5 Reasons Bookkeeping Services are Essential For Businesses in an Uncertain Economy

Why Small Businesses Need Bookkeeping Services in a Changing Economy

For many business owners, the economy feels uncertain. With unexpected market shifts, rising tariffs on outsourced goods, and steadily increasing costs, the path forward may feel uncertain. In moments like these, the pressure of every decision intensifies, yet the expectations remain. You are still expected to lead with confidence, adapt quickly, and keep the business afloat.

In this environment, having reliable bookkeeping services becomes a strategic necessity, allowing you to operate from a place of control. When financials are accurate, timely, and accessible, you gain the clarity to respond with intention. Bookkeeping is now a steady source of insight that supports sound judgment, measured growth, and long-term resilience.

What is the role of bookkeeping during a changing economy? Let’s explore how it can directly benefit your business. Here are five key advantages that make bookkeeping an invaluable asset, especially in today’s uncertain economic climate.

Identify Financial Trends for Proactive Management

When your books are consistently and accurately maintained, patterns begin to surface. Shifts like rising vendor costs, delayed customer payments, or narrowing profit margins rarely announce themselves with clarity. Instead, they appear subtly, through numbers that begin to drift off course.

Bookkeeping brings those numbers into focus. Categorizing expenses, tracking receivables, and reconciling accounts regularly creates a living record of your business activity. This allows you to compare performance month over month, spot anomalies, and flag inconsistencies before they turn into larger issues. Early visibility means you’re not reacting after the damage is done, but you are adapting in real time to protect your margins and maintain stability.

Financial Preparation for Loans, Grants, and Investors

Loans, grants, investor inquiries, or relief programs require detailed financial documentation. Incomplete or outdated books can delay or disqualify you from accessing these resources. Well-maintained records provide a clear picture of your business’s financial health, enabling you to confidently present your case to investors or lenders, and respond quickly when time-sensitive opportunities arise.

Visibility To Improve Business Decision Making

In uncertain times, every business decision carries more weight. Whether you’re considering a new hire, adjusting pricing, or reworking your inventory strategy, understanding the financial impact in real terms, not broad estimates, is imperative.

Bookkeeping provides that clarity by tracking and categorizing every transaction in your business. You see exactly how much revenue is coming in, where money is going out, and how those numbers shift over time. This level of detail allows you to monitor trends, spot inefficiencies, and plan based on facts. Accurate books connect the dots between your operations and your bottom line, so every decision is backed by real financial insight.

Maximize Your Tax Savings with Accurate Bookkeeping

A strong tax strategy begins with accurate books. When every transaction is recorded and categorized throughout the year, you enter tax season prepared, with clear documentation, organized records, and complete visibility into your financials.

This foundation allows your CPA to move beyond basic filings and focus on optimizing your tax position. Whether it’s identifying eligible deductions, planning for quarterly payments, or aligning with your long-term financial goals, strategic decisions are only possible when your books are current. In a shifting economy, this level of preparation becomes a financial advantage.

Save Time and Grow Your Business by Outsourcing Bookkeeping Services

Bookkeeping requires consistency, precision, and time, pulling focus from the areas where your leadership creates the greatest impact. Delegating this responsibility to a trusted partner allows you to gain those hours back and reinvest them where they matter most: serving your customers, supporting your team, and shaping your next phase of growth.

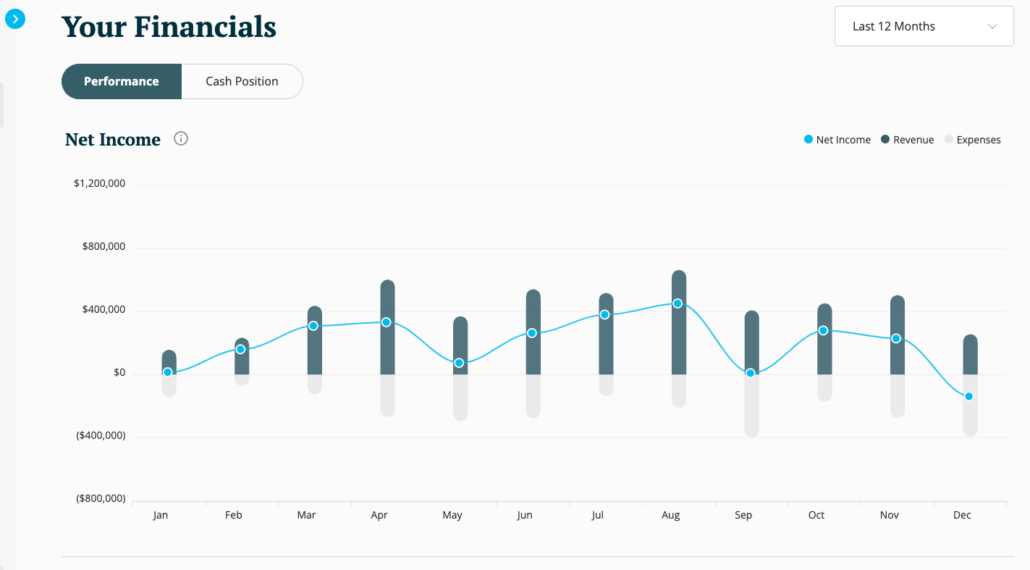

With Xendoo Accounting, Bookkeeping, and Tax as your partner, your books are kept accurate and up-to-date by a team that delivers accurate financials on time, every time. Additionally, you gain exclusive access to our advanced technology platform, Insights XP. This powerful tool provides real-time insights into your financial landscape, enabling you to seamlessly track cash flow, monitor expenses, and evaluate your business’s financial health. You will always remain fully informed, empowering you to lead with clarity, focus, and forward momentum.

Track your net income, revenue, and expenses month-to-month with Insights XP.

Conclusion

The ability to manage cash flow during market shifts with confidence is essential to your business’s success. By prioritizing reliable bookkeeping, you empower yourself with the clarity, insight, and preparedness needed to make informed decisions, seize opportunities, and stay aligned with your financial goals.