What Is Net Income Formula and How to Use It

Net income is one key metric that you can use to assess your business’s financial health. It is the bottom line on your income statement, also called a Profit & Loss Statement (P&L), and it tells you how much money you have remaining after deducting your costs and operating expenses from your total sales.

What Is Net Income?

Net income can be compared to “take-home pay” for an employee. It’s the amount of money remaining after taxes, insurance, and other expenses are deducted from your total pay or gross income.

Similarly, a business’s net income is the amount of money remaining after deducting all business expenses, including wages, interest, product costs, operation costs, and taxes. Net income, also known as the bottom line, net earnings, or net profit, appears at the bottom of income statements.

Generally, a healthy, growing business will have positive net incomes and increase consistently. In other words, the more you increase revenue and decrease expenses, the healthier you are.

The net income or net loss of your business may also show up on your balance sheet as retained earnings. Retained earnings are the amount of money that is held (not distributed to shareholders) to sustain and grow the business.

How Do You Calculate Net Income?

The net income formula helps calculate the net income of either an individual or a business.

Calculating net income is fairly straightforward for individuals. You take the total amount earned (gross income) and then deduct all expenses, such as interest payments and taxes. It is a little more complicated for businesses.

Net Income Formula

Businesses can use the net income formula to calculate net income for any timeframe. There are two primary ways to calculate net income: revenue and expenses or gross profit and expenses. We’ll go over each net income formula and how to use them.

Total Revenue

- Total Revenue = Quantity Sold * Price – Discounts

Cost of Goods Sold

COGS is the cost of the product or the service being delivered. If you have a t-shirt company, it is the wholesale cost of the t-shirt, plus freight, labor, and printing costs. If you provide consulting services, it is the cost of labor to provide the consulting.

Gross Profit

Gross profit represents the profit made on selling the product or service. This provides insight into whether your pricing brings you the desired profit on each sale.

- Gross Profit = Revenue – Costs of Goods Sold

Operating Expenses

Operating expenses are running the day-to-day business, including advertising & marketing, rent, payroll, insurance, software, website, postage, auto expenses, meals, travel, and more. These are the below-the-line (Gross Profit) costs.

Net Income

- Net Income = Gross Profit – Operating Expenses

It’s important to note that net income can be a net loss. If your operating expenses exceed your gross profit, you have a net loss. When your operating expenses are less than your gross profit, you have a net income.

Often, when a business is in start-up mode, a net loss is not surprising. Although a net loss has a tax benefit, it doesn’t lead to a sustainable or scalable company without further investment.

It’s also important to note that net income may include revenue that is not from your core business activities. For example, if your business owns real estate and rents out part of it or gains royalties from a past partnership, this is generally referred to as non-operating income.

Business Net Income Example

Let’s look at a hypothetical business scenario to understand the net income formula fully.

Marcus’ Archery, a company specializing in manufacturing and selling archery equipment, wants to calculate its net income for the fourth quarter. Here are the necessary figures to calculate net income from its accounts:

- Total Revenue: $20,000,000

- Costs of goods sold (COGS): $8,750,000

- Rent: $150,000

- Utilities: $40,000

- Payroll: $250,000

- Advertising: $70,000

- Interest expense: $70,000

According to the net income formula, Marcus’ Archery first needs to calculate Gross Profit. You would do this by subtracting the costs of goods sold, including direct labor costs, from the total revenue.

- $20,000,000 (Total Revenue) – $8,750,000 (COGS) = $11,250,000 (Gross Profit)

- $150,000 (Rent) + $40,000 (Utilities) + $250,000 (Payroll) + $70,000 (Advertising) + $70,000 (Interest Expense) = $580,000 (Total Expenses)

Marcus’ Archery can now calculate its net income with all these results. You use the net income formula to subtract total expenses from gross income to do this.

- $11,250,000 (Gross Income) – $580,000 (Total Expenses) = $10,670,000 (Net Income)

The fourth quarter’s net income for Marcus’ Archery is $10,670,000.

Cash Flow vs. Net Income

These are simplified explanations of how to calculate net income. However, net income does not equate to how much money is in the bank. We often hear questions like, “I made $100,000 this year, but why don’t I have $100,000 in the bank.” That is because cash flow is very different from net income

Factors like credit cards, business loans, owner’s payments, or investment income affect the money in the bank but aren’t factors in net income. You can learn more about cash flow vs. profit and how to use cash flow for decision-making in our blog.

Individual Net Income Example

We focus on business bookkeeping and accounting at Xendoo. However, looking at an individual net income example can help you better understand how it differs from calculating the net income for a business.

Let’s consider Nancy, an employee at a local ski shop. Nancy receives her paycheck every two weeks with gross pay of $4,500. She also receives $200 in interest and $600 in equity as her other forms of income.

She then pays all her taxes, including:

- Social Security taxes ($279)

- Federal taxes ($450)

- State taxes ($163.91)

- Medicare taxes ($65.25)

- Insurance ($280)

These are usually automatically deducted from your paycheck. After all these deductions, Nancy has a net income of $4,061. Here are the exact steps to calculate it.

- Gross Income – Total Expenses = Net Income

For Nancy, the math would be like this:

- $4,500 (Gross Pay) + $200 (Interest) + $600 (Equity) – $279 (Social Security Tax) – $450 (Federal Tax) – $65.25 (Medicare Tax) – $163.91 (State Tax) – $280 (Insurance) = $4,061 (Net Income)

Because Nancy’s gross income includes equity and interest, it totals $5,300. Based on her biweekly paycheck, Nancy has an annual net income of $105,586.

What key financial insights can business owners gain from income statements and other reports?

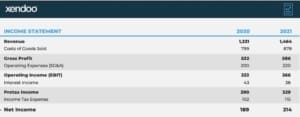

Business owners have a valuable resource in income statements and other financial reports. These tools offer crucial insights into a business’s financial health and can guide decision-making to foster growth. Income statements, for example, give a clear view of cash flow, offering a snapshot of profitability over time. Analyzing these statements allows business owners to grasp net income, a key measure of financial well-being. Paired with balance sheets and visual reports, income statements provide comprehensive insights into a business’s financial standing.

These reports are indispensable for tracking revenue, expenses, and profits. They help identify patterns and areas ripe for improvement. Access to current financial data allows business owners to make informed decisions rather than relying on guesswork. Ultimately, these insights enable entrepreneurs to manage resources effectively, spot growth opportunities, and steer their businesses toward success.

How can financial statements, including income statements, help small businesses understand their financial health?

Financial statements, particularly income statements, are crucial in providing small businesses with a comprehensive view of their financial well-being. By analyzing income statements, small business owners can gain insights into various aspects of their financial health. These statements detail important financial indicators such as sales revenue, cost of goods sold, gross profit, operating earnings, and net profit. Income statements offer a clear breakdown of the money flowing in and out of the business, enabling owners to gauge their profitability and track overall performance. Through these financial snapshots, businesses can identify trends, pinpoint areas for improvement, and make well-informed decisions based on precise financial data. Understanding and utilizing income statements can ultimately empower small businesses to optimize their financial strategies and enhance their overall financial health.

How Xendoo Can Help

Net income is critical for any individual or business’s financial health. The monthly income statement report details how effective the sales and operations process is at achieving financial success.

At Xendoo, generating up-to-date net income reports is one of the many bookkeeping and tax services you can access from our organization.

With Xendoo, you get a team of real people and bookkeepers who dedicate their skills and expertise to your business’s or individual finances’ success. Additionally, we integrate our services with the best software to ensure all your accounts are accurate. Get started today to meet your dedicated CPA team and expert bookkeeper.