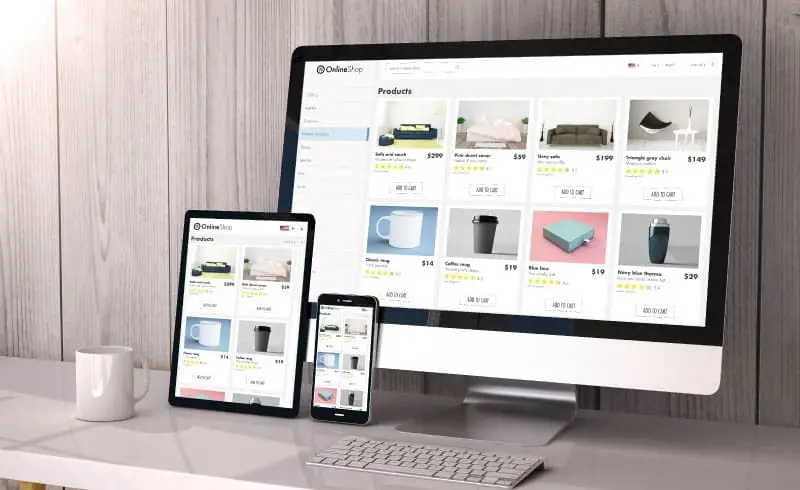

Online businesses can acquire customers from all over the world. However, running an eCommerce business also comes with unique challenges and solutions. Once your online store is ready to launch, it’s time to choose an eCommerce accounting software that will keep your books up to date. With an online accounting software, you can keep detailed records of invoices, capital and overhead expenditures, employee wages, tax returns, and more.

A strong eCommerce bookkeeping and accounting solution will also make it easy for you to track profit margins, cash flow, and other vital metrics that make the difference between business success and failure.

How do you know which eCommerce accounting software is right for you? We’ve covered some of the most important considerations and options for eCommerce businesses.

Top Considerations for Choosing eCommerce Accounting Software

Most businesses are online these days, even if they have an in-person store. It’s important to have a robust accounting software system.

The best systems for eCommerce can integrate with the payment platforms you use as well as other eCommerce tools. Ecommerce accounting software should help you track sales transactions, run quarterly reports, generate invoices, code expenses, and more.

When you’re selecting software for your online business, consider the following.

1. Is your eCommerce accounting software compatible with top eCommerce platforms?

You want your software to pull in data from Amazon, eBay, Shopify, and any of the other marketplaces where you may end up selling your products. This makes accurate inventory management and revenue tracking much easier. Integrations can be tricky, so we’ve also created a guide on the most important integrations for top eCommerce platforms.

2. Will it help you run payroll faster?

If you’re a small online business, you probably don’t have a payroll department yet. If you do, look for accounting software that will help you pay your staff efficiently. For instance, Gusto is a popular payroll option. If you use xendoo for your bookkeeping and accounting, you can set up integration with Gusto.

3. What financial reporting features does it have?

When your business is online, you can literally move inventory while you sleep. A good software program for ecommerce businesses is able to pull on-demand financial reports so you can see real-time updates on your sales, returns, and more.

4. Will it facilitate bank reconciliations?

Many software programs can pull data right from your banking website and reconcile those transactions with your internal records. Do the balances match? Running an online business on a tight margin means catching errors quickly so you can find out where the missing money went.

What is the best eCommerce accounting software?

How can you know which software accounting solution is right for you? It’s wise to compare your available options.

Keep in mind that xendoo can integrate with any of the accounting tools below when we take care of your bookkeeping needs. We’ve listed here some popular software choices for you to consider.

Quickbooks

Probably the most well-known software for small businesses, QuickBooks offers you a choice of accounting in the cloud or your internal network. It integrates with most of the top eCommerce platforms, such as Amazon, eBay, Shopify, and Etsy. You pay a monthly subscription fee (after the free trial month), which varies according to the package of capabilities you choose for your business.

Wave

A great option for new businesses on a tight budget, Wave offers free basic services such as accounting and invoicing. Additional capabilities such as payments and payroll are available for modest fees. Data from PayPal, Excel, and many other sources can be automatically imported into Wave books.

Kashoo

Exceptionally user-friendly for the non-accountant, Kashoo takes just one day to set up and learn. In addition to basic bookkeeping tasks and bank syncing, it provides one-click financial reports, so you can make smart business decisions and breeze through tax time. If you do have any questions, there’s free unlimited support plus a video tutorial library.

Xero

An international leader in cloud accounting, Xero gives business owners unprecedented access, speed, and reliability. Its superior functionality and security have made it popular with accounting and bookkeeping firms — including us here at xendoo. Solutions include invoicing, payments, payroll, tax coding, and bank reconciliations. Best of all, you can get a real-time view of your cash flow from any mobile device or desktop computer at any time.

xendoo

Programs like these make it as easy as possible for financial rookies to keep their businesses on track. But if you still don’t feel comfortable or don’t have the time to do the bookkeeping yourself, consider hiring a professional accounting firm. If possible, choose one that specializes in eCommerce — like xendoo.

With xendoo, you get the accounting software and the expertise, with a team of bookkeepers and accountants.

xendoo’s eCommerce accountants know where to find financial data across multiple platforms. We know how to set up accounting systems with third-party eCommerce tools, and how to navigate tricky tax issues when selling to people out of state or out of the country.

From bookkeeping to income and sales tax filings to financial reports, we take eCommerce accounting hassles off your shoulders, leaving you with the time and peace of mind to grow your business. We know you’re on a budget, so our flat monthly fee is less than half what you’d pay a bookkeeper who charges by the hour. If you’d like to know more, feel free to schedule a call today.

Editor’s Note: This post was updated on March 21, 2022, for accuracy and comprehensiveness.

[av_sidebar widget_area=’Blog Post Disclaimer’ av_uid=’av-om2w’]