If you’re managing a business—and your books—you’ve probably had to learn what is accounts payable vs. accounts receivable.

Accounts payable and accounts receivable are two different sides of the same coin. In this case, the coin is your business. One tracks money that is going out. The other tracks money coming in. Both are important to maintain a steady cash flow and grow your business.

Without a deep understanding of your accounts payable and receivable, you could face costly setbacks.

At xendoo, we’ve prepared a detailed guide about accounts payable vs. accounts receivable to help business owners stay on top of their cash flow. Let’s dive deeper to learn more.

- What Is Accounts Payable?

- What Is Accounts Receivable?

- Accounts Payable vs. Accounts Receivable

- How to Record Accounts Payable

- How to Record Accounts Receivable

- Accounts Receivable Turnover Ratio

What Is Accounts Payable?

Accounts payable (AP) is what your business owes creditors—like the amounts for products and services you bought on credit. Accounts payable is a liability account entailing debts (both long- and short-term) due in a specified period, usually a year.

Accounts payables are balance sheet entries. You record them under ‘current liabilities on the balance sheet.

If you don’t handle it accurately and efficiently, you won’t pay what your company owes on time or overspend. That means jeopardizing supplier relationships and incurring late payment penalties, among other consequences.

Accounts Payable Examples

The actual entries you record in your general ledger differ from business to business. However, typical categories of accounts payable include:

- Rent and lease payments

- Travel expenses

- Business equipment and supplies

- Raw materials to make products

- Transportation and logistics

To record accounts payable, here are a few examples.

Example 1

Suppose your beer company orders $1,000 barley from supplier X. Supplier X sends an invoice on the 15th of June with a 30-day payment period. The $1,000 is accounts payable, and you record it in your general ledger by crediting $1,000 on the supplier’s X account. Then, debit $1,000 into your asset account.

Example 2

Let’s say your business receives a $500 monthly electric bill. In that case, $500 is accounts payable that you credit on your business journal and debit on your utility expense account.

What Is Accounts Receivable?

Accounts receivable (AR) is the money customers owe your business for the goods or services you sell to them on credit. Accounts receivable is an asset account on the general ledger and balance sheet. You record the account receivables in the balance sheet under ‘current assets.’

To account for accounts receivable, you need to invoice, collect, and record customer debts.

Understanding your accounts receivable can help you evaluate your overall financial liquidity and stability.

If you don’t manage receivables well, it may translate to a negative cash flow. For a healthy accounts receivable, you should have an accounting system that accounts for and limits bad debts.

Accounts Receivable Examples

Typically, accounts receivable include the sale of goods or the supply of a service that hasn’t been paid in full yet. However, the amount is expected to be paid in the short term, within a year or less.

Example 1

Assume you are an electric company that charges clients after using electricity. In this case, the unpaid invoices (bills by clients) represent the accounts receivable in your company. You record them as current assets in your general ledger and balance sheet.

Example 2

Suppose your business supplies $1,000 barley to a beer company on credit. In that case, you will record $1,000 as an asset in accounts receivable.

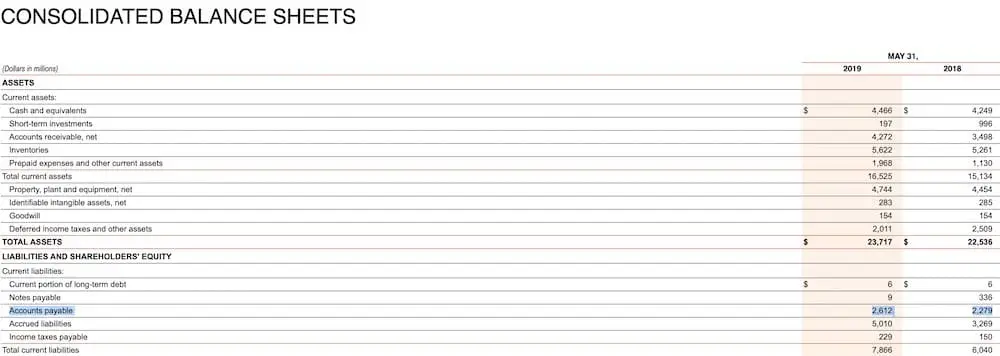

If you’re curious about how other businesses record their accounts payable and receivable, you can easily view the quarterly and annual reports of public companies. Companies submit reports to the U.S. Securities and Exchange Commission (SEC), as well as directly through the company site.

