How to Report Florida Sales Tax

Whether you’re a brick-and-mortar business located in Florida or an e-commerce seller who ships to customers in the state, one hassle you can’t get away from is collecting and remitting the state sales tax.

The first thing you need to know is that Florida is a destination-based sales tax state. That means you’ll charge customers the Florida tax rate, not the rate of whatever state their purchase shipped from. Currently, the Florida sales tax is:

Complicating things even further is that many counties in Florida also have a discretionary surtax. For a list of the counties and their tax rates, visit the Florida Department of Revenue’s Discretionary Sales Surcharge page.Before you get started, gather the information you’ll need, including:

- Records of sales and taxes collected

- Your Florida sales and use tax certificate number

- Your state-assigned filing frequency

- Your Florida electronic filing log-in details (user name, password)

- Bank routing and account numbers from which you’ll make the sales tax payment

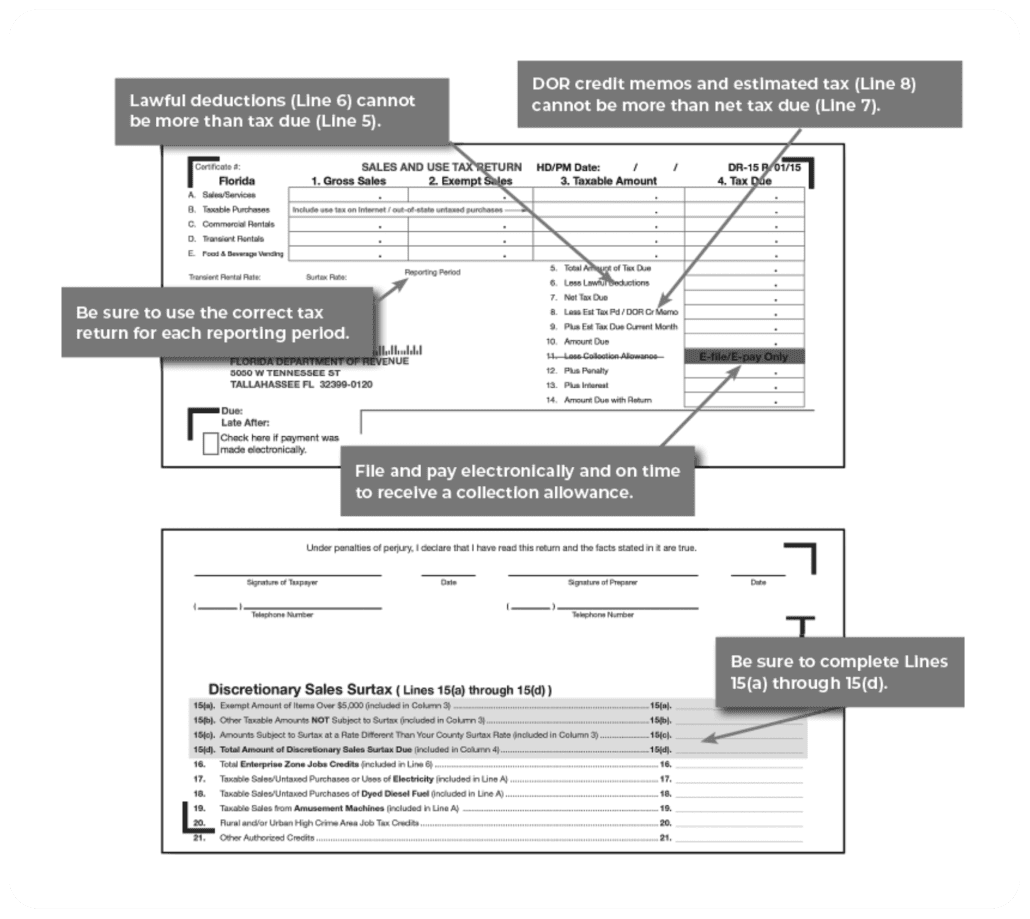

To file your sales tax return, you’ll need Form DR-15. To submit a physical return with a check or money order payment, print out the form from here.The Florida Department of Revenue also provides instructions on filling out Form DR-15.To file and pay your sales tax online, start at the Florida Sales and Use Tax, Prepaid Wireless E911 Fee, and Solid Waste Tax, Fees and Surcharge Website (which is the same place you’ll be directed to if you start on the Florida Department of Treasury’s home page, and click on the “File and Pay” box).From there, follow the steps outlined in Florida’s e-File and ePay instructions.

You can also print out a comprehensive tutorial if you want to keep it in your office. If you’re a new business, you will first need to register for a Florida sales tax permit (the permit number will be needed on your sales tax filing). Find information and application forms on the Florida Department of Revenue’s Account Management and Registration page. Right about now, you’re probably thinking that all this red tape is not fun — and not what you thought you’d spend your time doing when you went into business. That’s what xendoo is here for. We’ll handle all the sales tax calculations, reports and payments — even if you’re selling in all 50 states (each of which has their own rules and regulations). Now you can get back to doing the fun parts of your business!