How to Do Catch-Up Bookkeeping Services for Small Businesses

Author’s Note: This was updated on Dec 13, 2021, with new information and resources for small business owners.

Nearly 25% of businesses are behind on their books and nearly 41% of business owners try to do their bookkeeping themselves. It happens easily— you fall a month or two behind, then by the time you look up, an entire quarter has gone by, and your books haven’t been updated. With inaccurate and out-of-date books, you might have late invoices, end up over-extending your small business, and not be able to dial in your operating cash flow. You might even be in danger of being non-compliant with the IRS. Perhaps nothing bad has happened yet, but you know it’s time to catch up on bookkeeping. For more guidance, explore these bookkeeping tips for small businesses which can help you stay on top of your financials more effectively.

One of the most essential services a bookkeeper can provide for a business owner is to keep the company’s books accurate and up-to-date. Being able to quickly and easily review the status of your finances is crucial to short and long-term success for any business owner. When you know the health of your finances, you can make quicker decisions concerning everything from who to hire next to what marketing strategy recently worked best.

Reasons to catch up/reconcile

Besides being a smart business practice, catch-up bookkeeping provides additional benefits grow growing companies. Such as:

- Smart/quick decisions: A bookkeeper will review vendor payments and record expenses to manage your spending, helping you manage your cash flow. A bookkeeper will track your sales, so you know what’s most profitable and can focus on what works.

- Tax compliant: With up-to-date, accurate records, a bookkeeper can assist you during tax season – helping you maximize deductions and stay compliant.

- Loan: As you grow, you may want to borrow money or open a line of credit. Your lender will want accurate financial statements, and ideally, you aren’t scrambling to create them right then and there.

What is catch-up bookkeeping?

A bookkeeper will review source documents such as your monthly bank and credit card statements, invoices, payroll, receipts, and record basic accounting information for you, such as your monthly reconciliations, in your company’s books.

The end goal is to bring your financial records fully up-to-date. Outdated books only create problems when it comes to long-range business strategy and tax preparation.

In the worst-case scenario, your outdated books can leave you in the dark when it comes to your cash flow, jeopardizing your ability to cover expenses, payroll, and more.

Catch-up bookkeeping isn’t just for those who neglect their books. Anytime you migrate data or need to reconcile your accounts, it’s helpful to give yourself an audit to ensure you’re working with the latest data. Catch-up bookkeeping therefore offers peace of mind and the confidence you need to focus on your company’s future.

How do I catch up on my bookkeeping?

In fact, the more you can prepare and organize before you start the process, the smoother things will go. Don’t limit your timeframe to when your books started to unravel. Many business owners discover that their books decline in accuracy over the course of time. You’ll therefore want to make sure your catch-up process covers a sufficient number of weeks to ensure total financial accuracy.

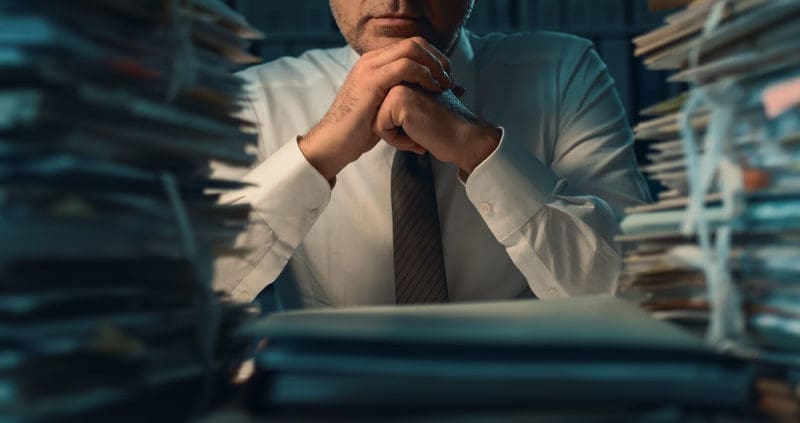

Understandably, many business owners want to catch up on their books themselves. We can’t blame anyone for wanting to cut costs, but isn’t that what got you into this situation to begin with?

