Just like a traditional brick-and-mortar business, your eCommerce business needs a good bookkeeping system for essential functions like tracking revenues and expenditures and filing tax returns. There are a lot of compelling reasons you need a bookkeeper, and for most small businesses, it’s generally more cost-effective to outsource the accounting and bookkeeping services to professionals like Xendoo that work with small businesses than trying to do it in-house. If outsourcing just isn’t feasible for your business, here are some bookkeeping basics for eCommerce that you need to know before trying to do it yourself.

Choose an Accounting Method

The first thing you’ll need to do is decide which of two accounting methods is right for your business – cash basis or accrual basis. The key difference between the two lies in when revenues and expenditures are recognized on the books. Let’s take a quick look at the differences between them.

- Cash Basis: Transactions are recorded at the time the money enters or leaves the bank. If an invoice comes in during December but you pay it in January, the entry would go on January’s books.

- Accrual Basis: Transactions are recorded at the time they are made, regardless of when cash enters or leaves the bank. An invoice dated in December would go on December’s books, even if it gets paid in January.

Cash basis accounting is simpler and easier to keep track of, but accrual basis gives a more accurate picture of the long-term profitability of the business by factoring in accounts payable and receivable ledgers. Most small business owners choose cash basis, but if you do, you may have to adjust your accounting software. QuickBooks, for example, defaults to accrual basis. Once you choose a method, you have to stick with it unless you are willing to go through a lot of government red tape to change it.

Record Your Transactions

Every time money comes into or leaves your business, whether it’s a retail sale, an invoice from a supplier that gets paid, or a loan payment, it has to be recorded “in the books.” Your “books” could be anything from an old-fashioned paper ledger to an Excel spreadsheet, or a full suite of accounting software. If you opt for manual bookkeeping, you’ll need to import all your information from your bank account into your ledger. Most good accounting software will interface with your bank and automatically enter transactions in your books for you, which can save you a lot of time. Whichever way you go, it’s crucial to stay on top of data entry so that you have an accurate picture of your business’s financial health.

Categorize Your Transactions

You’re probably starting to see a trend in these bookkeeping basics for eCommerce, and that is to stay organized. Every transaction that gets recorded has to also be categorized for financial reports and tax returns. The two most basic categories you’ll need are revenue and expenses, although you’ll almost certainly want subcategories of each for your reports to be useful. You’ll need to be able to tell the difference between expenses for rent, payroll, utilities, debt installments, etc.

Another category that you’ll probably want as an eCommerce seller is “Revenue – Returns and Allowances.” This would encompass things like merchandise returns and credit card chargebacks in the event of fraud, which are not expenses, but rather debits to your revenue as essentially a reversal of the sale. However, if your credit card processor charges you a chargeback fee for the return, this would be an expense separate from the return itself.

Monitor Your Budget

If you haven’t already, you need to create a realistic budget that factors things like the seasonality of the business, how much inventory stock you will need to support your sales, cost of goods sold, and overhead expenses like rent, payroll, and utilities. Remember: a budget should not reflect what you hope will happen, but what is likely to actually happen. Many owners tend to be overly optimistic in their budgets and assume a best-case scenario for everything, which rarely happens.

Once the budget is in place, the company’s financial reports have to be checked against the budget regularly to see whether the business is over or under-performing your expectations. This can be simplified by using a budget calculator spreadsheet that uses formulas to compare actual revenue and expenses to budget figures. That way, you can see at a glance where your budget might need adjusting.

Reconcile Bank Statements

Each month when the bank statement arrives, it’s crucial to compare what the bank says you have with what your internal books say you should have. This is done on a transaction-by-transaction basis and is critical for detecting problems early. If you find a discrepancy, you need to identify and resolve it quickly because it may be a sign of theft or another internal issue, or there may be a problem with the way you are keeping your books.

Check Your Cash Flow

Cash basis accounting gives a pretty clear snapshot of cash on hand, but if you’ve chosen accrual basis accounting, your books may show more cash on hand than you really have at the moment. This can be a problem if you need to pay a big invoice, so it’s important to run weekly or monthly cash flow reports to see the real amount of cash on hand and implement good inventory control policies.

