How Outsourcing Accounting Can Help Grow Your Small Business

Small business owners are notoriously short on time. They manage everything from sales and marketing to employee scheduling and benefits, not to mention being an expert in whatever good or service it is that their business offers. And there are hurdles every step of the way as you try to grow your business. Hiring an outsourced accounting service can help you tackle many of these including ensuring you don’t pay too much in taxes, that you have time to focus on sales and marketing, and that you are able to prepare thorough financial reports for investors.

Why is an accountant important in a business?

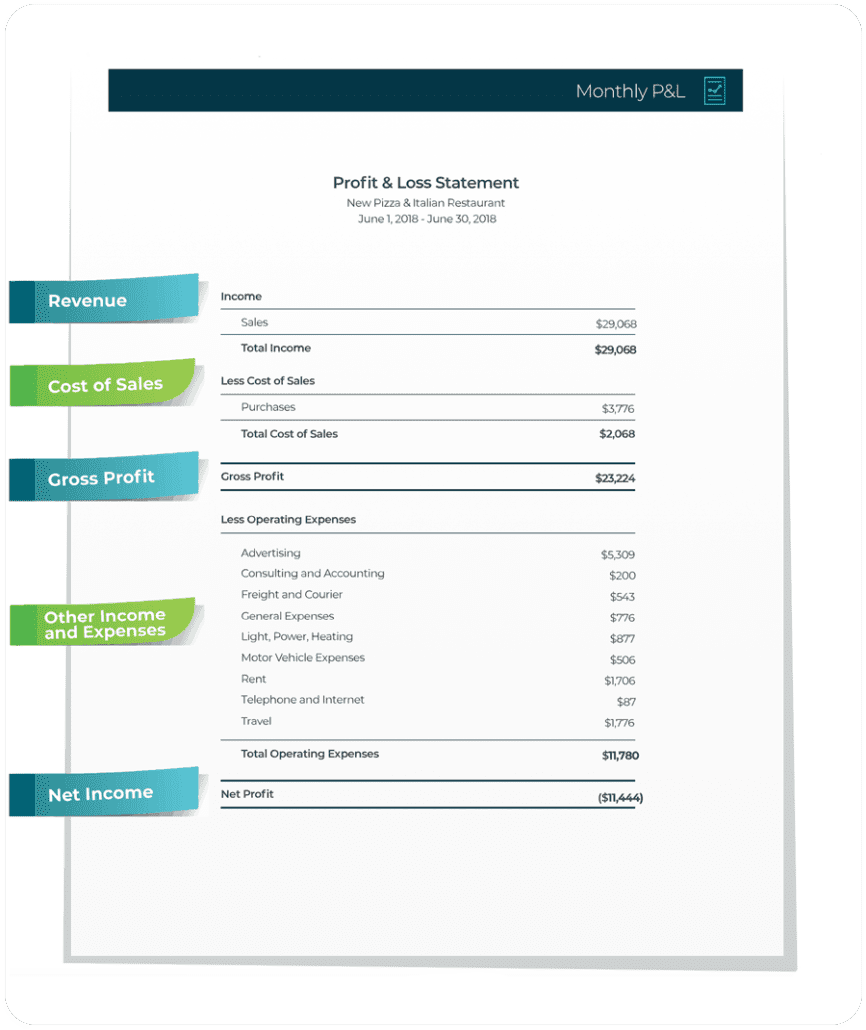

Accountants consider the big picture strategy needed to keep your business strong and growing. They can answer your questions about financial reports, cash flow, depreciation, and more. They can give tax savings advice, such as when to make capital purchases, what you can deduct, and how to reduce taxes on capital gains. They can identify opportunities to improve profit margin and business growth and keep you legal – preventing missed deadlines and noncompliance penalties.

When you’re looking to grow your business but don’t have the time or resources to do so, hiring an outsourced accountant or outsourced accounting service like Xendoo can free up your time and provide insights and ways into how you can increase your cash flow, strategically prepare for your taxes, and focus on what you do best.

How does outsourcing accounting help your business grow?

