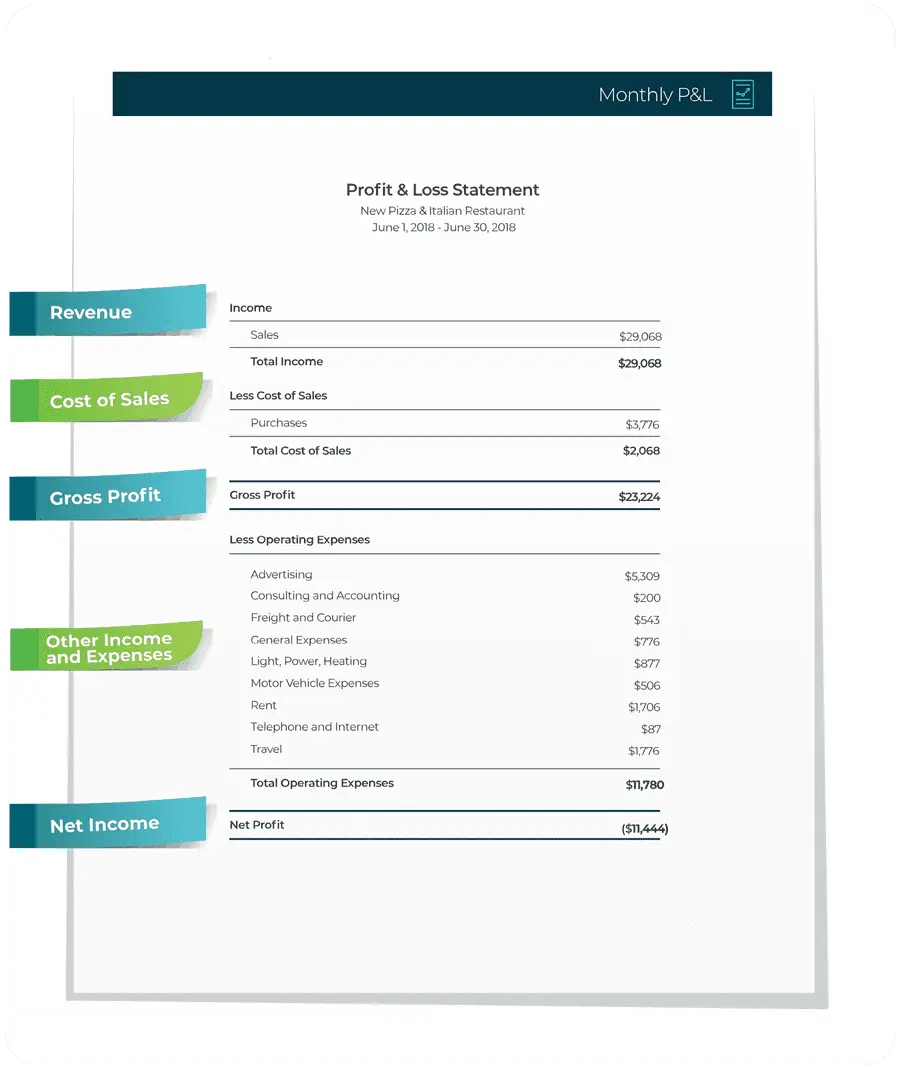

Every month you receive a P&L statement from xendoo. In a nutshell, it tells you whether your business made a profit or a loss — for the month as well as the year to date.

It can do more than that, though, if you know what the numbers mean. Here’s a quick guide.

Revenue on a profit and loss statement

The money you received from customers who bought your products or services. This section probably itemizes sources of those revenues, so you can see which areas are bringing in the biggest returns.

It shows the total sales amount including any sales tax collected. When you remit the tax to the state, that amount will be listed as a debit entry to be subtracted from total revenue. (All debit entries are shown in parentheses.)

This section will also account for any merchandise that was returned to you by customers, as a negative entry. Since the original sale is listed in this section, the return has to be there also, so that it balances out to zero.

Cost of Sales

These are the expenses directly related to the products or services you sell, including your purchase costs, labor, storage, and delivery.

The line called “Cost of Goods Sold” can either be what you paid for merchandise that you resell or raw materials that you make into products for sale, as well as manufacturing labor costs.

Gross Profit

Revenue – Cost of Sales = Gross Profit. This line is immediately under the Cost of Sales section. If the number is in parentheses, you made a loss instead of a profit.

Be sure to look at the year to date column as well as this month’s column. There’s no need to panic over one atypical month if the year to date figures are in line with your expectations.

Other Income and Expense

Here is where you’ll find everything not directly involved in making and/or selling your product.

- Office and equipment-related expenses such as utilities, leasing, and maintenance

- Employee-related expenses such as salaries, insurance, and business travel

- Fees such as licenses, bank charges, and merchant fees

- Taxes: real estate and payroll

- Costs of advertising, legal or other professional services

Net Income

Gross Profit – Other Income and Expense = Net Income. This line is immediately under the Other Income and Expense section. Net Income is your “bottom line”, which reveals whether your business is operating in the black or the red. Note, it does not include your business income tax, which will be calculated at the time you fill out your return.

Because we know how important these numbers are to your business decision-making, xendoo guarantees delivery of our clients’ Profit and Loss statement by the fifth business day of every month. This allows you to quickly identify — and react to — both trouble spots and growth opportunities. It’s just one of the ways we help keep your business growing strong.

[av_sidebar widget_area=’Blog Post Disclaimer’ av_uid=’av-om2w’]