If you’re a small business owner, you know that keeping track of all the moving parts can be challenging. Most small business owners keep track of their profit and loss statement, but the owner’s equity is equally important (and often overlooked).

In this guide, we will explain what owner’s equity is and how to calculate it. We will also give tips on how to grow your equity and protect it from potential risks.

What Is Owner’s Equity?

Owner’s equity is the portion of a business’s assets that the owner or shareholders possess. This applies to you, regardless of if your business is a sole proprietorship, partnership, or corporation.

Also, owner’s equity can be considered the residual value of a company’s assets after liabilities are paid. For example, if a business has assets of $100,000 and liabilities of $60,000, the owner’s equity will be $40,000.

Why Do Businesses Record Owner’s Equity?

No one wants to think about the end of their business which they have spent so much time and effort building. Yet, it is important to consider. Owner’s equity will give you some insight into the outcome of company liquidation.

It represents the amount of money that would be left over for owners if the company was liquidated. If you sell your business, it will also be taken into consideration.

For corporations, owner’s equity is also a critical factor in determining a company’s stock price. The higher the equity, the more valuable the company is considered to be.

Additionally, it can increase through profitability and investment. It can decrease through operating losses or share repurchases.

How you record equity can depend on the type of company structure.

Sole Proprietorship

In a sole proprietorship, the owner and the company are one and the same. The owner of a sole proprietorship has complete control over the equity of the business. However, this also means that the owner is personally responsible for any debts or losses incurred.

In a sole proprietorship, the owner’s equity is equal to the assets of the business minus any liabilities.

Despite the overlap between personal and business for a sole proprietorship, it’s still best practice to maintain separate accounts.

Corporation

By contrast, a corporation is a separate legal entity from its owners. The owners of a corporation are known as shareholders or stockholders.

In a corporation, the shareholders own the equity of the company. This means that they have some control over how the assets of the business are used, but they are not personally liable for the debts of the business.

But it also means, in the case of bankruptcy, that the owner’s equity is first used to pay off any outstanding liabilities of the company before being distributed to shareholders.

Ultimately, when it comes to ownership structure, it is up to each individual business to decide which type of structure is right for them.

What Do You Include in Owner’s Equity?

Owner’s equity is the portion of a business’s assets that are held by the business and not distributed to the owners. This can include various types of stock and retained earnings.

The balance in the owner’s equity account will increase when the company makes a profit and decrease when the company sustains a loss. It can also be increased through investment in the business.

When calculating owner’s equity, it is important to only include those assets that are owned by the business owner(s), whether they are shareholders or a sole proprietor. This means that any liabilities or expenses must be deducted from the total value of the assets. The result is the owner’s equity.

It can be a positive or negative number, depending on whether the value of the assets exceeds the amount of the liabilities.

Also, it may include the following:

- Common Stock

- Preferred Stock

- Prior Years’ Retained Earnings

- Current Year Earnings

- Less Current Year Distributions and Dividends

Examples of Owner’s Equity

There are several different types of owner’s equity, including common stock, preferred stock, retained earnings, and treasury stock.

Common Stock

Common stock is the most basic type of ownership interest in a corporation and represents the residual claim on a company’s assets after all debts and liabilities have been paid. Preferred stock gives holders priority over common shareholders in terms of dividend payments and asset distribution in the event of liquidation.

Retained Earnings

Retained earnings are typically profits that a company has reinvested back into the business instead of paying out as dividends.

Treasury Stock

Treasury stock is stock that has been repurchased by the company and is not currently outstanding.

How to Calculate Owner’s Equity

If you own a company, it’s important to understand how to calculate your owner’s equity. This figure represents your personal investment in the business, and it can be a helpful tool for tracking the health of your company over time.

To calculate your owner’s equity, simply subtract your total liabilities from your total assets. This will give you your equity stake in the business. Keep in mind that your equity can increase or decrease depending on your financial performance. If you’re looking to attract investors, strong equity can be a valuable selling point.

- Owner’s equity = Company’s assets – Company’s liabilities – Less funds withdrawn by owner(s)

By understanding how to calculate this figure, you can gain insights into the financial health of your business and make more informed decisions about its future.

Where Does Owner’s Equity Appear on the Balance Sheet?

It appears on the balance sheet as a positive number, representing the assets that the owner has put into the business.