It’s not just keeping track of your financials. Outsourcing an account can help your business grow in the following ways:

Accountants help save money

We can tackle the reinvestment more in detail here and use the tax preparation anchor here.

Accountants help small business owners save money in many ways, including through strategic tax preparation. They help you make smart decisions on your operating expenses, when to make big purchases, and what deductions you can make. Many small business owners spend too much money on taxes – an accountant can help you prevent overspending on taxes and help you strategize on how to cut costs in every area of operation. The money you spend on an accountant is an investment into your business and will help you grow by saving you money in the long run and leaving you with more money to invest back into your business.

Accountants help save you time

Time can be spent on marketing and other business growth while they look into the books.

Small business owners have enough on their to-do list – when you’re looking to outsource some of the work and focus on growing, outsourcing accounting and bookkeeping services are the best choices. Bookkeepers and accountants will do a better job at a quicker pace than a small business owner who is strapped for time and whose talents might lie elsewhere. You’ll be able to focus on sales, marketing, and all of the other ins and outs of growing your business when you aren’t worrying about accounting.

Outsourced accounting services are scalable

As you grow so can your services without the need to hire FTE.

Your outsourced accounting team can easily grow as your small business does. You won’t need to hire a full-time employee to handle your accounting when you have a scalable outsourced accounting team on board. You can skip the hassle of hiring and managing a full-time employee as you grow (and save on the need to offer expensive benefits, too!) by hiring outsourced accounting services like Xendoo.

Better business analysis

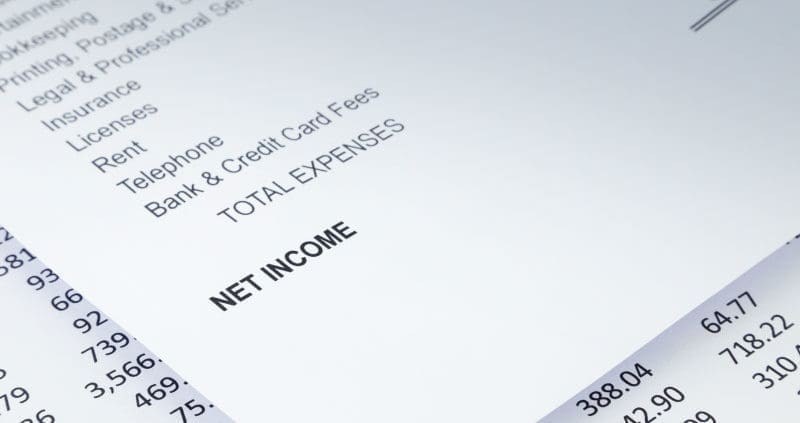

Gives you accurate insights into your business strengths and weaknesses, which is important if you want to expand. Investors will want to see accurate books.

As you grow you will continuously need better analytics on your business. An outsourced accounting team can provide accurate insights into your business strengths and weaknesses, helping you strategize on how to grow. And when you’re ready to take on investors or apply for a line of credit the banks and investors will want to see accurate and detailed financial reports. By having an outsourced accountant on your team, you will be able to show investors and banks precise, up-to-date records and prove you take your finances and the growth of your small business seriously.

Help increase cash flow

Keep track of outgoing and incoming money. Can find ways to help you save money long term with paying on time or ahead, and chasing down delinquent invoices.

A key strategy to growing your business is taking charge of your cash flow. Outsourced accounting services like the team at Xendoo can keep track of your incoming and outgoing money and can help you find ways to save money in the long term – through strategic tax preparation, cutting operational costs, and paying your bills on time or even ahead of time! And they can help you chase down delinquent invoices from clients who are behind on paying you. Your accounts payable and receivable will be closely monitored and managed without you ever needing to worry about it.

Outsourcing accounting can help you grow your business. By outsourcing your accounting, you can save money on hiring a full-time accountant, plus, it will give you more time to focus on running your business and creating value for your customers and your employees. Xendoo is all about providing timely and accurate financial information to business owners allowing them to make strategic decisions. If your business is struggling, know that there is a better way and Xendoo can help.