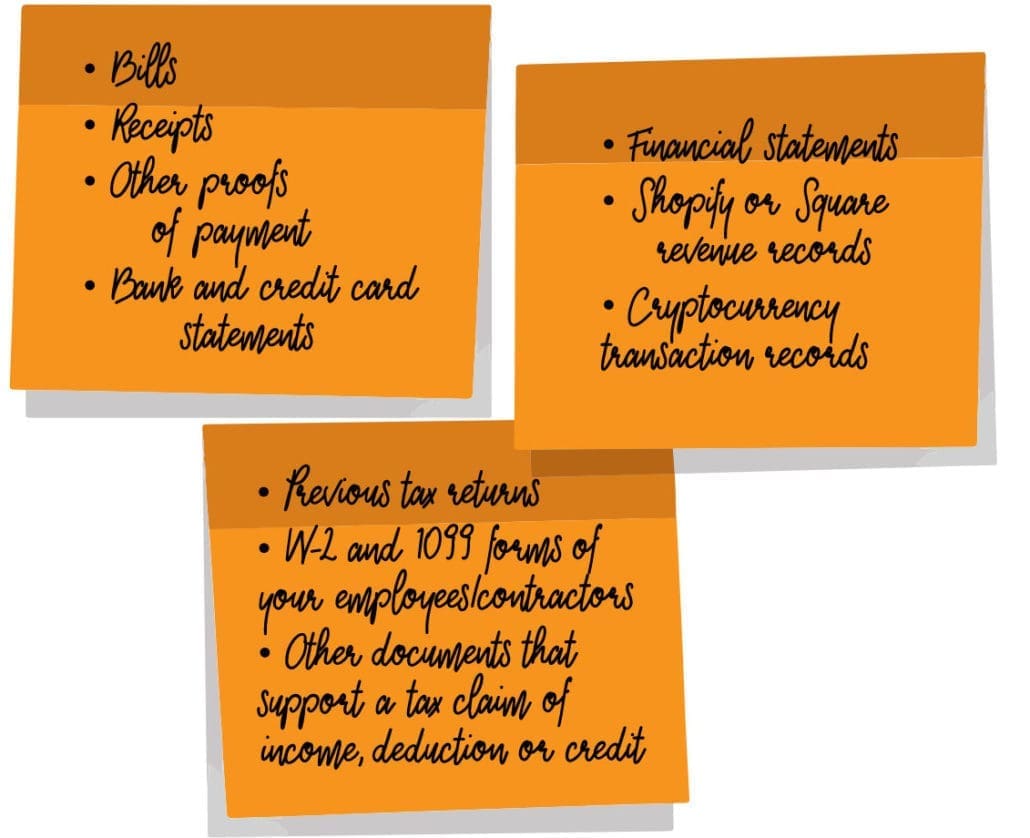

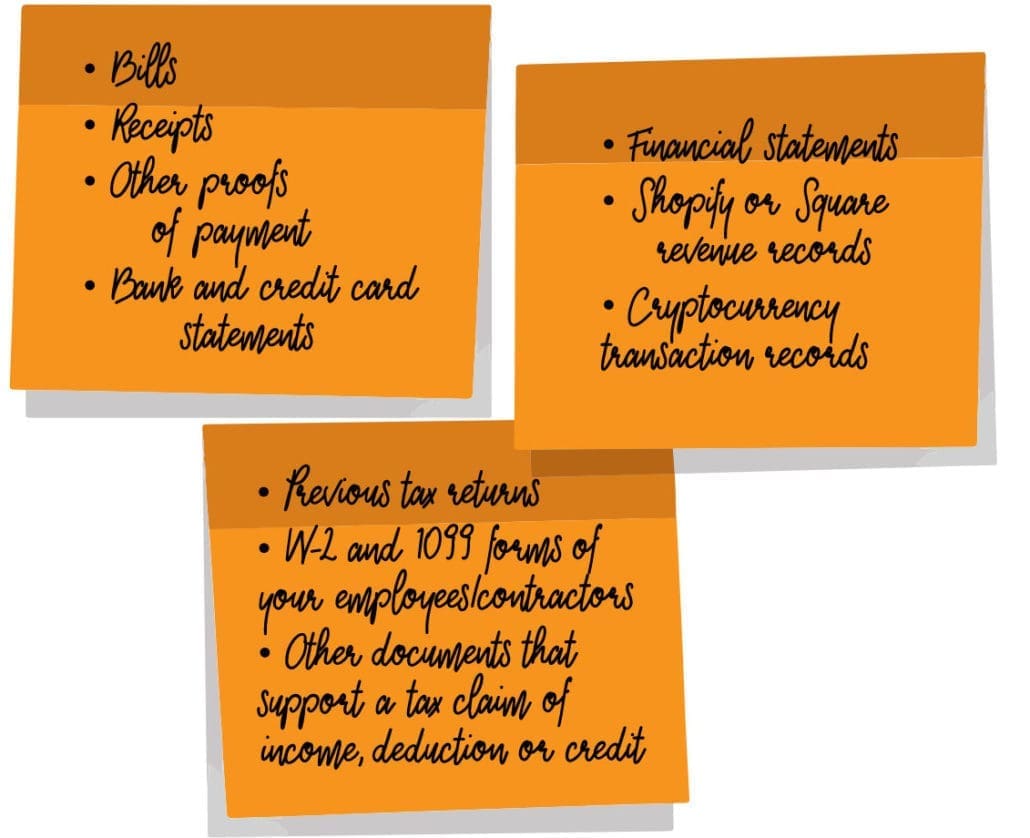

Save & Organize Records

If there’s one bookkeeping basics for eCommerce rule you need to follow when you are starting out, it’s save everything. Good record-keeping is essential for any business, so you should save everything – receipts, invoices, statements, etc. You might just need to refresh your memory about a transaction you can’t remember, or you might need to validate your tax return for an audit.

You might notice that you are paying more than usual for a particular supply item and want to see what you paid for it in the past. You just never know, so be prepared. Here is a sample list of folders you should have in your filing cabinet for the basics of bookkeeping for eCommerce:

- Invoices

- Receipts

- Other proofs of payment

- Bank and credit card statements

- Financial reports and statements

- Shopify or Square revenue records

- Cryptocurrency transactions

- Previous tax returns

- W-2 and 1099 forms for employees and contractors

- Other supporting documents for income, deductions, or credits

Be sure to keep these bookkeeping documents in an area where you can easily find them.

File Sales Tax

Since the Supreme Court decision in Wayfair, Inc. v. South Dakota (2018), eCommerce retailers are subject to the sales tax requirements of each state in which they sell goods. That means that potentially, you might have to file 50 different sales tax returns monthly, quarterly, or annually, depending on the state. This is incredibly time-consuming for a small business and creates a lot of extra accounting overhead, which is just one of the reasons it’s generally more cost-effective to outsource your accounting and bookkeeping to a professional service like Xendoo.

Pay Income Tax

Most businesses pay estimated quarterly income taxes and then file an annual return in April, in much the same way individuals have estimated withholding every pay period and then file a return in April. To calculate how much to pay each quarter, you’ll need to estimate your annual business income for the year. If you’ve been in business for a while this may not be too difficult, but if you’re just starting up you may need to make some careful calculations. The IRS has worksheets to help you calculate your quarterly taxes – Form 1040-ES for individuals and Form 1120-W for corporations.

