Net Profit and Retained Earnings: What’s the Difference?

Retained earnings are a key indicator of a company’s financial performance. Read on to learn about what they are, how to calculate them, prepare a retained earnings statement, and more.

What is the difference between retained earnings, revenue, net income, and shareholders’ equity?

Retained earnings represent the portion of a company’s net income that is kept within the business after dividends are paid out to shareholders. It is calculated cumulatively by adding the retained earnings from previous periods to the current period. Revenue, on the other hand, refers to the total income generated from sales before deducting expenses, taxes, and dividends. Revenue is calculated for each accounting period and is typically listed at the top of the income statement. Net income is the profit a company earns after all expenses have been deducted from its revenue. It provides a clear indication of how profitable the business is during a specific period. Shareholders’ equity, or stockholder equity, is the total value of a company’s assets that shareholders own outright after all liabilities have been settled. It includes components such as outstanding shares, common stock dividends, retained earnings, additional paid-in capital, and treasury stock. In summary, while retained earnings represent accumulated profits held by the company, revenue reflects total income before deductions, net income is the profit after all expenses, and shareholders’ equity is the net value shareholders have in the company after liabilities have been accounted for.

What are retained earnings?

Sometimes called member capital, retained earnings are what’s left from your net profits after you pay out dividends to shareholders.

Shareholders are investors who own stock or equity in your business.

Dividends are a company’s distribution of revenue back to the shareholders. Sometimes they are paid as a cash dividend. Companies may offer a dividend reinvestment program (DRIP) for shareholders to reinvest the dividends back into company stock, usually at a discount.

Typically, your retained earnings are kept in a ledger account until the funds are used to reinvest in the company or to pay out future dividends.

You’ll usually find them in one or two places:

- On a balance sheet under the owner’s or shareholder’s equity section

- As a standalone report referred to as a statement of retained earnings

In rare cases, businesses include it on income statements. Once reported on the balance sheet, retained earnings become a part of a business’s total book value.

Why are retained earnings important?

Lenders and investors will consider retained earnings even more than net income when deciding whether to trust you with their money.

It gives you a clearer picture of your business than just looking at monthly net profit figures, which can vary quite a lot depending on a wide range of factors.

It also indicates if and how you should invest money back into your business.

- If the number is low, it’s better to keep the money in the business as a cushion against cash flow problems, rather than handing it out as dividends.

- If both are substantial, it’s time to invest in growing your business, perhaps with new equipment or facilities.

Both your net profit and retained earnings can help you gauge your company’s overall financial health.

What is net income?

Also called net profit or net earnings on some profit and loss statements, net income is the money you have left after deducting all costs, including taxes and operating expenses. For example:

- $70,000 Revenue – $60,000 Costs = $10,000 Net Profit

Revenue is the money you receive from selling products or services to your customers. Costs are everything businesses pay such as:

- Rent & Utilities

- Employee payroll

- Office Supplies

- Bank fees & loan interest

- Insurance premiums

- Repairs & maintenance

- Advertising and marketing

- Legal & professional fees

- Taxes

- Depreciation

Keeping track of expenses is crucial for understanding your company’s finances in general, but it can also help you better understand your net profits.

For instance, when you track expenses such as those listed above, you can see how each category directly impacts your net profit. You may be able to use this data to decrease wasted spending and increase your profitability.

Expense trackers can automate this process. Xendoo plans work with Quickbooks and Xero to help you manage business expenses.

Retained earnings vs. net income

Net income and retained earnings are important to track because they give a picture of your company’s cash flow. While these two terms overlap, they are not synonymous.

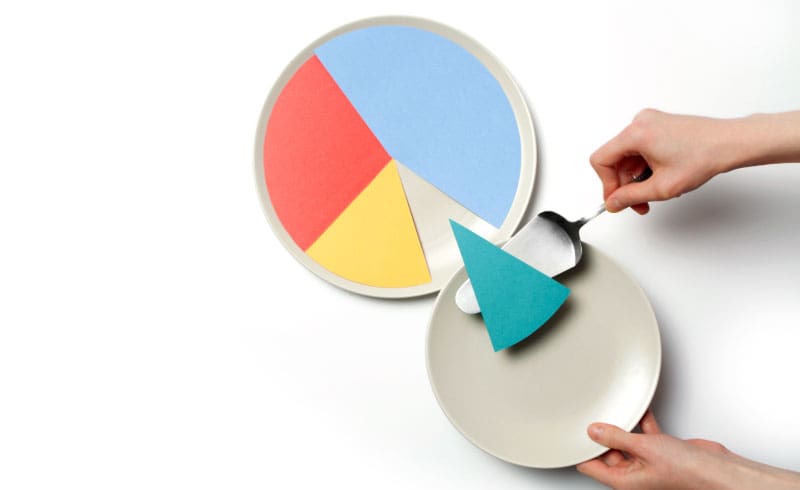

Net income is the amount you have after subtracting costs from revenue. On the other hand, retained earnings are what you have left from net income after paying out dividends.

You need to know your net income, also known as net profit, to calculate it.

How to calculate retained earnings

You need to know a few things to calculate retained earnings.

