Balance sheets and income statements are indispensable financial tools for all business owners. What should businesses know about the balance sheet vs. income statement?

The two complement each other in tracking vital financial metrics such as net income, expenses, profitability, and more. However, there are differences between the two documents.

Understanding these statements can be the first step in making better financial decisions and improving your business performance.

This guide provides an extensive overview of the balance sheet vs. income statement to help you understand what they mean for your business.

What is a Balance Sheet vs. Income Statement?

Financial statements like balance sheets and income statements give you insights into your business’s financial performance and health.

Usually, a balance sheet represents what a business owns and owes at a specified time. An income statement explains a company’s total revenue and expenses.

Accountants prepare the two statements from financial records. Businesses use them to determine how well they are doing, their worth, and the areas that require improvement.

When combined, the balance sheet and income statement provide a better knowledge of the overall financial position.

What is a Balance Sheet?

A balance sheet provides a clear view of its financial position at a specific time. Its key components are assets, liabilities, and shareholder’s equity. Assets represent what a business owns, including cash, property, trademarks, and equipment.

Liabilities include everything the company owes, such as short-term and long-term debts. Stakeholder’s equity represents the remaining assets after settling all liabilities. Overall assets are equal to the summation of the total liabilities and shareholder’s equity. Like any other financial statement, the structure of a balance sheet will vary based on the company.

- Assets = Liabilities + Shareholder’s equity

Usually, businesses create balance sheets every fiscal quarter and at the end of the fiscal reporting year. You can track company performance since inception, including all transactions, acquired assets (and their current valuations), and accumulated debts, all in one statement. Let us look at the components of a balance sheet in detail.

Assets

Assets in a balance sheet represent what your business owns at a specified time. There are two classifications of assets, namely current and long-term or non-current assets. The current ones are those that are effortlessly convertible into cash. Types of assets include:

- Cash and cash equivalents (Stocks and bonds)

- Inventories

- Money in the bank

- Accounts receivable

- Short-term investments

- Prepaid expenses

Conversely, it is not easy to convert non-current assets into cash. In other words, non-current assets are assets that you do not expect to generate revenue within the accounting year.

Non-current asset examples are:

- Properties such as land and buildings

- Intangible assets like patents, copyrights, and trademarks

- Machinery and equipment

- Long-term investment

Liabilities

A company’s liabilities are what it owes to creditors and vendors. Just like assets, there are two categories of liabilities—current and long-term. The current ones are those that are due within one accounting year.

Current liabilities may include:

- Accounts payable

- Accrued expenses

- Employee wages

- Taxes

Long-term liabilities are a company’s financial obligations that are due more than one accounting year in the future.

Long-term liability examples include:

- Mortgages

- Loans

- Payable bonds

- Dividends payable

Stakeholder’s Equity

Stakeholder’s equity refers to the net value of a business or the money left over for stakeholders, owners, and executives, after paying all liabilities. It equals the sum of the total assets minus the total liabilities.

Retained earnings from treasury bonds, stocks, capital investments, and gains are also part of stakeholders’ equity. Profitable businesses have positive retained earnings, while those experiencing losses have a negative figure.

Equity can help banks and financial institutions determine how solvent your business is and its ability to meet financial obligations. Lenders will assess this before approving you for business loans.

What is an Income Statement?

The income statement summarizes the financial health of your business during a specified period. Accountants also call it a profit and loss (P&L) statement. This statement categorizes a business’ revenue and expenses, with the difference between the two representing profit or loss.

An income statement helps business owners know whether they generate profit or loss during the statement period. The period could be monthly, quarterly, or yearly based on the business needs and personal preferences. A company’s income statement has two parts.

- Operating portion – Includes revenue and expenses that come directly from the core operations. It may include the revenue obtained from selling products and services or costs incurred from product development.

- Non-operating portion – Includes revenue and expenses derived from activities that aren’t closely linked to core operations. Examples include profit from investments, dividend income, or expenses like interest payments and asset write-downs.

In addition, there are two methods of documenting revenue and expenses in an income statement.

Single Step Income Statement

The single-step income statement uses a simplified format to report net income. It uses a one-step subtraction method. To use it, you subtract all expenditures from the total revenue.

- Net income = (Revenues + Gains) – (Expenses + Losses)

Most small businesses have less complicated core operations and accounting and prefer the single-step income statement.

Multi-step Income Statement

This statement is comprehensive compared to a single-step statement. It utilizes several equations to determine a company’s net sales. There are three formulas or steps used in the multi-step statements.

- Gross profit = Net income – Cost of products sold

- Operating income = Gross profit – Operating expense

- Net income = Total operating income + Non-operating income

Large and complex companies often use this option since they have many different sources of revenue, employees, and activities. Small businesses usually do not need to take this approach.