Busy entrepreneurs often get behind in their books because they’re trying to handle their administrative tasks, as well as their core business. It’s unlikely that you’ll be able to find the time to perform catch-up duties, at least not with the speed and accuracy your business deserves.

That’s why you should seek out an accounting team that specializes in catch-up bookkeeping. Admittedly, this will cost your company money, but most small businesses discover the cost is negligible compared to the peace of mind that comes from having a team of experts to bring their books up to date.

During the catch-up bookkeeping process, a skilled accountant will help you do the following:

Gather your paperwork

Some of the paperwork and documents you will need to gather for your bookkeeper are:

- Receipts

- Bank and credit card statements

- Invoices

- Debt collections

- Business expenses

- Vendor accounts

This is an important part of the process, as it will provide a clear record of all of the income and expenses that apply to your business.

The first benefit will be immediate. You’ll discover whether your business has any outstanding invoices that your customers have yet to pay, which can later be used to track down delinquent accounts and make arrangements to write off bad debt. It can also let you know whether you have any outstanding debts you need to pay.

These receipts will also be useful during tax season, providing a record of any business expenses that can be used as tax deductions.

Reconcile your bank accounts

- Each month you need to reconcile all of your bank and credit card accounts. First, make sure all transactions for the month have been entered. Using your bank statements, you can make sure all of the transactions in your books match the transactions in your statements. This allows you to find any errors in your books and ensure your records are accurate.

- It’s easy to fall behind on reconciliation, especially if you come across reconciliation errors that need fixing. If you are too far behind on your monthly reconciliations, the bookkeeping team at Xendoo can help you get organized, reconciled, and caught up.

Collect W-9s, 1099s, and W-2s

- W-9s are IRS forms that all business owners must keep on file for any self-employed workers (such as freelancers and independent contractors), to keep track of their external team members. If you employ subcontractors, you’ll need to make sure you are collecting these important forms.

- When a small business pays an independent contractor $600 or more in a given year, they must report these payments to the IRS using a 1099 form for the contractor.

- A W-2 form shows the amount of money an employee made, and the amount of taxes that were withheld from paychecks throughout a calendar year.

Go digital

- Reduce the amount of paperwork you have to keep up with by choosing to have paperless bills and bank statements.

- A good choice for the environment, too.

Your smartphone can easily be used to scan receipts, allowing you to maintain a digital archive of your business transactions.

The best accounting firms also integrate with the latest software, which can streamline the catch-up process and ensure that your books are brought up-to-date — and that they can stay that way.

At Xendoo, for example, we can sync with such popular software as Gusto, Stripe, Intuit QuickBooks, and more. Relying on these digital solutions can make it easier to maintain your books, reconcile your accounts, and ensure precision and accuracy for all of your financial processes.

Best of all, cloud-based technology makes your financial data accessible from anywhere in the world, giving you maximum flexibility and control over your company’s finances.

How much does catch-up bookkeeping cost?

Starting at just $150, your dedicated Xendoo team will catch you up and set you up for success with a solid bookkeeping system, or you can utilize our ongoing bookkeeping services. Once you know how good that feels, you’ll want to sign on for a monthly bookkeeping service package that fits your business needs.

You’ll never worry about falling behind again, knowing your dedicated financial team is on it, your up-to-date records are always available, and there’s an expert at your fingertips to answer any questions. You can count on using your books to make quick, smart decisions – leaving you with a healthy, growing business.

Leave catch-up bookkeeping to the professionals

It’s overwhelming to discover a pile of late invoices and frustrating when you can’t dial in your operating cash flow or realize you’ve over-extended your business expenses because of inaccurate books. Then tax time sneaks up, and you realize you’re non-compliant with the IRS and need someone to organize your financial data quickly. If you’re time-starved and neglecting your bookkeeping, it’s time to enlist Xendoo for your catch-up bookkeeping service.

Let a professional sort your books for you and develop a bookkeeping system that will serve you well now and for the future. Xendoo can quickly and accurately catch you up, setting you up for success.

Always know your company’s financial status and sleep soundly at night with Xendoo’s expert support.