Generate Financial Statements

This may need to be done manually if you’ve opted to keep your books by hand, but generally, your accounting software will be able to generate these for you. You’ll need to go over your monthly profit and loss statements, balance sheets, cash flow statements, and other documents. Once you have insight into all of these, you’ll be able to plan ahead to make your business more efficient. Without them, you’re flying blind. Your P&L statement can reveal several key things:

- Administrative Expenses (too high if they are over 20% of gross revenue)

- Cost of goods sold (should be less than 75% of gross revenue)

- How much you can afford to reinvest in the businesses

Similarly, your balance sheet can provide you with a snapshot of your company’s total assets and liabilities, including debt and equity positions. With this information in hand, you can calculate some key ratios that a lender will look at when you apply for a loan, including:

- Assets to Liabilities Ratio (the company’s solvency or ability to pay bills)

- Debt to Equity Ratio (financing from creditors in relation to stockholders)

- Asset Turnover Ratio (how efficiently you generate sales from assets)

These are the bookkeeping basics for eCommerce that you need to know before you start your online business, but to grow your business and sustain success, you’ll probably need to do more than just manage your books.

At Xendoo, we specialize in small business accounting for eCommerce and offer a full suite of accounting and bookkeeping solutions. We can help you every step of the way with automatic bookkeeping entries, tax reporting, financial statements, and much more to keep your new business lean and mean. It’s also a lot more affordable than you probably think because Xendoo’s low flat monthly fee is less than half of what you would typically pay an hourly accountant.

Sign up for a free trial today and see how Xendoo can help your online business grow.