For example, you can see Nike’s balance sheet listed accounts receivable under assets and accounts payable under liabilities. (Figures are in millions).

Accounts Payable vs. Accounts Receivable

While accounts payable and receivable are different, they have some commonalities.

- Both accounts payable and receivable are general ledger entries—one as a liability and the other as an asset.

- You need an overview of both to get an accurate picture of your business’s financial health.

Analyzing accounts receivable can give you a picture of your total payment owed, and the success rate of your debt collection efforts.

On the other hand, accounts payable tells you if you are able to pay business debts. Combined, they show your company’s financial stability.

Accounts payable and receivable are equally important. It’s critical to use the right tools to track, record, and manage both.

Differences Between Accounts Payable vs. Accounts Receivable

Accounts receivable are assets while accounts payable are liabilities. Accounts receivable amounts must be accurate to help you establish business profitability.

Second, you can sell your accounts receivables to a lender when you need cash urgently and can’t wait for customers to pay their debts. This method is called invoice financing or accounts receivable financing.

While a finance company (e.g., a bank) might refuse to buy your invoices past due dates, a debt collection company may buy them at a discount. It is not ideal, but it can add more value than writing off the bad debt.

On the other hand, accounts payable are liabilities because your business will pay the debt within a specific timeline.

The table below summarizes the differences between accounts payables and accounts receivable.

| Accounts Payable | Accounts Receivable |

| It’s the amount your company owes creditors | It’s the amount your company collects from debtors |

| You record it as a liability in the general ledger and balance sheet | You record it as assets on the general ledger and balance sheet |

Your accounts receivable and account payable should be efficient. That way, you will avoid issues during auditing and prevent getting caught up in fraud by unethical suppliers.

When managing your accounts payable, ensure all entries are accurate by minimizing accounting errors in your business. On top of that, watch out for suppliers who may mistakenly bill for more products than they have delivered.

When managing your accounts receivable, ensure that debtors pay what they owe on time. If the accounts receivable are way past their due dates, you may need to adjust your expectations.

Debts past due dates (with several months) might translate to bad debts, which you should remove from accounts receivable and record as an expense.

How to Record Accounts Payable in Accounting

When recording accounts payable, you either use the cash or accrual accounting method.

Cash vs. Accrual Accounting

Cash-basis accounting is simpler than accrual accounting. With cash basis accounting, you record transactions on a cash basis as they happen—after the money exchanges hands.

That means you record expenses after the business pays the bills or debts from creditors. For example, let’s say you bought supplies on credit on June 1st and payment is due June 30th. You don’t record the transaction in your books on the 1st but the 30th, when you make the payment.

On the other hand, accrual accounting refers to recording transactions as they happen, regardless of whether or not money exchanges hands. In the above example, you would record the transaction in your books on June 1st instead of waiting for the 30th.

Which accounting method should you use?

Consider cash-basis accounting if you own a small business or make products on demand. On the other hand, accrual accounting suits you best if you have a business with a large inventory. Read our full cash basis vs. accrual accounting guide to help you choose the method for your business.

How to Record Accounts Receivable in Accounting

Recording accounts receivable is a little more involved because you have to coordinate customer invoices and payments. To help your business get paid on time, here are some accounts receivable tips:

1. Run a credit check

Unpaid invoices happen, but you can limit and prevent some by taking measures like running a credit check before delivering goods or services. Other tips for preventing late and unpaid invoices include:

- Get a signed agreement on payment terms before starting work

- Get a personal guarantee which gives you the right to sue the business owner personally—rather than the business—for unpaid debts. (Save this one for those with a bad credit record.)

