Whether you are running your own freelancing business or are looking to hire an independent contractor for your company, you’ve probably heard of a 1099 form.

There are many different types of 1099 forms. When it comes to independent contractors, you’ll typically deal with the 1099-NEC.

In this article, we’ll go into the specifics of 1099 tax forms, the pros and cons of independent contractors, and what it all means comes tax season.

What Is a 1099 Tax Form?

In general, the IRS uses 1099 forms for taxpayers to report income that is not subject to withholding. For example, a regular employee does not use 1099 forms because their income tax is withheld during each payment period.

On the other hand, taxpayers use 1099 forms to report income from freelance work, interest, dividends, and capital gains.

The payer of the income is responsible for sending a 1099 form to the payee and the IRS. The payee then uses the information on their 1099 form to file their taxes. In other words, if your business has paid more than $600 to an independent contractor or freelancer this year, you’ll need to send a 1099 form to them.

Types of 1099 Forms

There are about 20 different types of 1099 forms, so it can sound overwhelming. Luckily, when it comes to independent contractors, you usually come across two—1099-NEC and 1099-MISC.

Most often, you’ll be using the 1099-NEC. To send a 1099-NEC form, you first need to have independent contractors fill out a W-9 form, which contains information like their name, address, and tax ID or social security number.

What Is a 1099-NEC Form?

The 1099-NEC form is an IRS tax form used to report non-employee compensation (NEC). How do you know if you need a 1099-NEC form? You’ll likely need to use this form if you meet the below requirements.

- Over $600 – Businesses must complete and send a 1099-NEC form to the IRS and to each person they paid $600 or more during the year.

- Non-employees – Payments must be made to non-employees. This includes independent contractors, freelance workers, and other self-employed individuals.

There are some unique cases where you may not send a 1099-NEC form. These include:

- Corporations – You are not required to send a 1099 to a corporation (either a C-corporation or S-corporation). You do not need to send one if an LLC is taxed as a corporation. There is no penalty for sending a 1099 to a corporation, so if you are unsure, you should send it anyway.

- 1099-K and freelance marketplaces – If you hire and pay freelancers through third-party platforms like Upwork and Fiverr, you won’t prepare a 1099-NEC or 1099-MISC. Because these are classified as “payment settlement entities”, the platforms send a 1099-K to freelancers. However, always double-check with the platform you’re using and the IRS to avoid penalties.

The 1099-NEC form is an important document for both payers (companies) and recipients (independent contractors). Payers must ensure that they correctly report all NEC payments, and recipients need to use the form to correctly file their taxes. The 1099-NEC form helps to ensure that everyone pays their fair share of taxes.

What Is an Independent Contractor?

The IRS also has specific guidelines for classifying workers as employees or independent contractors.

Employees fill out W-4 forms when they start a new job or need to make updates to their information, and they must receive a W-2 form from their employer for taxes. Independent contractors, on the other hand, fill out W-9 forms and receive 1099 forms.

1099 Form Independent Contractor Requirements

Independent contractors have a lot of advantages. They are their own boss, set their hours, and can deduct a lot of business-related expenses come tax time. But there are also some cons, one of which is that they have to pay self-employment tax.

As a business, hiring independent contractors can supplement your workforce and provide specialized expertise. Plus, independent contractors can come with more flexibility and lower costs than an in-house employee.

So, what exactly does it mean to be an independent contractor? According to the IRS, to be considered an independent contractor, an individual must:

- Be in control of how they do their work – In other words, the client can’t enforce how many hours or what days of the week to work.

- Not employed by the company – They must be self-employed.

- Use their own tools to complete their work – This is usually applied to tradesmen who may bring their own tools to a job site.

Filling out the wrong forms can lead to costly mistakes, so it’s important to understand the difference between employees and independent contractors.

Employees vs. Independent Contractors

A company hires an independent contractor to do a specific job. Because a contractor isn’t considered an employee, they are not eligible for the same benefits as employees, such as health insurance and paid vacation days.

As a result, independent contractors are also not subject to the same tax laws as employees.

An employee is also typically expected to comply with the company’s rules and regulations. An independent contractor has more flexibility.

Another key difference is that an employee may work full-time or part-time and have defined tasks and requirements. An independent contractor works on a contract basis and you have less control over how they perform their work.

Independent Contractors vs. Self-Employed

Self-employed means that you make your income by being your own boss. All business owners are self-employed, but not all self-employed are business owners. For example, an independent contractor can be self-employed without running their own business.

The IRS may consider an independent contractor also self-employed. For example, if you earned more than $400 per year, you also need to pay self-employment taxes, which refers to Social Security and Medicare taxes.

1099 Form Independent Contractor Example

For example, if you are a freelance writer or graphic designer, you would receive a 1099-NEC from each client that paid you more than $600 in a year. You would then use the 1099s to report your earnings for the year.

What’s the Difference Between 1099-NEC and 1099-MISC Forms?