Balance Sheet Example

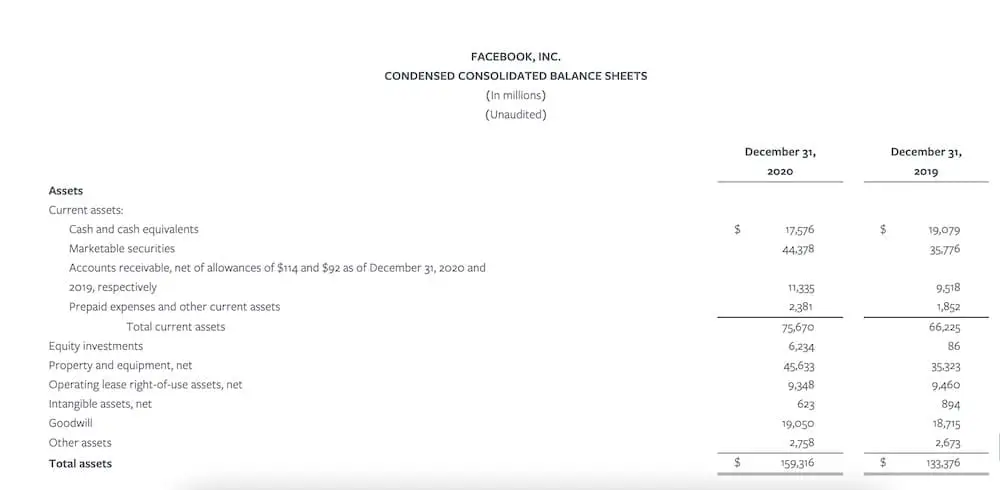

Here is an example of a balance sheet from Facebook. It is a condensed statement from the last quarter of 2020.

Facebook has among the healthiest balance sheets, with the total assets adding up to $159,316,000. That is enough to clear four times the total liabilities, which add up to $31,026,000. The total stakeholder’s equity is impressive, totaling $128,290,000.

From this statement, Facebook has a chance to be flexible by trying new things without suffering any long-term consequences if they fail.

Income Statement Example

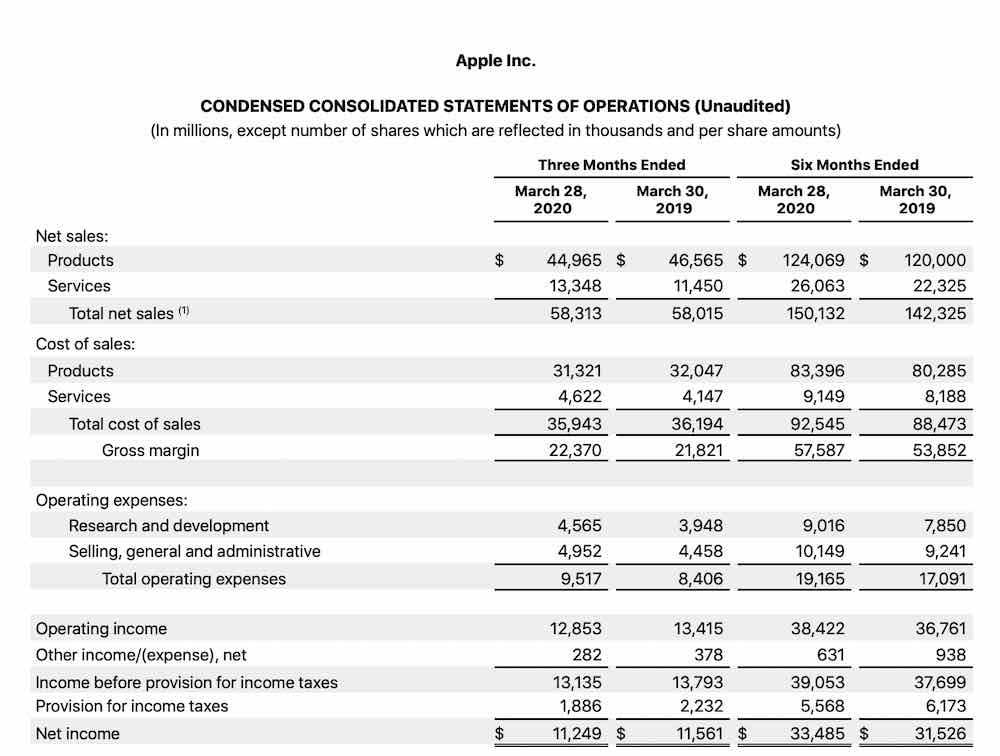

Below is an income statement example from Apple. The reporting period is from the second quarter of 2020, compared to 2019. It is a multi-step income statement, with figures represented in millions. It includes operating income and expenses.

The operating income adds up to $11,249,000, for Q2 2020, respectively, increasing from the same quarter in 2019. Finally, the total net sales are $58,313,000, and $150,132,000, for three-month and six-month periods.

Comparing the total net sales with the previous year, Apple made significant improvements despite the pandemic.

Remember, Facebook and Apple are huge enterprises with complex accounting needs. An income statement or balance sheet for a small business will look much simpler.

Balance Sheet vs. Income Statement: What Comes First?

The income statement comes first. By now, you know that income statements break down revenue and expenses.

First, you need to know whether your business is making a profit or loss. If your revenue is positive, it means your business is profitable. Negative revenue means you are experiencing a loss. An income statement then gives you the information you need to generate a balance sheet.

Similarities Between Income Statements and Balance Sheets

When you look at balance sheets vs. income statements, there are some similarities. Each provides information about a company’s financial position. They offer core financial reporting, and any omissions or errors lead to inaccurate results for both statements. Investors also look at balance sheets and income statements to evaluate your ability to repay loans.

The two also follow a similar accounting cycle, with an income statement coming before a balance sheet.

Ultimately, there is a lot that business owners can learn from balance sheets and income statements. A balance sheet provides a clear picture of what a business currently owns and owes. An income statement records the revenue and expenses for a specific period. These financial statements are crucial in helping you make strategic choices for the future.

If you need help getting your business finances in order, reach out to xendoo. Our online booking and accounting team can help your small business prepare and understand financial statements and more.