FREE Review of Your Books Learn More >

High-volume eCommerce businesses generate thousands of transactions across marketplaces, payment processors, and bank accounts. Sales may appear strong, yet payouts, fees, refunds, and chargebacks often tell a different financial story once deposits hit the bank.

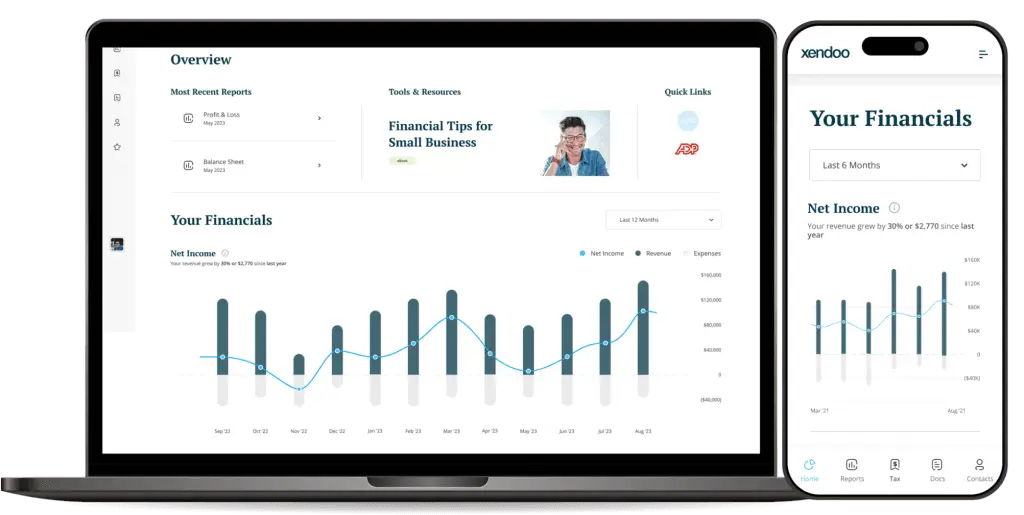

The partnership between Xendoo and A2X solves this problem at the source by combining structured marketplace data with disciplined bookkeeping and accounting oversight.

The result is financials that reflect what actually happened in the business.

This solution is designed for eCommerce businesses that:

Third-party platforms do not deposit revenue transaction by transaction.

They send net payouts.That single deposit includes:

Without proper mapping, those payouts often get recorded as income. Reports inflate revenue, margins look stronger than reality,

and cash flow decisions rely on distorted numbers.

The problem is not volume. The problem is structure.

A2X specializes in translating marketplace activity into accounting-ready data.

Instead of forcing bookkeeping systems to interpret raw payout deposits, A2X:

This creates a clean, auditable trail from marketplace to books.

Automation alone does not produce reliable financials.

Xendoo provides the human oversight, monthly discipline, and accounting standards required to turn structured data into usable financial statements.

With Xendoo:

The result is financials that business owners trust and advisors can rely on.

This partnership removes common friction points that slow growth.

Business owners gain:

Instead of questioning reports, owners use them.

Many tools stop at automation.

Many accounting firms stop at reconciliation.

This partnership combines both—without collapsing marketplace activity into net deposits or relying on estimates.

Compared to automation-only tools:

Compared to generic bookkeeping:

High-volume eCommerce requires systems that scale.

The Xendoo and A2X partnership supports:

As sales grow, the accounting process holds steady.

Yes. The integration is designed for multi-channel businesses and keeps marketplace activity separated and properly categorized.

Yes. Entries reconcile directly to bank deposits, creating alignment between marketplace activity and cash movement.

Yes. The process produces clean, reconciled financial statements suitable for tax preparation, lending, and investor review.

Automation structures data. Xendoo ensures that data is reviewed, reconciled, and reported accurately each month.

Reclaim your time – focus on growth while we take care of the numbers.