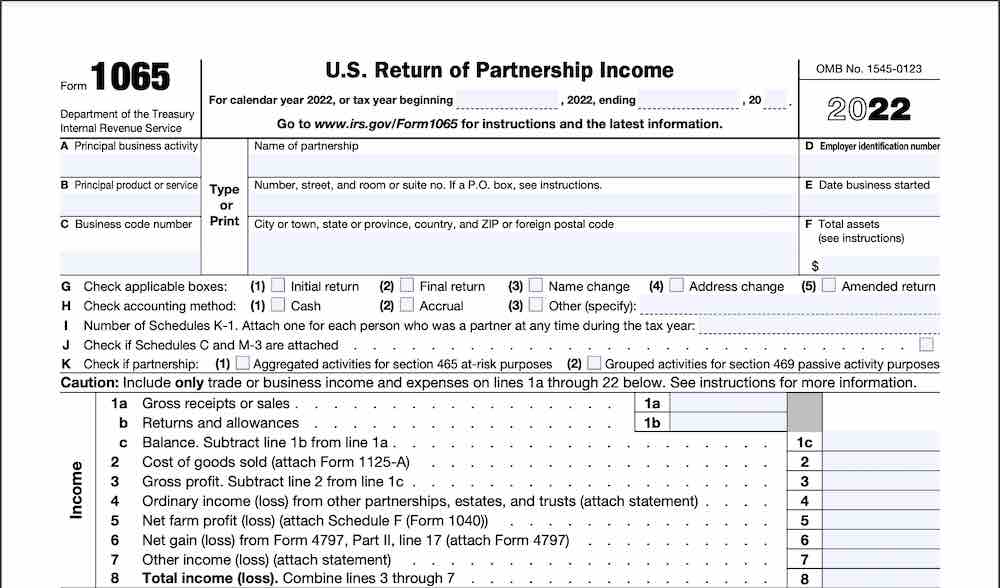

2. Provide company information

Next, you’ll need to fill out the required information on the form, such as your:

- Employer identification number (EIN), which is assigned by the IRS to identify your company’s tax account

- Business code number, which classifies your company based on the type of service or product you provide

- Accounting method (cash or accrual)

- Cost of goods sold if you sell physical products (in which case you’ll also need to attach Form 1125-A)

- Income totals for the tax year

- Deductions your company is eligible for, which will reduce your tax liability

3. Consult an online business tax service with CPAs

To make sure you’re filing an accurate Form 1065, have a tax professional take care of it for you. If you work with a business tax service that also does year-round bookkeeping, they’ll already have your information to file for you. It makes the process simpler and faster for you, but verify that they have in-house CPAs to file taxes. Some online bookkeeping, accounting, and tax services don’t have CPAs and outsource tax returns.

To recap, all U.S. and foreign partnerships need to file Form 1065. For most partnerships, this falls on March 15th.

Small business tax services like xendoo come with a year-end package to make the process easier and stress-free for small business owners. We also have in-house bookkeepers and CPAs to file your taxes.

FAQs

Is Form 1065 for an LLC?

LLCs need to file Form 1065 only if they have elected to be taxed as partnerships. LLCs that choose C corporation for their tax filing status need to file Form 1120 instead.

Is Form 1065 the same as a Schedule K-1?

Your tax professional will reconcile Form 1065 and Schedule K-1 against each other, but they are not the same. You’ll only file one Form 1065 per partnership, but you’ll need to file a Schedule K-1 for each partner.

A Schedule K-1 will show one partner’s share of the company’s gains and losses. Form 1065 will show the amount of all partners combined.

Example: A two-person partnership’s year-end profit equals $100,000. In this case, each partner should receive a Schedule K-1 showing a $50,000 year-end profit. Form 1065 should show a total of $100,000.

Do you need to file Form 1065 if you didn’t have partnership income?

No, you don’t need to file Form 1065 if your partnership has zero income and expenses to report. However, if you have zero income but some expenses to report, you’ll need to file it.