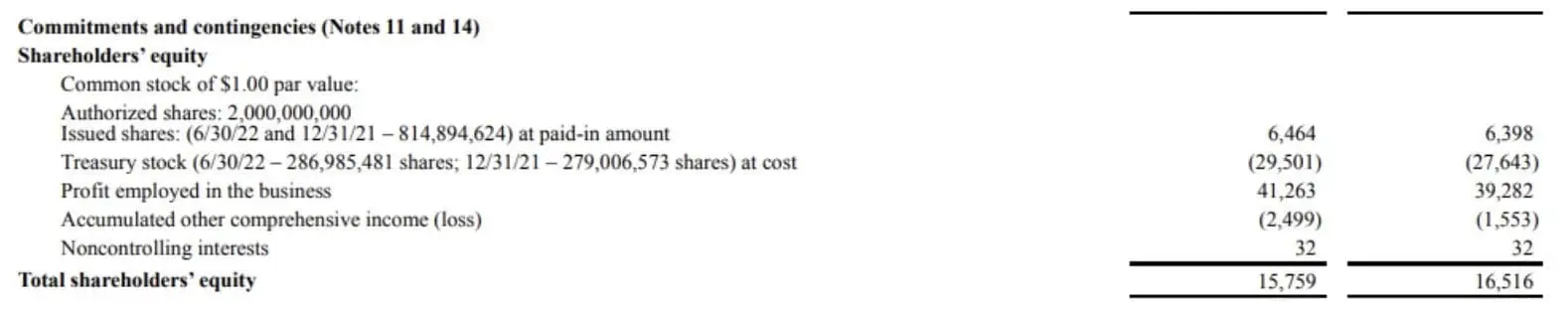

For publicly traded companies, the owner’s equity can be spotted on the balance sheet. Below is an example from a recently filed 10-Q for Caterpillar. In the example, you can see that the shareholders’ (owners’) equity is $15,759 million. This means that the combined investment by shareholders since the company’s inception is $15,759 million.

Privately held companies will see the owner’s equity on the balance sheet below the liabilities as well. However, there are usually fewer categories included in the balance sheet of a privately held company.

Business owners could use their equity to pay for business expenses, buy new assets, or reinvest in the business. It can also be used as collateral for loans, to pay dividends to shareholders, or to buy back shares from shareholders.

How to Increase Owner’s Equity

It can be increased in a number of ways, including reinvesting profits, reducing liabilities, and increasing the value of the assets.

Invest Additional Funds Into the Business

When a business is doing well, it can be tempting to just sit back and enjoy the fruits of your labor. However, if you want to continue to thrive, it’s important to reinvest some of your profits back into the business.

This will help to increase your equity, which provides a cushion in case of tough times and can also help you finance growth opportunities. There are a number of ways to reinvest in your business, such as hiring new staff, investing in new equipment, or expanding your facilities.

By taking the time to reinvest in your business, you can help ensure its long-term success.

Reduce Liabilities

It’s important to understand the relationship between liabilities and equity. Simply put, liabilities are what you owe, while equity is what you own. By reducing your liabilities, you increase your equity.

Reducing liabilities can be accomplished in several ways, such as paying off debt or increasing your savings. Reducing your liabilities has a number of benefits. First, it frees up cash that can be used to grow the business. Second, it improves your credit rating, making it easier to get loans in the future. Finally, it reduces the amount of interest you owe, which can save you money in the long run. So if you’re looking to strengthen your business’s financial position, reducing liabilities is a good place to start.

Minimize Expenses

As a business owner, it’s important to keep an eye on your expenses. Not only will this help to improve your bottom line, but it will also increase your owner’s equity.

By minimizing expenses, you can increase the amount of equity and make your business more attractive to potential lenders and investors.

There are a number of ways to reduce expenses, including negotiating better terms with suppliers, cutting unnecessary costs, and increasing efficiency. However, before you can reduce expenses, you need to have a system for tracking them. You can use your accounting software, an app, or even a small business expense tracking spreadsheet.

By taking a diligent approach to expense management, you can ensure that your business is financially viable.

Do Not Take Distributions (Or Dividends)

One way to increase owner’s equity is to avoid distributions and dividends. This can be beneficial because it allows the company to reinvest its earnings and grow the business. In addition, it can help to build up a cushion of cash that can be used in case of unexpected expenses or opportunities.

Of course, there are also downside risks associated with this strategy. If the company’s earnings decline, then equity will also decline. In addition, if the company needs to raise cash for any reason, then it may have to issue new equity or take on debt. As a result, this strategy should only be pursued if the company is in a strong financial position and has a solid plan for growth.

Equity is an important part of any business and should be considered when making decisions. By increasing it, you are putting yourself in a better position to run your business successfully. There are many ways to increase your equity and we have outlined some of the most common methods.

If you still aren’t sure how to calculate and record owner’s equity (or if you just want some expert help), consider an online bookkeeping service. xendoo’s bookkeeping plans come with balance sheets and can include equity figures as well as other financial reports.

[av_sidebar widget_area=’Blog Post Disclaimer’ av_uid=’av-om2w’]