A 1099-MISC form is used to report payments made to non-employees for services that do not fall under non-employee compensation. Types of miscellaneous income you might report with a 1099-MISC form include:

- Rents

- Royalties

- Prize winnings

- Other income (not subject to self-employment taxes), and medical and health care payments

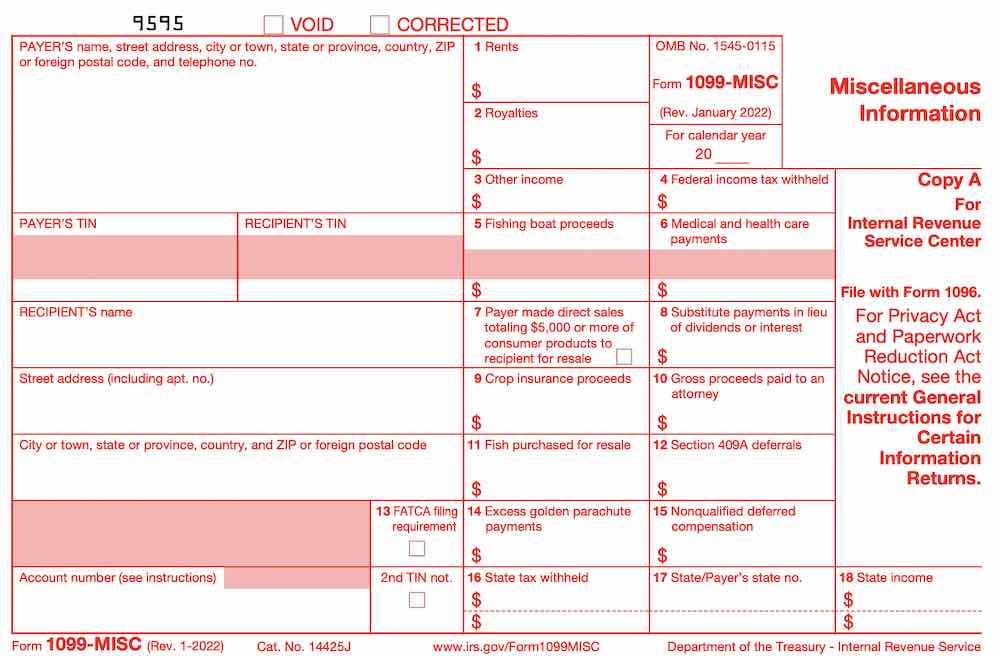

The payer must provide a 1099-MISC form to the recipient by January 31st of the year following the payment. If you receive or submit a 1099-MISC form, you can see exactly what it looks like below or by going to the IRS website.

The 1099-MISC form does not include withholdings for Social Security and Medicare taxes. Despite its simple appearance, the 1099-MISC form plays an important role in the tax system.

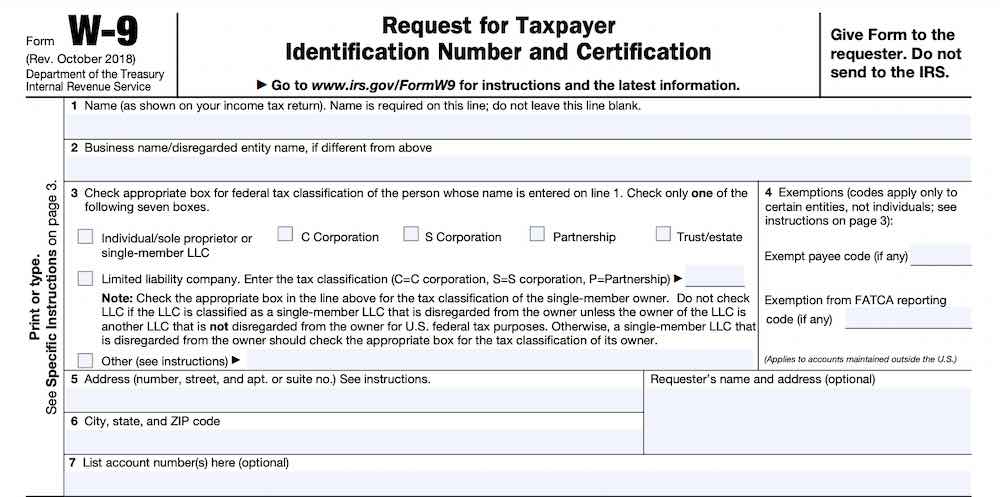

1099 Form vs. W-9

The main difference between 1099 and W9 forms is that 1099 forms report income from sources other than employment. W9 forms provide contractor information to employers. You can see how the W-9 form differs in the image below, and you can view the full form on the IRS site.

Employers use W-9 forms to obtain contractor information such as name, Social Security number (or tax identification number), and address. Before an independent contractor starts work, they should fill out a W-9 form.

What Do You Need to File a 1099 Form for Independent Contractors?

To summarize, as a business, you need to file a 1099 form for an independent contractor if you pay them $600 or more during the tax year.

Specifically, you’ll need to prepare a 1099-NEC form and send it to the IRS and the independent contractor. You can file either by paper or electronically using IRS-approved software.

Also, you need to send the form to the contractor by January 31st of the year for the previous year.

Before you can submit a 1099 form, independent contractors need to fill out a W-9 form. The W-9 form collects information for tax purposes, including:

- Social Security Number or Individual Taxpayer ID

- Name and address

- Any other pertinent information on the W-9

If you don’t file a 1099 form when required, you risk IRS penalties.

Final Thoughts

The rise of the 1099 independent contractors has been a great thing for workers and businesses alike. Businesses get more flexible work and efficiency. Workers earn income on their own schedules.

Businesses need to be aware of the different tax implications of hiring contractors versus employees and set clear expectations about deadlines, deliverables, and payment.

Self-employed workers are responsible for their own taxes, so they need to maintain good records.

If you’d rather not juggle all the tax forms and bookkeeping that goes along with hiring independent contractors, you can use an outsourced bookkeeping and accounting service like xendoo. You’ll get a dedicated team of experts to help you with all your bookkeeping, accounting, and tax needs. View our plans or schedule a consultation.

[av_sidebar widget_area=’Blog Post Disclaimer’ av_uid=’av-om2w’]