- Send your invoice immediately after work is done

- Track the customer’s payment history with you and deal with those who are consistently late payers. (Change payment terms or stop doing business with them.)

- Make it easy for customers to pay you with options such as debit card, credit card, PayPal, Stripe, and more.

2. Send an invoice

As mentioned above, invoices should be sent in a timely manner. The easiest way to do this is with online invoicing software. The invoice is sent to the customer by email and the amount owed is automatically entered into your bookkeeping and collections system.

Good software should also allow ways for the customer to make payments online with a credit card or bank transfer. All xendoo plans come with invoicing software Xero, and include templates and more.

With invoicing software, your accounts receivable staff and your customers can save a lot of time.

2. Track payments

You’ll also want to track payments and set up automatic reminders to go out when payment is near due, and if it’s late.

Your accounting software should be able to generate an aging report, which lists past-due invoices in order from the least to the most number of days since the due date. Do this regularly, because the longer you wait to pursue payment, the less likely it is that you will ever get paid.

3. Set a timeline for collections

Next, you need a strategy in place for aging (overdue) invoices. Your accounting software should be able to automatically send past-due reminders, according to trigger dates you’ve established. To plan your collections, answer the following:

- How will you notify the customer when a payment is past due? Will you send a second notice invoice through email, snail mail, or phone call?

- How many reminders will you send before you escalate overdue payments?

- Will you cut off sales until the outstanding balance is paid?

- When will you take actions like charging late fees or sending overdue invoices to a debt collector?

Your software should also be able to generate an aging report, which shows you at a glance all your past-due invoices listed in order from least to most overdue.

4. Record bad debts

If all your efforts to get the invoice paid have failed, the time has come to write it off as a bad debt.

You decide when that write-off will occur. Typically, if an invoice hasn’t been paid in 6 months, it is not going to be paid.

Be sure to include the write-off on your income tax return. If the customer does eventually pay, you can declare it as income on next year’s tax return. You’ll also need to get a tax refund if you’ve already paid taxes on the expected income.

Failure to collect debts is one of the top reasons small businesses go out of business. So it’s super important to make consistent, persistent efforts to get the money owed to you.

Accounts Receivable Turnover Ratio

How do you know if your accounts receivable process is working? The accounts receivable turnover ratio measures how efficient your business is at collecting payments.

It shows how you manage customer debts by showing how quickly you collect them. A higher receivable turnover ratio shows that your business manages debts efficiently.

A lower ratio translates to inefficient debt management. Here’s the formula for calculating your accounts receivable turnover ratio.

- Accounts Receivable Turnover Ratio = Net Credit Sales ÷ Average Receivable

Net credit sales represent debts you collect later. Below is the formula for net credit sales.

- Net Credit Sales = Credit Sales − Sales Returns − Sales Allowances (Discounts)

The average receivable is the starting and ending receivables over a set period of time divided by two.

- Average Receivable = (Starting AR + Ending AR) ÷2

Example of the Turnover Ratio

A vintage shop had gross credit sales of $50,000 and returns of $5,000. The starting and ending accounts receivables for that year were $5,000 and $7,500. Here’s how to find the account receivable turnover over ratio for that year.

- Receivable Turnover Ratio = (50,000 − 5,000) ÷ [(5,000 + 7500)÷2] = 7.2

The business collected accounts receivable approximately 7.2 times over the year.

Mismanaged accounts payable and receivable can tank your business. If you don’t have the time, capability, or desire, xendoo can help. Our plans come with advanced bookkeeping software, an automated accounts receivable process, expert debt management, and income tax guidance. Request your free trial today to get started or chat with a xendoo expert bookkeeper.

[av_sidebar widget_area=’Blog Post Disclaimer’ av_uid=’av-om2w’]