- Your earnings from the previous reporting period

- Net profit (also called net income)

- Dividends that you need to pay out

Once you have those figures, you can use this retained earnings formula:

- Beginning Retained Earnings + Net Income – Dividends = Retained Earnings

If you do pay dividends, there are some considerations. For instance, say you sold common stock to business shareholders to raise capital. The company is starting to make healthy profits, and it can pay dividends. Once your expenses, cost of goods, and liabilities are covered, you must pay dividends to shareholders. The figure that’s left after paying out shareholders is held onto or retained by the business.

- $1,000 Beginning Retained Earnings + $10,000 Net Income – $2,000 Dividends = $9,000 Retained Earnings

If you don’t have any shareholders, your calculation would look like this:

- $1,000 + $10,000 – $0 = $11,000

The beginning balance should be zero when calculating it for the first time.

1. What does a negative retained earnings balance indicate about the company’s financial performance?

A negative retained earnings balance implies that the company has incurred consistent losses from the previous year or earlier. It indicates that the company’s dividend payouts have exceeded its profits, leading to a negative retained earnings balance and reflecting a challenging financial situation.

2. How should retained earnings be considered with the balance sheet?

Retained earnings should be calculated as frequently as the company’s balance sheet is updated. It is essential to always consider retained earnings in the context of the business type and align the calculation with the balance sheet maintenance for better financial context and management.

3. What is the impact of cash dividends on retained earnings calculation?

Cash dividend payments to stakeholders have a significant impact on retained earnings calculation. When dividends are paid out, it reduces retained earnings. Depending on the amount paid out, it is possible to end up with negative retained earnings, indicating consistent losses incurred by the company.

4. How does the nature of the business type influence retained earnings calculation?

The nature of the business type can impact the variation in retained earnings. For seasonal businesses like a snow removal company, retained earnings are likely to vary across quarters. In contrast, retained earnings tend to be more constant for year-round businesses like car shops.

Accumulated deficit

Sometimes, your business can record a positive net income but negative retained earnings. This is known as an accumulated deficit.

If you made $70,000 in revenue and spent $60,000, your monthly net income is $10,000. But if you have two shareholders and paid each $7,000 in dividends that month, you’ll be left with a negative amount.

- $0 + $10,000 – $14,000 = -$4,000

Monitoring your net income and retained earnings over time can highlight trends and patterns you can plan for in the next business cycle.

Net losses

Unfortunately, there is also a possibility that your expenses exceeded your revenues or that you made a net profit, but it was offset by dividend payouts. This is called a net loss.

For some businesses—such as those with seasonal revenue fluctuations—this is normal. For others, it’s a red flag.

This is how it would look on your profit & loss statement if you have a net loss:

- $500 + $1,000 – $2,000 = – $500

There are many reasons why businesses can experience a net loss, including:

- More competition

- An increase in the cost of goods and inventory

- Higher expenses (e.g., utilities, supplies, insurance premiums)

- Seasonal sales patterns

Some net loss is to be expected, especially for businesses that experience seasonal fluctuations in sales. Therefore, the most important thing to do is to prepare in advance for periods of low revenue.

Retained earnings and shareholder equity

Shareholders’ equity is like a company’s net worth. It can be used to tell stockholders how much return they would have if a company is liquidated or sold, after paying off debts.

To calculate shareholders’ equity, use this formula:

- Total Assets − Total Liabilities = Shareholders’ Equity

Since businesses add net income to retained earnings each accounting period, they directly impact shareholders’ equity.

Example of retained earnings

Public companies publish annual reports that include balance sheets, so you can easily find examples of retained earnings. Here are a few that you can view:

Search for annual reports and go to the balance sheet or CTRL + F to search for “retained earnings”.

For example, Apple Inc.’s 2019 balance sheet from Q3 shows that the company recorded retained earnings of $53.724 billion by the end of June 2019. You can see it within the balance sheet below.

How to prepare a retained earnings statement

Companies usually publish statements quarterly or yearly. However, you can create one at any time. For example, startups might post them more often, because they hold crucial information for lenders and investors. Here are the steps to prepare a statement for your business.

1. Create a heading

At the top, create a three-line heading for your statement. The first line defines the business name. The second contains the document title, for example, “Retained Earnings Statement.” The third line is the report’s accounting period, such as for a year or for a quarter.

2. Calculate your beginning amount

Find the amount that you started with in the equity section of your balance sheet. If you are preparing a statement for 2021, your beginning retained earnings is the figure on the balance sheet at the end of 2020.

3. Add net income

If the business had a net profit of $30,000 for 2021, add it to the beginning retained earnings. If it’s a net loss, deduct it from your beginning balance.

- $100,000 (2020 retained earnings) + $30,000 (2021 net income) = $130,000

4. Subtract dividends

If your business has a dividend policy and made payments during that accounting period, deduct the number from net income. If not, deduct $0. It doesn’t matter if you’ve paid them out or not; you record dividends as debits or reductions.

5. Get the total

Once you subtract the dividends, you’ll get the ending balance for the accounting period. This is the figure you’ll record in the retained earnings account on your next business balance sheet.

It’s important to always check these figures with a professional financial advisor or skilled accountant.

How Xendoo can help

Understanding your company’s finances is so important. The right reporting can help you highlight patterns in your cash flow and make adjustments to keep your business profitable, regardless of your external circumstances.

Xendoo can prepare financial statements like retained earnings, profit and loss, balance sheets, and more for you. We’ll also help you understand what all these numbers mean for you and your business. Each Xendoo plan comes with a team of experienced accountants and top accounting software. You can view plans or sign up for a free trial.