When state legislatures in the United States implemented the first sales tax laws to boost revenues in the 1930s, the American economy depended on the manufacture and sale of physical goods. Typically, early sales tax laws allowed only the taxation of “tangible personal property” (TPP), rather than taxing services.

As the United States has shifted from a manufacturing-based economy to a service-based economy, many states started to impose sales and use tax on services as well. Many businesses that provide services are still unaware of these statutory changes—some mistakenly believe they don’t have to pay any sales tax at all, even if they’re selling services all over the United States.

Every state is different

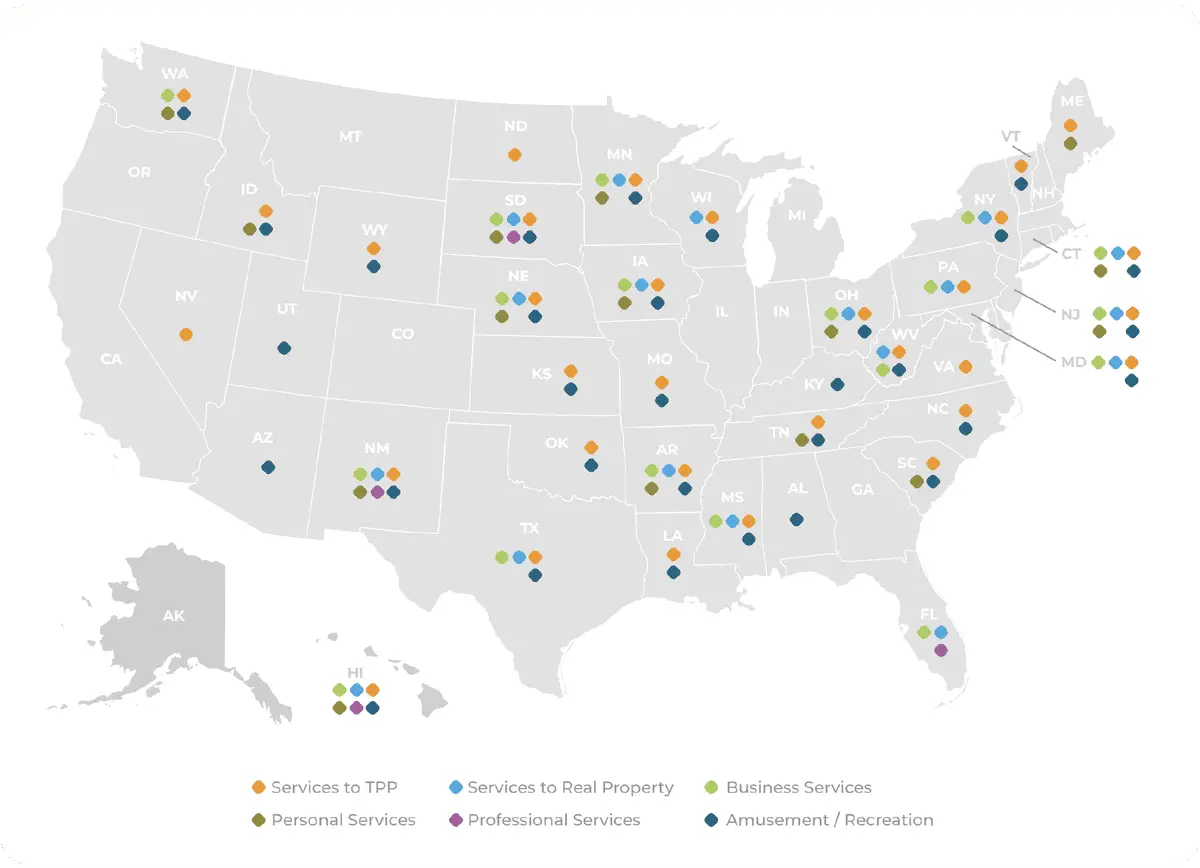

This guide is designed to provide an overview of the complexity of sales tax on services by state.

Five U.S. states (New Hampshire, Oregon, Montana, Alaska, and Delaware) do not impose any general, statewide sales tax, whether on goods or services. Of the 45 states remaining, four (Hawaii, South Dakota, New Mexico, and West Virginia) tax services by default, with exceptions only for services specifically exempted in the law.

This leaves 41 states — and the District of Columbia — where services are not taxed by default, but services enumerated by the state may be taxed. Every one of these states taxes a different set of services, making it difficult for service businesses to understand which states’ laws require them to file a return, as well as which specific elements of their services are taxable.

Categories of taxable services

No two states tax exactly the same specific services, but the general types of services being taxed can be divided roughly into six categories.

Services to TPP: Many states have started to tax services to tangible personal property at the same rate as sales of TPP. These services typically improve or repair the property. Services to TPP could include anything from carpentry services to car repair.

Services to real property: Improvements to buildings and land fall into this category. One of the most commonly taxed services in this area is landscaping and lawn service. Janitorial services also fall into this category.

Business services: Services performed for companies and businesses fall into this category. Examples include telephone answering services, credit reporting agencies and credit bureaus, and extermination services.

Personal services: Personal services include a range of businesses that provide personal grooming or other types of “self-improvement.” For example, tanning salons, massages not performed by a licensed massage therapist, and animal grooming services can be considered “personal services.”

Professional services: The least taxed service area, in large part because professional groups have powerful lobbying presences. Professional services include attorneys, physicians, accountants, and other licensed professionals.

Amusement/Recreation: Admission to recreational events and amusement parks, as well as other types of entertainment. Some states that tax very few other services, like Utah, still tax admission charges to most sporting and entertainment events.

How to use this chart

Remember that within each category of services, states can still have drastically different regulations. For instance, both Florida and Iowa are marked as taxing “business services,” even though Iowa taxes a wide range of these services and Florida only taxes security and detective services. Keep in mind that locating your business in another country, such as Puerto Rico, may have tax benefits.

For more details about the specific tax liability of your business in individual states, consult state Departments of Revenue for additional information.

[av_sidebar widget_area=’Blog Post Disclaimer’ av_uid=’av-om2w’]